Are you looking to improve your family’s financial situation and create a life of true wealth and happiness?

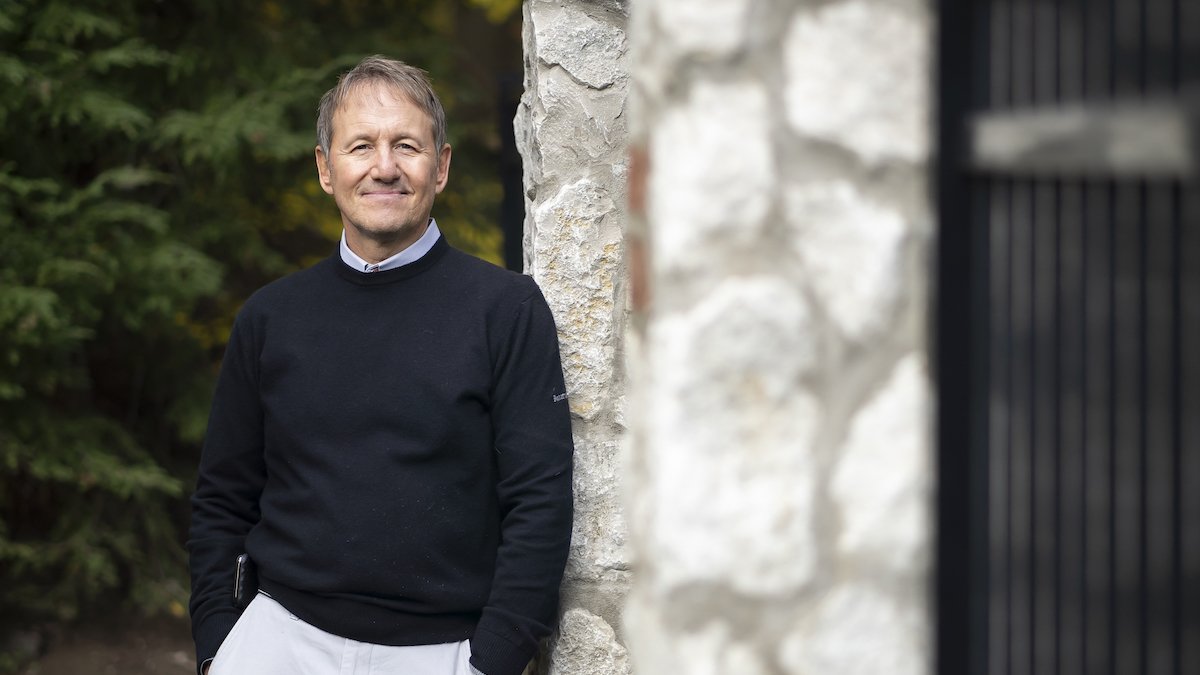

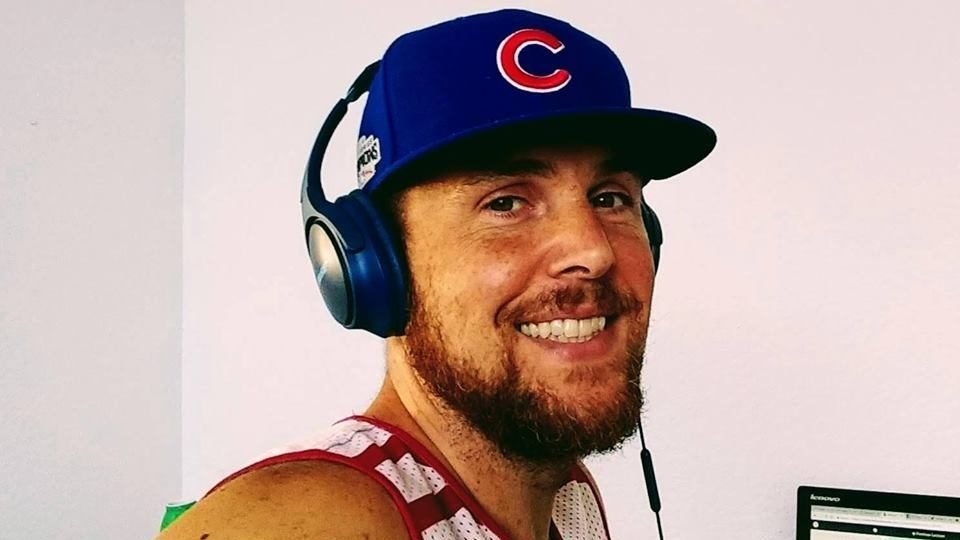

The Marriage Kids and Money Podcast is dedicated to helping you do just that. Each week, Andy Hill interviews personal finance experts, millionaire parents and financially independent couples to find out how they achieved their success. He then takes that information and breaks it down into digestible takeaways that will help you win with money.

With over 400 episodes and counting, Marriage Kids and Money has been awarded “Best Family Finance Content” by Plutus two years in a row and "Content Creator of the Year". We review everything from how to achieve family financial independence to how to help your kids become future millionaires (who are generous).

Join the family wealth-building conversation by listening to this 5-star rated family empowering podcast today!

- All

- Achieve Family Financial Independence

- Become a Happy Homeowner

- Build Generational Wealth

- Fintech Spotlight

- Give Back and Serve

- Maximize Family Experiences

- Strengthen Your Marriage

How to Create a Money Date with Your Spouse

My wife and I have had some incredible financial wins during our marriage. We eliminated nearly $50,000 of debt, paid off our $500,000 home and increased our net worth by over $1,000,000 all in the…

Die With Zero Review: How This Book Changed Our FIRE Journey

Congratulations! You have done everything right. All of the sacrifices your family has made are finally paying off as account balances continue to climb. You’ve maxed out your retirement contributions year after year for almost…

Financial Pros And Cons Of Marriage: Is It Worth It?

There's no denying that getting married comes with plenty of great benefits – as long as it's to the right person! From the emotional joys of companionship to the excitement of starting a family, married…

Federal Reserve Interest Rate Cut: Pros and Cons for Families

Recently, the Federal Reserve cut interest rates for the first time in 4 years. What does this big decision mean for families? Big questions like these are always better with really smart friends so we're answering…

Darius Foroux: How to Invest Like a Stoic

Stoicism supports living in the present. It's not worrying about what may come or what you don't have. Author Darius Foroux is on a mission to support our wealth creation the stoic way. Darius is…

How to Increase Your Salary (5-Figures to 6-Figures)

I don’t know about you, but when I got pay raises at work, it felt incredible. I got a giant smile across my face because I felt like my hard work was finally validated. All…

35 Profitable Side Hustles For Stay-at-Home Moms and Dads

Are you looking for some side hustles you can do from home? A lot of stay-at-home Moms and Dads find themselves in this situation, especially recently. I was in a very similar spot a few…

Top 10 Coast FIRE Jobs That Can Pay $40/Hr. Or More

You’ve achieved Coast FIRE, congratulations! While paying down your mortgage and eliminating your other low-interest debt it’s time to start thinking about your next career move. You could even call it your first Coast FIRE job. In…

60/40 Generational Wealth Plan: How to Banish The Third Generation Challenge

As parents, our goal shouldn’t be to simply give our children generational wealth. Instead, we should inspire generational wealth as well. By showing our children how to build their wealth, they will gain the knowledge…

FU Money: What It Is and Why It's a Smart FIRE Movement Alternative

If you're fed up with your job, you may be considering early retirement. As a FIRE Movement fan, I like the idea of piling up assets like stocks and real estate and diversifying your income…

How We Paid Off Our Mortgage in 5 Years

In late 2013 while I was traveling out of town for work, my wife Nicole found our “forever house”. This home had everything she wanted, including an attached garage, an open floor plan, an updated…

Sam Dogen on Why Coast FIRE is Irrational

Coast FIRE gives you the ability to free up more of your money to enjoy life now instead of retirement. I'm a fan of the concept and it has impacted the trajectory of my family's financial…

Harmonizing Work Aspirations with Family Ambitions w/ Eric Roberge

When we become parents for the first time, something switches in our brains. For the longest time, we were only concerned with our well-being or our spouse’s well-being. Now there is a new human in your…

How We Became Debt Free After Paying Off $50,000 in 1 Year

A little over a decade ago, I married my dream girl. She was funny, beautiful, and chock-full of 90's TV trivia. Our first couple of dates consisted of a lot of Saved by the Bell…

5 First-Time Home Buyer Mistakes That Cost Thousands Of Dollars

When I was 22 years old, I bought my first home. There was a lot of pride in this moment for me. Until then, I repeatedly heard that homeownership was one of the smartest financial…

Family Wealth and Happiness: 10 Steps to a Better Tomorrow (Today)

Over the past 8 years when I run into someone and tell them about my family wealth-building podcast, one major question that continues to come up is “What have been your biggest takeaways?” It’s a…

Navigating the Money Minefield in Relationships | Scott Rick

My wife and I have had our fair share of disagreements around money. Some of those disagreements have helped us develop a new sense of understanding and empathy for each other … and some have pushed…

10 Best Books to Learn About Investing

One of the best ways to learn about the stock market and investing is through a good book. A podcast listener named Christopher reached out and wanted to know my recommendations on the best books…

How to Reach Coast FIRE by Age 30, 40 and 50

Coast FIRE is when you’ve saved up enough in traditional retirement accounts that you can simply coast to retirement without any further contributions. I love this concept because it allows you to metaphorically check another box…

5 Millionaire Milestones Reached By Automating Our Finances

One of our favorite wealth-building hacks is automation. We set up a process, put it on autopilot, and watch our net worth grow. There have been a variety of automation strategies we’ve learned over our…

How to Increase Your Net Worth to $1,000,000 in 10 Years

Do you want to increase your net worth? Well, so did we. Let me tell you how we did it. One fall night in 2010, my wife Nicole and I were watching the Suze Orman…

United States National Debt is $34 Trillion (Why You Should Care)

Over the years, I’ve shared hundreds of stories of debt-free and financially independent families. That type of financial standing and financial strength empowers families and helps them build generational wealth and happiness. But what about…

Is $2 Million Enough to Retire?

When you think about your retirement, your mind probably fills with questions. Is $2 million enough to retire? What about $1 million? How can I be sure? It’s normal to have questions about retirement, especially…

Brian Preston: How to Become a Millionaire Starting From $0

The millionaire path can be simple, but it isn't easy for many people. When I was looking for a simple approach to investing it was hard to find! So how can we find a roadmap with…

How to Become a Millionaire in 10 Years

After 10 long years, our family has joined the double comma club! We are now millionaires! While this feat is awesome and we feel really proud of it, it’s important to point out some privileges we’ve…

Jamila Souffrant: How to Enjoy the Financial Independence Journey

The financial independence path of saving most of what you earn isn’t easy for many people. Especially for those of us not making a multi-six-figure household income. So how can we pursue a life of…

7 Life-Changing Benefits of Coast FIRE

Investing for retirement is a smart idea, but eventually, you get to a point where you don’t need to contribute any more money to achieve your retirement goals. That’s what we call Coast FIRE. When…

Unfaithful Spouse: Stay or Leave If Your Partner Cheats?

In marriage, infidelity can become a reality for some of us. Depending on what survey you read, and which gender is answering the questions, the percentage of cheating in relationships wavers between 10 and 40 percent…

Backdoor Roth IRA: Is It Right For You?

When you’re investing for your future retirement as a high-income earner, the idea of a Backdoor Roth IRA might come up. But is this the right option for you? Big questions like this are always better…

FU Money vs. FI Money: JL Collins Explains the Difference

It was the mid-1970s and the Great Inflation was in full swing. On one hand, recently graduated English major JL Collins was feeling lucky to have a job in a stagnant economy. On the other…

Mini Retirements: A New Cure for Corporate Burnout

It appears companies are ramping up their return to the office requirements. According to a recent survey published in CNBC, 90% of companies plan to implement return-to-office policies by the end of 2024 with nearly 30%…

What Happens If You Don't Pay Your Student Loans

For many student loan borrowers, the thought of October 2023 inspires chills that have nothing at all to do with Halloween. After a three-year hiatus, the debt ceiling deal approved by Congress has awoken federal student loan…

Jon Acuff: Reach Your Potential Through Goal Setting

To help us get motivated and realistic with our goals, I’ve invited speaker and author Jon Acuff on the show today. Jon is the New York Times bestselling author of nine books, including his most recent…

15 Incredible Benefits of a Paid Off House

There are so many opinions on whether or not you should pay off your mortgage early. Some say that paying off your mortgage is a bad idea because you could make a lot more money in…

Workaholism: Escaping The Cult Of Never Enough w/ Manisha Thakor

Most of us need to work to earn money so we can survive and thrive. There is a point when workaholism can take over our lives. So how do we know when to slow down…

Farnoosh Torabi: Why Fear Is Your Friend

We’re all taught to fear… fear. But what if we welcomed fear into our lives as a friend? America’s leading personal finance expert, Farnoosh Torabi, joins us to discuss how fear can fuel financial success as…

An Alternative to 10% Giving for the Modern Family

The idea of 10% giving has been around for thousands of years. Traditionally this has been seen as a donation to your local house of worship. While giving and growing one’s religion is important, the…

Leaving California To Get A Real Good Life | Stevie and Sazan Hendrix

It can be difficult for us to slow down and decide what we want from life and marriage. And as parents, it can be even more difficult when our careers and obligations conflict with our family…

Don't Sacrifice Your Future To Pay For Your Kid's College

Sometimes, parenthood can feel like nothing less than an endless rollercoaster of emotions. After all, kids have the unique ability to fill you with joy and pride one day and leave you feeling downright baffled…

Building Your Coast FIRE 3-Day Workweek

Each week, we get seven days to live our lives. A lot of us work five days and take two days to relax, enjoy our hobbies and spend time with the ones we love. This…

How to Start Investing Today in 10 Simple Steps

There comes a time in our lives when we're ready to get off the sidelines and start investing. There are people building wealth all around us and we want in on the money-making action. But…

Pay Off The Mortgage Or Invest? Here's How We Did Both

There’s a hot debate between paying off your mortgage or investing. Paying off your mortgage allows you to significantly lower your expenses today and potentially create more time freedom in your life. Meanwhile, investing has…

Your Job Is Not Your Life w/ Simone Stolzoff

As you climb the corporate ladder or grow your small businesses, work can take up most of your time. Even when you get some free time, those extra hours can tend to be used for…

Don't Pay Off Your Mortgage (Yet!) – w/ Brian Preston

I love living mortgage-free. The freedom our family has after we decided to pay off our mortgage early is incredible. But just because I love my paid-off house, doesn’t mean I think everyone should rush…

Debt Snowball vs. Debt Avalanche: Which is Right For You?

If you sometimes have a hard time believing you'll ever come up with enough extra money to pay off all your debts, rest assured you're not alone. Between student loans, personal loans, car loans, credit card debts, and…

Coast FIRE: How Do I Know When I Can Stop Investing for Retirement?

There comes a point in time when you ask yourself, “When can I stop investing for retirement?” Not only is this a possibility, but there's a whole entire movement around it. It's called Coast FIRE!…

The Secret To A Happy Life (Based On 80 Years Of Research)

What is the secret to a happy life? While there are countless opinions, articles, and videos on the subject of happiness, I thought it would be fun to learn about happiness from a study that…

How Maxing Out My 401k Helped Me Become A Millionaire

About a decade ago, I started a new job with excellent pay and benefits. My salary was $160,000 and the company matched 15% of my 401(k) contributions. After learning about the magical powers of compound…

Why Kids Should Do Chores At Home (And How To Get Started)

As parents, it is our job to teach our kids financial responsibility and independence. One excellent way to do this is with chores at home. For our family, this is something we’ve been experimenting with…

Lessons Learned From Investing For Our Kids For 10 Years

Investing can do wonders if you have time and patience on your side. I’ve seen this firsthand with investing for my kids over the past decade. As new parents, my wife and I heard over…

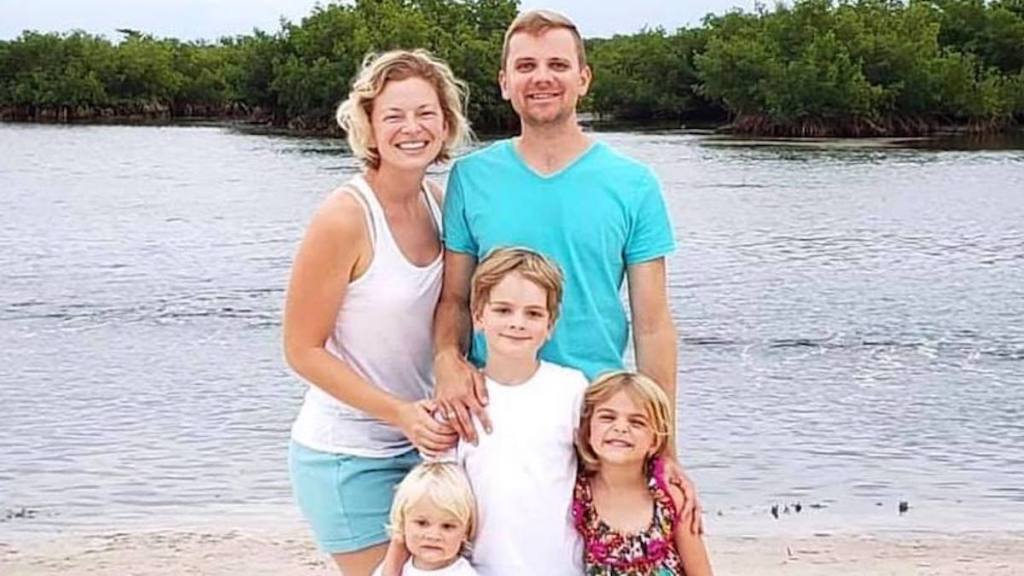

How Fatherhood Sparked My Desire For Family Financial Independence

Becoming a new father definitely changes a man. You go from thinking about yourself to instantly thinking about how you can best protect the ones you love. As a new Dad, I remember THE DAY…

Dealing With a Money Imbalance in Relationships – w/ Erin Lowry

Money imbalance in relationships can be everything from one spouse earning more than the other to one spouse spending much more than the other. When these types of imbalances exist, resentment and tension can grow in…

How to Invest On Your Own Without a Financial Advisor

Adam from Tampa is skeptical about working with a financial advisor and wants to know how to invest on his own. “For most of my life, I have been told what to do with my…

Become a Millionaire Couple (Even If You Disagree Financially)

While every couple has their fair share of disagreements, most would agree that becoming a millionaire couple sounds like a pretty awesome idea. But what if you and your spouse don't exactly agree on the…

I Only Want To Work Part Time. Is It Possible?

Are you dreaming of having more control over your time? Do you want to design your days differently? If early retirement isn’t on the horizon, part time work might be the solution. Many people find…

John Strelecky: Finding Life's Purpose at The Cafe on the Edge of the World

Each day, we all have a variety of things we do that fill up our time. We sleep, we eat, we take care of ourselves, we take care of family, we work, we take care…

Millionaires Never Buy New Cars, But We Just Did

You should never buy new cars, right? That seems to be one of the cornerstones of personal finance. The millionaire next door doesn't. And what about our favorite billionaires? We love to hold up Bezos,…

Tracy McCubbin: Your Stuff is Costing You Time

While money is nice, time is the ultimate currency. If our spending habits and our continual accumulation of stuff get out of control, then we’re not only losing time, but we’re losing our money as…

Why Are Banks Failing?

With multiple high-profile banks failing as of late, a lot of people are wondering … “Is My Bank Going to Fail?” Or more importantly, “Is My Money Safe?” Big questions like these are always better with…

Indexed Universal Life Insurance: Is It Worth It?

Money secrets of the ultra-wealthy are teased all over social media. Instagram, Facebook, TikTok, you name it, and someone is promising to share how the wealthiest people make their money. One of the commonly mentioned…

Generational Wealth: These 3 Investing Accounts Can Give Your Kids A Bright Future

Many parents are looking for ways to give their kids a bright future. While money can’t necessarily buy happiness for our children, investing early for generational wealth can pave a comfortable path forward. Kids have…

Allison Baggerly: Become Debt Free While Still Enjoying Life

According to the Federal Reserve Bank of New York, Americans now owe around $1 Trillion in credit card debt. This is the highest number since the New York Fed began tracking this information in 1999. As…

Money and Love: Navigating Big Decisions in Marriage

Money and love … with so many emotions around both subjects, there’s bound to be difficulty. While we can’t eliminate all strife when it comes to relationships and money, we can become better communicators. To help…

Financial Infidelity: What Should You Do?

Strong marriages are built on a foundation of communication, trust, and honesty. But when these principles begin to break down, things can quickly head in the wrong direction. One type of marital conflict that stems…

Devon Kennard: Why FIRE is Easier with Real Estate Investing than Stocks

If you're looking to retire early, real estate investing may be your FIRE Movement ticket to success. Devon Kennard not only believes this, but he's banking on it. Knowing that the average NFL career only…

Scarlett Cochran: Overworked Lawyer Redefines “Rich” and Chooses a Family Focused Entrepreneur Life

As Scarlett Cochran was growing up and moving into her professional life, she had a pretty clear definition of what “rich” meant. Over time, that definition changed dramatically. After seeing the realities and requirements that…

Holderness Family: Everybody Fights So Why Not Get Better at It?

Are you having more marriage fights lately? Kim and Penn Holderness, of Holderness Family Productions, join us to discuss their new book “Everybody Fights: So Why Not Get Better at It?“. After more than a…

Mortgage Free 5 Years Later: Was it Worth It?

I was cleaning my office the other day and came across the letter from our former mortgage provider. The letter read, “Congratulations! Your mortgage has been paid in full and your account is now closed.”…

Rich Jones: How a Sabbatical Made Me Realize I Didn't Want to Quit My Job

To combat work-life burnout, sabbaticals may be corporate America’s latest weapon against the Great Resignation. Rich Jones, the Founder of Find More Balance, recently took a sabbatical from his corporate career at Google and found…

Should I Wait to Buy a House?

A lot of first-time homebuyers (and repeat homebuyers) are looking at this housing market and wondering … should I wait to buy a house? Big questions like these are always more fun with really smart…

Megan Hyatt Miller: The Importance of Mindset in Setting Goals

I'm all about that Carpe Diem lifestyle! We seize the day so we can build our family wealth and happiness. But what if our thinking is holding us back? What if our mindset and the…

Barbara Sloan: Bringing the FIRE Movement to Tipped Workers

Financial independence can feel difficult if you're a tipped worker in the service industry. Barbara Sloan is showing us how the FIRE journey can be possible for waitresses, strippers, bartenders, and any other service position….

How to Fight Inflation at Home (and Save Thousands!)

Inflation is the worst. Prices are WAY up for the small stuff like food and even the big stuff like housing. Although complaining about inflation may give us some momentary satisfaction, it doesn’t help long…

7 Savings Goals to Create a Happier Today (and Tomorrow)

We’ve all heard about the importance of saving more money. Putting away dollars for a rainy day can do a lot of good for most of us. Without a purpose for saving, I tend to…

Andrew Giancola: This 34-Year-Old Millionaire is Helping His Kids Become Millionaires

There’s come a point in your financial journey where you cross that 7-figure net worth milestone and you’re feeling very comfortable financially. So … What’s next? A lot of wealthy families turn their attention to their kids…

Year-End Financial Checklist: 7 Ways to Finish the Year Strong

The year is coming to a close. This is time for reflection, relaxation, and a little last-minute preparation. If you’re wondering if you’ve checked the right boxes financially this year, we’ve created a nice year-end…

Money After Divorce: 6 Steps to Take to Thrive Financially

Managing money after divorce can be incredibly overwhelming at first. Not only are you dealing with the emotional fallout from your marriage ending, but now you have financial responsibilities you are shouldering on your own….

Part-Time Work at 40 Years Old: How We Afford Working Fewer Hours

There’s a change happening. The pandemic allowed us all to pause, rethink our priorities and decide if the full-time employment grind is worth it for us. This “great pause” gave us more time with family…

Derrick Kinney: Make More Money to Do More Good

It’s the age-old question … can money buy happiness? I know I’ve said it. “If I make more money, I’ll be happier.” If I can get the next commission check, if I can score that…

Charitable Giving with Family: Making Lasting Traditions of Generosity

Charitable giving can feel difficult or even impossible when we’re in debt and barely scraping by. When we’ve lifted ourselves up to a position of financial strength and confidence, giving back feels like the right…

How to Stick to a Budget – with Kumiko Love from The Budget Mom

When we're in the midst of paying off debt, it's important to know how to stick to a budget. This way, you're telling your money what to do instead of the other way around. Imagine…

Roth IRA for Kids: Hire Your Child + Invest in Generational Wealth

Have you heard about the life-changing benefits of a Roth IRA for kids? It's essentially an investment account that allows you to invest for your children's future retirement needs with their earned income. Dee from…

Are We In A Recession … Or Not?

It's the question a lot of us are asking right now … Are we in a recession or not? You'll find all sorts of different answers on the financial news media and even amongst your…

How to Live Without Regrets – w/ Jordan Grumet

Death can inspire some important conversations about life. And when we're thinking about how to live without regrets, thoughts around how we're spending our time and our money open come up. To explore this topic…

Pay for College Without Student Loans: 5 Ways Parents Can Help Their Kids Graduate Debt Free

The future cost of college is no joke. That's why parents like me are looking for a way to pay for college without student loans. According to Vanguard, the average rate of inflation for college…

Got Money Fights? Here's How Marriage Counseling Helped Our Relationship

After some major marital money fights a few years ago, my wife brought up marriage counseling. Going to a therapist was not something I wanted to do, but it was important to my wife. Here…

Do Nothing: The Cure for the Overworked Parent | Celeste Headlee

Are you feeling overworked and overstressed? As a young parent, I have experienced this too much for my liking. According to our guest Celeste Headlee, it may be time for us all to do nothing! Celeste…

Lessons Learned After Becoming a Millionaire Family in our 30's

After 10 years of working together, my wife and I became a millionaire family! This was a huge milestone and accomplishment that we're proud of. Here are the 6 lessons I learned after hitting this…

Dave Ramsey Baby Steps: One Couple's Lessons Learned After 10 Years

Are you getting started with the Dave Ramsey Baby Steps? Congratulations! You're about to embark on a really powerful journey! After completing all 7 Baby Steps, Nicole and I have some pros and cons to…

Jean Chatzky & Kathryn Tuggle: Money Advice for College Graduates

Jean Chatzky and Kathryn Tuggle, hosts of the Her Money Podcast, share some important money advice for college graduates As these young adults step out into the “real world”, managing money and their careers successfully…

Investing for Kids: How We're Building Generational Wealth

When we're feeling comfortable with our financial situation, our minds start to turn to our children. How can we save and invest for our kid's future? In this episode, I share how we're building generational…

Kiersten and Julien Saunders: Work 15 Years, Then FIRE Yourself

We graduate from college and we get our first job. After the new career happy feelings fade, it’s not uncommon for us to think … “how long do I need to keep doing this?” For…

Should We Get an Electric Car?

Electric cars?! Are they worth it? This question has been on my mind a lot lately because our 13-year-old Audi is on its last legs. This once cherished luxury car now has over 125,000 miles…

What To Do After Maxing Out Your Roth IRA (w/ Nick Maggiulli)

Nick Maggiulli, author of “Just Keep Buying”, shares what to do after maxing out your Roth IRA. As an advocate for continued capital accumulation as a way to financial independence and security, Nick breaks down…

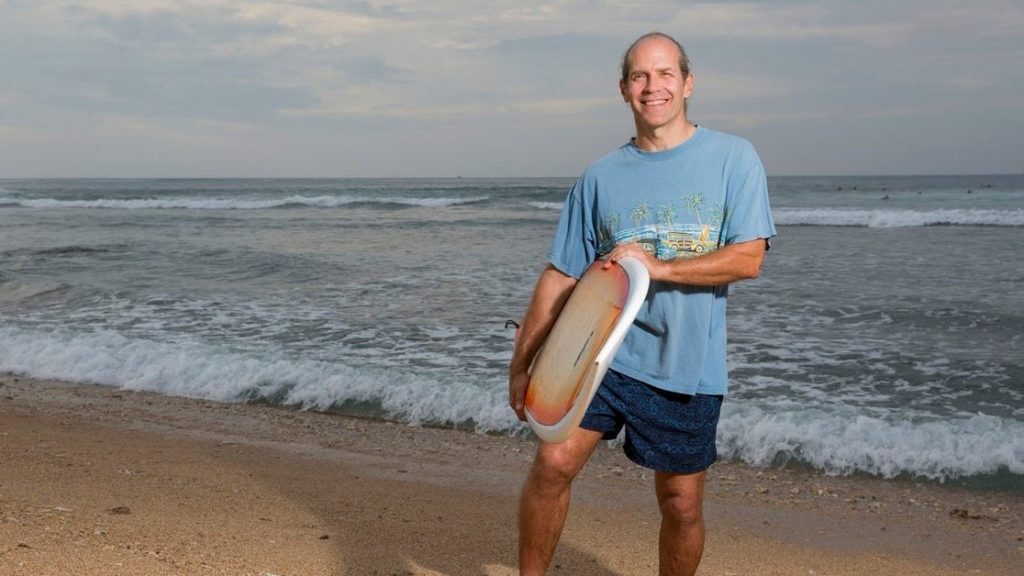

Real Estate Investing Strategies in a Competitive Market (w/ Sam Dogen, aka Financial Samurai)

Real estate has proven to be an excellent place to invest your money. But where should you start in this competitive market? Rentals? Airbnbs? Sam Dogen, also known as the Financial Samurai, joins us to share…

Preparing for a Recession: Our Family's 5 Step Financial Plan

It's no secret that it's been a bumpy few years for the economy–COVID, lockdowns, inflation, you name it. With growing talk of bear markets and recessions, it's time to share our family plan. It's not…

Joshua Becker: How to Overcome the Distraction of Money

Money can allow us to have our most basic needs met and buy more time freedom to enjoy more life today. But can we become too distracted by money? Can the pursuit of more money…

Boomerang Kids: How to Get Adult Children to Launch (w/ Bobbi Rebell)

Worried about your adult child moving back home? You're not alone! Boomerang kids are a group of adult children who move back in with their parents after going out into the world. John, a concerned…

Downsizing Your Home: The Pros and Cons

Have you considered a change of pace when it comes to the size of your home? Do you think you could make the change to something… less? Recently, podcast listener Samantha asked about the pros…

Have We Still Achieved Coast FIRE After This Market Downturn?

For the past year or so, I’ve been talking about the freedom that comes with achieving Coast FIRE. This is when you accumulate so much in your retirement investment accounts that you can simply coast…

Mark Ostach: How to Honor Family Over Technology with Digital Wellness

How’s your “Digital Wellness” these days? Have you thought about doing a “Digital Fast”? Mark Ostach thinks we all should! As a parent and digital entrepreneur, this is something I’m working on constantly. But as…

Why is My Roth IRA Losing Money?

Are you wondering, “Why is My Roth IRA Losing Money?” You're in luck! While we didn't dig up any extra money to hand out, we did manage to dig up some answers. Meghan Rabuse, aka…

I'm a Mortgage-Free Millionaire. Now What?

You've saved and invested aggressively. Your net worth now exceeds $1,000,000. And you even paid off your mortgage! What do you do with your money now that you're a mortgage-free millionaire? Well, that's a question…

Is College Worth It? (w/ Dan Sheeks)

If you're raising a teenager and looking at the cost of higher education, you may be asking yourself … is college worth it? Dan Sheeks, Author of First to a Million: A Teenager's Guide to…

Stop Investing to Pay Off the Mortgage Faster? (Why Coast FIRE Comes First)

For those who are working to become mortgage-free, you might ask yourself if it makes sense to stop investing to pay off the mortgage faster. This can be a difficult decision to make. That's where…

Financial Trauma: How to Manage It – w/ John Delony

Dr. John Delony knows all about financial trauma. Having experienced it personally and helping others get through it, he knows the signs of it and how to manage it. In this interview, Dr. John Delony…

Is Now a Good Time to Invest?

Some folks are feeling uneasy about investing. Uncertain times can create nervous investors. Colin is one of those folks. He asked this question about investing in a Roth IRA: “Before the war, I was planning…

How to Pay Off Debt on a Low Income (w/ Jessi Fearon)

Do you want to pay off debt but you have a low income? Jessi Fearon paid off $50,000 of debt in 2 years on a household income below $50,000! Find out how she did it…

20% Home Down Payment: What are the Pros and Cons?

Taking the plunge into homeownership can be a big undertaking. And in a hot real estate market like this, it's no wonder families are stressed out trying to make homeownership a reality. One major topic…

How Maggie Tucker and Her Husband Are Retiring in their 40's

Most of us are aware of traditionally retiring in our 60s or 70s and what life might be like when we’re old and gray. But what if you could add another 20-30 years on that…

Is it Better to Invest or Save Your Home Down Payment Money?

With housing prices soaring, it can be hard for people looking to save for a home down payment. To make things worse, even high yield savings accounts aren't yielding much. Recently, I received a question wondering…

How to Create an Early Retirement Bridge Account

Interested in FIRE and retiring early? Well, you might need a bridge account that helps fund your lifestyle from early retirement to traditional retirement. To help us with this intricate plan, I've invited The Landshark…

$1 Million Inheritance: Can I Retire Early Now?

If you received a $1 million inheritance, how would that change your life? How could you take that blessing and make it your way out of a job you don't enjoy and retire early? Recently,…

How to Prepare for Divorce (Without Losing Your Kids, Money and Mind) – w/ Raiford Palmer

If you're wondering how to prepare for a divorce or in the midst of one, this can be one of the most difficult times in your life. With your marriage ending, the last thing you…

Inflation Up and Stocks Down. What Should Investors Do? [w/ Meghan Rabuse]

With the stock market down and inflation way up, families are concerned about their personal financial outlook. Recently, our family has seen increases at the grocery store, our utility bills … and even Netflix raised their…

Why I Retired at 38 (During the Peak of my Earning Years)

The number of workers who left their jobs last year broke records. By some estimates, nearly 40 million people quit their jobs in the US. Today, we're speaking with someone who recently left their high-paying…

Nir Eyal: How to Create an Indistractable Family Life

Nir Eyal is on a mission to help us all become indistractable. Technology has done a lot of wonderful things for us over the last decade. Tasks that were once extremely time-consuming or monotonous are…

Keep the Mortgage for the Mortgage Interest Tax Deduction?

Does it make sense to pay off your mortgage if you lose the mortgage interest tax deduction? This is a common question people struggle with who are considering paying off their mortgage. Will my paid-off…

Joe Saul-Sehy: How to Invest With the End in Mind

Saving and investing can be a smart idea for most everyone. But without a definition of WHAT we're saving and investing for, we can lose motivation and interest. Joe Saul-Sehy, Author of the new book…

50% to 10%: Why We're Happy Saving Less as Part of Our FIRE Journey

When you've been saving around 50% of your income for a decade on your FIRE journey, it's hard to save less. Our family hit some incredible financial milestones over the last 10 years including becoming…

Religion and Giving: The Similarities and Differences in Christianity, Judaism, and Islam

“Why do you give?” If you ask five people this question, you're likely to get five different–and highly personal–answers. But for many people, the idea of charitable giving is often rooted in their culture or…

What We Did With a $30,000 Inheritance

Receiving an inheritance or a cash gift from a family member can be a beautiful blessing on your financial journey. Also, this new experience can leave you wondering about the best way to use this…

Brennan Schlagbaum: Losing Motivation to Pay Off My Mortgage. What Do I Do?

Kevin has been working on paying off his mortgage for years but now he’s having second thoughts. Real estate investing sounds much more interesting to him now. Brennan Schlagbaum, the founder of Budgetdog, joins me…

Is Honesty the Best Policy? [Bread & Wine]

We all know telling the truth is a smart move. But how honest do we need to be? In this episode of Bread & Wine, Nicole and I discuss being forthright with your supervisor, straightforward…

Jeremy Schneider: How to Become a Millionaire with Index Funds

Want to become a millionaire? Index funds have helped our family achieve this 7-figure milestone. Jeremy Schneider from Personal Finance Club is an index-fund evangelist and thinks they are a great place to start with…

Chris Hutchins: How I Travel the World for Free After Earning 10 Million Credit Cards Points

Chris Hutchins has accumulated over 10 million credit card rewards points. He’s used these points to travel first class with his wife and stay in luxury resorts around the world. Today, he shares how he’s…

Did Privilege Help Us Become Millionaires?

After posting a video about how we became millionaires in 10 years, a conversation about privilege came to the forefront. The video now has 1.6 million views and a boatload of comments about privilege vs…

My Husband Wants Separate Bank Accounts (But I Don't). What Do I Do? [w/ Rachel Cruze]

Rachel Cruze joins me to answer a question from Anonymous: “My husband wants separate bank accounts and I don't. What should I do?” We discuss the options available to our anonymous friend, including the importance…

HSA Investment Strategy: Use it Now Or Later?

If you have a Health Savings Account (HSA) and you have upcoming medical expenses, it may be difficult to know when how best to pay for them. This HSA investment strategy conundrum is a question…

The Grass is Greener on the Other Side: True or False?

A lot of us are working toward something. A financial goal. A personal challenge. Overcoming a difficult career change. Will life be better when you reach your final destination? We discuss if the grass is…

How to Make a Million in Real Estate [w/ Dustin Heiner]

Do you want to make a million with real estate? Dustin Heiner was able to quit his job at 37 after building up enough passive income through long-distance real estate investing. Now he spends very…

How to Bring Back Intimacy in Marriage (w/ Nick & Amy McKinlay)

Are you looking to bring back intimacy in your marriage? Nick and Amy McKinlay, founders of The Ultimate Intimacy App, share couples can grow their intimacy together. We review the importance of communication, understanding your…

Feeling Valued vs. Not Feeling Valued at Work [Bread & Wine]

Nicole got a new job recently and she's so much happier. It is amazing how your life can change based on your job. Feeling valued at work is very important for a lot of us….

How to Find Life Balance and Take Back Your Time [w/ Christy Wright]

Are you ready to take back your time? Christy Wright shares the simple steps we can take to find life balance. We also discuss how your priorities can shift over time and why that's okay. …

Big Dreams … Can They Be Simple? [Bread & Wine]

When some people think of big dreams, they think of big houses, fancy cars, or flashy wardrobes. But can big dreams be a lot simpler than that? Nicole and I explore this topic, share out…

Target Date Funds: What Are the Pros and Cons?

Target Date Funds are rapidly surging in popularity lately. Investors are flocking to this “set it and forget it” retirement tool as an easy way to diversify their portfolio and eliminate the fees of working…

Coast FIRE: An Easier Way to Join the FIRE Movement

We’ve all been told that money doesn’t buy happiness, but there’s no denying that it affords us time and freedom. Whether you are well on your way to financial independence or just learning the very…

Are You a Sell Out? [Bread & Wine]

What classifies someone as a “sell-out”? Nicole and I explore whether either one of us has been a sell-out in the past. We also discuss what it actually means to be a sell-out. We all…

How I Won $500k in College Scholarships [w/ Kristina Ellis]

College is not getting any cheaper. By some estimates, the cost of college is rising at a rate of 8% per year. To combat this rising cost of hiring education, parents and teens need to…

Should I Invest or Buy a House? [with Marcus Garrett]

Caitlin wants to know if she should invest or buy a house. This is a tough decision that a lot of people grapple with especially as they become debt-free. Marcus Garrett, Financial Expert and Author…

I Don't Agree With My Financial Advisor. Is That Okay? [Bread & Wine]

If you get advice from your financial advisor and you don't agree, should you follow it anyway? After all, they do have more education and experience than you. But in the end, aren't your motivations…

We Reached Coast FIRE! How We Saved $500,000 by 40

Coast FIRE … You’ve maybe heard of this concept before, but perhaps you don’t know what it is. That’s what YouTube subscriber Allen is feeling right now. He asked me to make some content clarifying…

Thinking More Than One Step Ahead [Bread & Wine]

Feeling like you're simply reacting to the moment right in front of your face? Yeah, we've been there (and still catch ourselves doing it). It's in our nature, evidently. But how can we get out…

We Won $1.2M in Vegas (Here's What Happened to our Marriage) – w/ Adam & Danielle Silverstein

What would it be like to win $1.2 million in Vegas? Life-changing, yes, but for good or bad? Adam & Danielle Silverstein, from the Marriage & Martinis Podcast, share how this windfall affected their marriage….

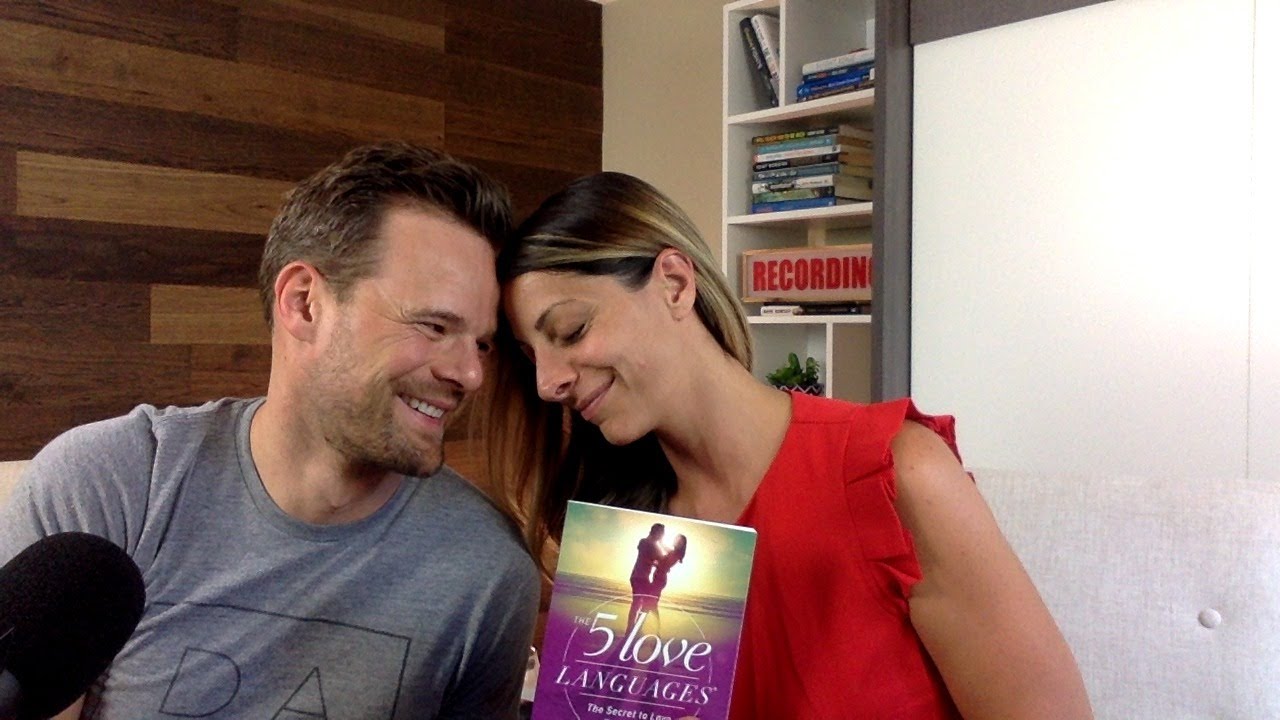

What's Your Love Language? [Bread & Wine]

The 5 Love Languages by Gary Chapman is a book that has really helped our marriage. The concept may be simple, but it can be difficult to remember when you're in the midst of work,…

The Benefits of a Side Hustle While Working Full-Time [w/ Daniella Flores]

According to a Zapier survey, 1 in 3 Americans has a side hustle in 2021. This number has grown significantly over the recent years. So … why the growth? What is the attraction to the side…

Are We MORONS for Paying Off Our Mortgage? [Bread & Wine]

This past week, we received a lot of negative feedback for paying off our mortgage early. There was name-calling, swear words and someone even said “you are ruining people's lives!” Woah, yikes. While we're very…

How to Pay Extra on the Mortgage (Principal, Not Interest!)

Yolanda wants to pay extra toward her mortgage but she’s not sure if she’s doing it correctly. Holden Lewis, a Mortgage Expert from NerdWallet, joins me to help her out. We discuss how to ensure…

Should We Tell Our Partner Everything? [Bread & Wine]

I tend to tell my wife everything … but is that the right way to go? My friends often tell me I'm TOO open with her. I'm not sure that's really wrong. Nicole and I…

Living on a Budget: Is This an Awful Term? [Bread & Wine]

Do you think “living on a budget” feels like a life of restriction? Nicole and I discuss our history with budgeting over our 10-year marriage. We share our feelings on the term “living on a…

Return to Work or Start a Business? [w/ Tori Dunlap]

Are you dreading the inevitable return to work this fall? Jennifer feels your pain. She's enjoyed the flexibility of working from home as a parent but knows that is coming to an end soon. As…

Working With Your Spouse: Is it Worth It? [Bread & Wine]

Are you considering working with your spouse? Depending on how things are arranged, this could either be a great way to connect more or a complete disaster! Nicole and I discuss the pros and cons…

Is College Worth It? [Bread & Wine]

With the cost of college rising and rising year over year, as parents, we have to ask ourselves “Is college worth it?” Nicole and I debate the topic and discuss our college plans for our…

Inheritance from Parents: Good Idea or Not? [Bread & Wine]

Would you want to receive an inheritance from your parents? At first glance, the answer might be “hell yeah”! Nicole and I dive deeper into the subject and discuss the ramifications of getting money after…

80/80 Marriage: How to Create a Happier Relationship (Kaley & Nate Klemp)

Nicole and I have seen some tough days in our relationship. There's been yelling, name-calling, and even marriage counseling. We’ve also had excellent days where we’ve felt appreciated, loved, and thrilled that we’ve chosen to…

Should You Try to Change Your Spouse? [Bread & Wine]

In a relationship, there can be certain things that bother us about our partners. Should we try to change them? Or love them just the way they are? Nicole and I discuss a recent marriage…

Time is the New Currency [Bread & Wine]

In post-pandemic life, do you feel like you're constantly pressed for time? Lately, we're feeling like time is the new currency. Nicole and I discuss how trying to do it all has been difficult and…

How House Hacking Helps Us Live for Free – w/ Ali & Josh (The FI Couple)

In this wild real estate market, house hacking has become a popular way to lower your cost of living and take advantage of the appreciating asset of real estate. But what is house hacking? How…

Taylor & Scott Rieckens: Are They Still Playing with FIRE?

Taylor & Scott Rieckens started a very public journey towards FIRE (Financial Independence Retire Early) a few years ago. They developed a documentary entitled “Playing with FIRE” that received high praise from publications like the…

The Disadvantages of Entrepreneurship

In January 2020, I decided to make the leap to a life as a digital entrepreneur. There were very few thoughts in my head about any disadvantages of entrepreneurship. I was mainly looking at the positive…

Nature vs. Nurture with Money: How Our Parents Shaped Us [Bread & Wine]

As we grow up, our parents have a lot of influence on the people we eventually become. But outside of parenting, sometimes we are who we are and there's not much they can do to…

Generational Wealth: How to Build It For Your Family [w/ Anne-Lyse Wealth]

Generational Wealth is the type of wealth that allows your family to experience financial freedom, choice, and options for generations to come. It's wealth that allows you to have the financial power to be the…

When Should I Tip? [Bread & Wine]

With all the services and restaurants we interact with on a daily basis, it's hard to know when you should tip and when you shouldn't. Nicole and I discuss the world of tipping and the…

Is Getting a Prenup a Good Idea for your Relationship? [Bread & Wine]

According to the American Psychological Association, 40-50% of marriages in the United States end in divorce. With a statistic like that, one might wonder if a prenup (prenuptial agreement) is a smart move. Nicole and…

How to Strengthen Your Family Tree – w/ Cindy and Butch Hill

It's our 250th episode! To commemorate this milestone, I decided to invite my parents, Cindy and Butch Hill, on the podcast. We discuss the childhood lessons that shaped their lives and how our family came…

Return to Work? Do I Have To? [Bread & Wine]

Employers are implementing their “return to work” strategies and employees are bracing for the change. Nicole and I discuss how this change will affect her work-life and the pros and cons of working from home….

We Interviewed 200 Millionaires (and Here's What It Takes to Become One) – w/ Clark Sheffield & Jace Mattinson

Ever wonder what it takes to become a millionaire? Clark Sheffield and Jace Mattinson, from the Millionaires Unveiled Podcast, have interviewed over 200 millionaires. Today, they are sharing the habits, investment strategies, and commonalities of…

We Spent $75,000 of our Savings! Now What? [Bread & Wine]

In the last year, we spent $75,000 of our savings on cars, trips, house upgrades and much more. Now, there's no money left! After this spending spree (including what we received from the Stimulus Checks),…

Should I Invest in Cryptocurrency? 13 Personal Finance Experts Weigh In

Recently I received a question from Christopher asking, “Should I invest in cryptocurrency and what is Bitcoin all about in laymen's terms?” Since I'm new to the cryptocurrency scene (like a lot of us), I…

Stay-at-Home Mom vs Working Mom: Deciding the Right Path – w/ Catherine Alford

Today, we’re talking with Catherine Alford about being a stay-at-home mom vs a working mom. This can be an incredibly difficult decision for mothers after they have children. Do I stay at home or do…

What To Do With New Money [Bread & Wine]

Will you be receiving money from the Child Tax Credit in 2021? Based on our income this year, we will be receiving the tax credit starting in July and could be upwards of $250 per…

Anthony ONeal: Will Income-Based Repayment Help with my $200k of Student Loans?

Stephen and his new wife have $215,000 of student loan debt and they don't know what to do next. They are considering Income-Based Repayment (IBR) but aren't sure if that is the right thing to…

Dealing with Negative Reviews [Bread & Wine]

As a small business owner, negative reviews can be devastating. They can deal a major blow to your confidence and, in some cases, to your bottom line. We invited two small business owners to the…

Pete the Planner Helps Us Move From Financial Disaster to Millionaire

After doing this show for the last 5 years, I’ve heard from a lot of people that say they feel like a complete financial disaster. They are making good money, but they are disappointed with…

Can Money Buy Happiness? [Bread & Wine]

It's the age-old question … Can money buy happiness? Joe Saul-Sehy, Host of the Award-Winning Stacking Benjamins Podcast, joins us to help answer this question. There may not be a right answer, but the three…

Socially Responsible Investing: Does it Pay Well to Do Good?

More and more people are looking for ways to do good in the world. So it's no wonder that people are starting to question what goes on behind the scenes with their investments. Making sure…

Climbing the Corporate Ladder [Bread & Wine]

At what point do we stop climbing the corporate ladder? For the last couple of years, Nicole has jumped back into the corporate world. She's doing a great job (per usual) and there is talk…

Female Breadwinners: How to Earn More and Worry Less [w/ Jennifer Barrett]

Author Jennifer Barrett wants women to earn more and worry less. As our nation grows with more and more female breadwinners, Jennifer is on a mission to ensure women are creating the most successful future…

Why Keeping Score in Relationships is a Good Idea [Bread & Wine]

Some folks say keeping score in relationships is a bad idea. We disagree. Nicole and I discuss how keeping score in our marriage helps us keep our sanity and helps each other feel loved. We…

Dave Ramsey Baby Steps Complete! Now What?

If you've been following the Dave Ramsey Baby Steps, you know there is a sequential order to each and every money decision. So when you've finally reached Baby Step 7, how do you invest your…

15-Year vs. 30-Year Mortgage: How to Choose? [feat. Scott Trench & Mindy Jensen]

Samantha and her husband are trying to decide on a 15-year vs. a 30-year mortgage. She wants to pay off the mortgage faster and he wants to “have options” Scott Trench and Mindy Jensen, co-hosts…

Employee vs. Entrepreneur: Which is Better? [Bread & Wine]

Is it better to be an employee or an entrepreneur? Nicole has been an employee her entire adult life and Andy is diving into year 2 of being a small business owner. With this background,…

The Budgetnista: Unemployed to Multi-Millionaire in 10 Years [w/ Tiffany Aliche]

The Great Recession had a major impact on Tiffany Aliche (aka “The Budgetnista”). She went from a happy pre-school teacher to unemployed living back home with her parents. Over the next 10 years, she transformed…

Do Opposites Attract? [Bread & Wine]

Love is in the air! But do opposites attract? Nicole and I talk about our larger-than-normal tax refund and we both have VERY different views on what to do with the money. We over-analyze our…

The One Thing: How to Prioritize What Matters Most [w/ Geoff Woods]

Have you heard of The One Thing, but don't know what it is? Geoff Woods, the host of The One Thing Podcast, shares how we can conquer our goals and have more time dedicated to…

The Disadvantages of Paying Off Your Mortgage

I've created a lot of content around the benefits of a paid-off house. One thing I haven't dived into much is the disadvantages of paying off your mortgage. I received a question from Maria on…

Join the FIRE Movement or Not? [Bread & Wine]

Are you considering the FIRE (Financial Independence Retire Early) Movement? This is a big decision to make especially if you're in a committed relationship. It's not just your decision … it affects both of you….

How to Decide Marriage Roles and Responsibilities | Bread & Wine

Confused about your marriage roles lately? Is it okay to change from your current station in marriage? Perhaps you're ready to go back to work instead of being a stay-at-home parent. Or you're ready to…

Leaving the City to Save Money? [w/ Stefanie O'Connell Rodriguez]

Are you considering leaving the city to find a more reasonable place to live? Well, you're not alone. Even before the pandemic, big cities like New York, Los Angeles and Chicago were seeing triple-digit daily…

Why Do We Judge Others? [Bread & Wine]

What a year! Has the judgment increased lately or is it just us? For as hard as we try, why do we judge others? And why do we care what others think about us? Nicole…

Airbnb Superhost: How We Made $100,000 in One Year with Airbnb – with Wendy Hill Manson

Want to become an Airbnb Superhost? Check out this story of someone who started small and grew her short term rental business. Wendy Hill Manson wanted a side hustle to make some extra money to…

Never Do Business with Family and Friends? [Bread & Wine]

What is your policy on doing business with family and friends? Nicole and Andy discuss the awkward nature of working with people you know instead of people you don't know. It's easy to go with…

Am I Ready to Buy a House?

After renting for a while, you may ask yourself, “Am I ready to buy a house?” There's a lot of pride that comes with homeownership. At the same time, this is a big decision and…

Should the Man Always Pay For Dinner? [Bread & Wine]

Should the man always pay for dinner on dates? What about dinners with friends? How do you handle that? Nicole grew up in a different culture than Andy and they discuss how this “paying for…

Jill Schlesinger: Common Money Mistakes to Avoid

CBS News Business Analyst Jill Schlesinger shares common money mistakes to avoid on our financial journey. It's fun to celebrate the big financial wins, but it can be just as important to review our mistakes….

Increase Income or Decrease Expenses? [Bread & Wine]

Is it more important to increase your income or decrease your expenses? Which lever is more important to pull on your financial journey? Nicole Hill throws a curveball at Andy Hill and tells him he…

How to Create a Financial Independence Plan

You've heard about financial independence (or FIRE). The personal freedom, new options, and a relaxed lifestyle all sound amazing, but you don't know where to start. It's time to create a financial independence plan. Just…

How to Start Investing in your 30's – with Erin Lowry

Are you in your 30's and you're ready to start investing? Well, you may already be an investor and you didn't even know it! Find out why when I chat with Broke Millennial Author, Erin…

Cheap vs. Frugal | Bread & Wine

Is there a difference between cheap and frugal? Some see them as the same thing and others feel there is a big difference. As per usual, Nicole and I disagree on the cheap vs. frugal…

How to Invest $100,000 (After You're Debt Free) – w/ Faith & Leo-Jean Louis

Faith & Leo Jean-Louis recently paid off over $200,000 of debt. The year after, they decided to invest $100,000 in the stock market to build generational wealth for their young family. In today's interview, we…

The 10 Steps I Took to Quit My Job to Start a Business

After 15 years of working as an event marketing professional, I decided that I was ready for a new chapter in my life. It was time for me to quit my job and start a…

How to Negotiate a Severance When You Resign – with Sam Dogen (Financial Samurai)

After working in his corporate career for 20 years, Joe from Michigan asks, “How do you negotiate a severance when you resign?” He's looking to leave his corporate career after two decades of solid work…

Jesse Mecham: You Need a Budget (and Here's Why)

Some people feel that budgets can be restricting or that they reinforce a scarcity mindset. Others, however, enjoy a sense of freedom and control with their budget. So who is right? Jesse Mecham, Founder of You…

Can We Have Separate Bank Accounts in Marriage? [Bread & Wine]

Can you be happily married and have separate bank accounts? Nicole and I dive deep into the subject and analyze if this is something we could do in our relationship after 10 years of having…

How to Keep Your Personal Information Safe Online – with Eric Cole

We see cyberattacks in the news. Our workplaces get hit with phishing scams. And how many emails have we gotten recently about our data being breached?! It feels like a daily occurrence. To learn how…

How to Increase Your Credit Score (After Becoming Debt-Free)

Have you recently paid off your debt and noticed your credit score drop? This recently happened to Christin from Detroit after becoming debt-free over the past 10 years following the Dave Ramsey plan. Her score…

How This Teacher Made a Million Dollars in the Stock Market Before 40 – with Brian Weitzel

Ever want to know how regular people make a million dollars in the stock market? High school teacher Brian Weitzel tells us how he did it. By age 35, high school teacher Brian Weitzel already…

Teenage Money Management Tips for Parents Who Aren't Money Pros – with Ed Vargo

As parents, we want our kids to have a healthy relationship with money. As they get older, learning smart teenage money management tips is even more important. After all, they are almost out of the…

Election Results: Should I Change My Investment Strategy?

Election 2020! What a year! The news, the tweets, the lawn signs! Honestly, I’m so glad it’s all over. Between the election, the pandemic, and the craziness of my kid’s in-person school getting cancelled, uncancelled and…

Lawrence Gonzalez: Smart Financial Planning Goals Before Marriage

When you're about to be married, money can sometimes be one of the last things you think about. Lawrence Gonzalez, the creator of The Neighborhood Finance Guy, shares the importance of making financial planning goals…

Roth vs Traditional IRA: Which is Right for You?

When you're investing for the future, you may come up against the choice of Roth IRA vs. Traditional IRA. Both are smart retirement investment options, but for different reasons. Alyssa asked us this question recently…

Semi-Retirement: Leaving California for More Time in Florida – with Joe DiSanto

In 2018, more than 86,000 people left California and moved to Texas. Joe DiSanto was one of them. After he became a new Dad, his “9-to-9” work lifestyle was just too much to sustain. He…

Dual Income No Kids: What To Do With Extra Money

Scott and his husband are a dual income no kids (DINK) household. They have come into some extra money lately and want to know what to do with it. Do they invest the money? Do…

Why Index Funds are a Good Investment – with Paula Pant

With all the noise out there in the financial media, it's hard to know if index funds are a good investment. Hot stocks that have had major spikes recently can be tempting to own. If…

How to Pay for Adoption Costs without Debt – with Amanda and Jonathan Teixeira

If you're considering adoption, one of the first stumbling blocks is the cost. Depending on which route you take, you could be looking at tens of thousands of dollars. So, how do you pay for…

5 Ways to Prevent Parental Burnout in the Pandemic

A lot of us are feeling parental burnout lately due to the pandemic. With virtual school, the recession, and so many other things happening at once, stress can start to take over. Author and Podcaster…

Work-Life Integration Over Work-Life Balance – with Mark Timm

A lot of folks can feel like rockstars in their small business or at the office, but at the same time feel like failures at home. One solution to consider is striving for work-life integration instead…

Money Smart Kids: Raising Children to Understand Financial Independence – with Doug Nordman and Carol Pittner

Do you want to raise money-smart kids? I'd venture to guess a lot of us parents want to, but we're not quite sure where to start. Doug Nordman focused on simple and practical lessons as…

How Dividend Investing Helps with Financial Independence – with Nadia Busseuil and Nicole Ozelge

Wouldn't it be amazing to earn money while you sleep? In my quest to learn how to do this, I came across the concept of dividend investing. You might be asking, “What is dividend investing?”…

How to Travel the World for Cheap (or Free) – with Lee Huffman

Dreaming of traveling to a bucket list destination but can’t seem to figure out how to make it work? Wouldn't it be amazing to travel the world for cheap or or even free? Lee Huffman…

Is It Better to Pay off the Mortgage, Save or Invest?

After you've paid off your debt and your savings starts to grow, you may stay to wonder what to do next. This is an exciting time for families as they start to make some major…

What to Do When Your Spouse Has a Spending Problem – with Ericka Young

When one spouse thinks that the other has a spending problem, this can be a recipe for a marriage disaster if it's not handled correctly. There are so many feelings around how we handle our…

Tips to Retire Early (From a Couple Who Did It) – with Dylin Redling and Allison Tom

Retiring earlier than 60 years old can sound like a pipe dream. But there are some who have completed this incredible financial feat. I was lucky enough to chat with a couple who retired in…

7 Steps to Become a Millionaire by 30 – with Lisa Schader

Have you ever dreamed of becoming a millionaire? For most people, those seven figures symbolize a certain level of financial status and freedom. It’s one thing to live and look like a millionaire, but it’s…

High Paying Jobs Without a College Degree (for your Teen) – with Ken Rusk

As parents, we want the best for our kids. We want them to have things we never had. For many of us, that’s the gift of quality education. A college education is a noble pursuit…

Why Digital Cash Envelope Budgeting Wins – with Qube Money

The Cash Envelope Method is an effective budgeting method that helps people to save money and limit overspending. At the same time, the convenience of credit cards for online shopping and shopping on the go…

How to Retire by 40 – with Steve Adcock

Wouldn't it be amazing to be able to retire at 40 years old? David, a listener of this podcast, thinks so! Here's his question: “My wife and I are turning 30 next year and we…

The Progressive Levels of Financial Independence

Are you interested in financial independence? Do you follow people in the FIRE movement? It’s easy to feel intimidated when you’re first getting started. However, a better understanding of the levels of financial independence makes…

How to Help Your Kids Have a Mortgage-Free Future – with Sarah Phillips

No matter where you are in your debt freedom journey, you can appreciate the power of what mortgage freedom means. A sense of freedom coupled with a boatload of options sounds appealing to most adults….

How We're Handling Job Changes, Coronavirus and Racism at Home

We've reached episode 200 of the podcast!! Since 2016, I’ve been interviewing debt-free couples, personal finance experts, financially independent parents, and young millionaires to figure out how they've succeeded. With this information, we’ve all had…

Roth IRA Investing | How to Save for Retirement Today – with Jedidiah Collins

Are you ready to start investing? Many people who are nearing the end of their debt payoff journey start to wonder how to begin investing. Debt freedom is powerful, and investing your money is another…

Generosity and Financial Independence: 3 Ways to Give Back on your FIRE Journey – with Dave Mason

Financial independence is a great financial goal to pursue. As we try to save more and increase our income, where does giving back fit in? It seems counterintuitive to give away money when the goal…

From $46,000 of Credit Card and Car Debt to Mortgage-Free – with Bob Lotich

Have you ever wondered what it would feel like to own your home outright? Maybe you’ve always wanted to pay off your mortgage early or maybe the idea of being mortgage-free seems like an impossible…

Planning Your Retirement Savings Using Expenses (Not Income) – with Joe Saul-Sehy

Have you ever wondered if you are on track with your retirement savings? We’ve all seen the articles that suggest how much money you should have saved by certain ages. But is that really the…

JL Collins: Financial Independence Through Index Fund Investing

As you explore the FIRE movement, you will quickly learn that investing is a key component of financial independence. You might be thinking that now is the right time to invest. After all, there’s a…

3 Simple Steps to Financial Empowerment – with SAVVI Financial

SAVVI Financial is on a mission to democratize financial advice. That means that they want accurate, fiduciary advice available to the masses. No matter if your net worth is in the negatives or you’ve already…

Student Loans and Coronavirus: Why You Shouldn't Pay Your Federal Loans Right Now

Stock market volatility, staggering unemployment, and a global pandemic. It's no wonder that people keep talking about how different our world feels right now. In times of uncertainty, people find themselves with more questions than…

Patrick Aime: From Bankrupt to Young Millionaire in 10 Years

Everyone loves a success story. Yet, in these uncharted waters, success might seem unlikely. With more and more people drawing parallels between the current pandemic and the last recession, it's no wonder people are worried….

Pay Off the Mortgage Early or Invest More? Why We Chose a Mortgage-Free Life

Should we pay off the mortgage early or invest extra? That is a question that many homeowners find themselves asking. There are certainly benefits to investing more, and there are also benefits to being mortgage-free….

Pay Cuts: 10 Ways to Save Money When Your Income Drops

The global pandemic has been wreaking financial havoc on families across the US. People are losing their jobs, getting furloughed or taking pay cuts. With no guaranteed end in sight, this can be a frightening…

Stop Money Fights Before They Start – with Adam Kol

When the topic of finances comes up in the conversations that you and your partner have, do you brace yourself for money fights? Some people think the solution is to simply avoid the topic of…

Investing in a Financial Crisis: How to Stay Calm During a Global Pandemic

The stock market is going up and down like crazy lately. It's hard to predict what will happen next. I was an “investor” during the last recession, but my tiny 401k balance at the time…

Mortgage Free: Complete Debt Freedom During a Financial Crisis – with Keith Robinson

For most of us, housing is one of the biggest expenses we face each month. Experts suggest keeping housing to 30% of your budget, yet high cost-of-living areas can claim much more. It's a huge…

FIRE Movement: Pros and Cons of Pursuing Financial Independence

There's more to life than working and paying bills. If you're like most people, you dream of a week filled with more time and more freedom. That's why a growing number of people are joining…

Teen Entrepreneurs: Inspiring Kids to Start a Small Business – with Rob Phelan

When it comes to mastering personal finance or exploring entrepreneurship, one of the most common laments I hear is that people wish they started sooner. Managing money well and taking the leap into entrepreneurship are…

How Being Honest in my Marriage Helped us Pay Off $61,000 of Debt – with Michael Lacy

Being in debt can cause mental stress, physical stress and marital stress. Michael Lacy and his wife Taylor were under marital stress when their debt caused them more problems than they were prepared for. After…

3 Real Estate Investing Strategies for Minimalists

For years now, my wife and I have been sitting on the sidelines of real estate investing. We’ve been watching people grow their wealth, expand their portfolio and grow their passive income. We have the…

How Living on 50% of Our Income Helped Us Reach Financial Freedom – with Kelly Smith

There may not be a single right way to achieve financial freedom, but supersizing your savings is certainly a powerful strategy. But what does supersizing your savings mean? More importantly, how does someone go about…

How This Couple Makes $250,000 Per Year Blogging – with Kelan and Brittany Kline

Imagine being able to take your side hustle to the next level and quit your full-time job? That’s exactly what Kelan and Brittany Kline managed to do after working on their blog for over a…

The Top 3 Reasons Marriages End (And How to Prevent It) – with Kimberly Holmes

One of the most important decisions anyone can make is who you choose to spend your life with. Marriage impacts us emotionally, socially, legally, financially, and in so many other ways. While the divorce rate…

Save for Your Home Down Payment in 10 Simple Steps

Rachel from Chicago has a question about saving up for her home down payment. My husband and I are trying to save for a down payment on a house. We are pretty good at living…

How the Great Recession Inspired Me to Pay Off My Mortgage Early – with Christin McKamey

The Great Recession (2007-2009) caused higher levels of unemployment, plummeting real estate values and a lot of people to feel uneasy about their financial situation. Many parts of the United States were hit hard during…

Climbing Out Of $1,000,000 of Debt to Achieve Financial Independence – with Wendy Mays

Being neck-deep in debt can make you feel like all the odds are stacked against you, especially when you reach almost the seven figures! Today, Andy talks to Wendy Mays on how her family is…

How We Can End Hunger in America Together – with Zuani Villarreal

For our “Be The Change” segment this month, we are featuring Feeding America. They are the nation’s largest domestic hunger-relief organization. Together with individuals, charities, businesses and government, their goal is to end hunger in…

Why Multi-Level Marketing (MLM) is a Bad Side Hustle – with Melissa Blevins

Multi-level marketing (MLM) is a $36 billion industry, but according to AARP, 73% of people who participate in MLMs make no money or lose money. So what’s the appeal? Why do people keep coming back…

Pay Off Your Mortgage Early in 10 Simple Steps

Our question of the month comes in from Mike: Andy, I saw the Business Insider article about you paying off your mortgage early. We’re in a similar situation. With $228,000 left on our mortgage, our…

How We Paid Off $300,000 of Student Loans in 6 Years – with Okeoma Moronu

Americans are currently carrying $1.5 trillion worth of student loan debt. That number reflects a monumental financial burden and a serious emotional one too. Many people find themselves battling poor sleep and anxiety while feeling…

How This Stay-at-Home Dad Makes $200,000 Per Year in Passive Income – with Sam Dogen

A lot of us have had this moment in our lives: we become parents and we want less time working and more time with family, but the income is just not there to support it. …

How to Teach Kids the Value of Money (And Why They're Never too Young) – with Liz Frazier

Almost half of the US would not be able to cover a $400 emergency. Around 40% have credit card debt. And 1/3 of Americans have saved $0 for retirement. If we want our children to…

How We Paid Off Our $160,000 Mortgage in our 30's – with David Venis

On our Mortgage Freedom series today we're going to interview someone who paid off their mortgage at 32 years old. And now he and his wife have a lot more money to enjoy. David Venis…

Why I'm a Family Man with a Business (And Not a Businessman with a Family) – with Jon Vroman

A lot of us are hard-charging employees, side hustlers, or business owners who are looking to grow, get that promotion, or just make more money. But we can't forget the most important people in our…

How I Quit My Six-Figure Job and Took A Year Off – with Michelle and Jacob Wade

Sometimes, hustling to make more money is not the answer. Today, Andy talks to Jacob and Michelle Wade, who recently took a “year off” with their family of five. Jacob is a former sales professional…

7 Reasons Not to Buy a Home (When You’re In Debt and Have No Savings)

Our second question of the month comes in from Anonymous from our Thriving Families Facebook Community: Hey Andy, Should we wait until we're debt-free in order to buy our first home knowing that we'll be…

Why I Stopped Pursuing FIRE and Early Retirement for a Happier Life Today – with Lisa Harrison

The FIRE movement (Financial Independence, Retire Early), has become a wildly popular concept over the last decade, but it's also become wildly controversial. Today, Andy talks with Lisa Harrison, the writer and podcast host behind…

5 Smart Ways to Save and Invest for Your Child's Future – with Damian Dunn

In today’s episode, Andy chats with Damian Dunn about how to save for our children’s future. Damian is the director of personal finance strategies at Your Money Line and is the co-host of the Pete…

How We Paid Off Our Mortgage Early By Living On One Income – with Tracey Sherman-Falcon

For this month's Mortgage Freedom series, I caught up with Tracey Sherman-Falcon from Aurora, IL. She and her husband Gandi Falcon just paid off their mortgage! They are so thrilled with the emotional benefit of…

Building a Multi-Six-Figure Online Business from Home – with Monica Louie

A lot of young parents are looking for a flexible work schedule so they can spend more time with their kids. Creating a business that provides your family with a good income and the flexibility…

How to Make Long-Distance Real Estate Investing Easy – with Zach Evanish from Roofstock

For our Fintech Spotlight segment this month, we are featuring our sponsor Roofstock. A company that makes investing in single-family rental properties radically simple. I've invited the Director of Retail at Roofstock, Zach Evanish to…

Why One-On-One Time with Your Kids is the Best Investment | Jim Sheils

As career-driven individuals and busy entrepreneurs, we can get often caught up in the time-consuming race of constantly growing our income and expanding our businesses. While our motivations may be pure, there can be long…

How Our Kids Helped Us Pay Off $250,000 of Debt (Including our Mortgage) – with J'Neal McCoy

For this month's Mortgage Freedom series, we're talking with the McCoy Family! They partnered together to pay off their mortgage early. In the 3 years that I've been doing my podcast, I've never interviewed both…

Tiny Home Living and Minimalism Are Helping us Become Debt Free – with Jill Sirianni

According to a recent survey by the National Association of Home Builders, more than half of Americans would consider living in a home that's less than 600 square feet. And when you ask millennials the…

Why Investors Need a Fiduciary Financial Advisor – with Brent Weiss from Facet Wealth

For our Fintech Spotlight segment this month, we are featuring our sponsor, Facet Wealth. They make working with a Certified Financial Planner professional simple and convenient. I’ve invited a founding member and the Chief Evangelist…

Where Can I Open a Brokerage Account to Invest for my Kids?

Our second question of the month comes in from Kevin from our Thriving Families Facebook Community … My kids are getting physical cash from grandparents for holidays. They are small denominations like $5 for Halloween,…

Living Paycheck to Paycheck on $100,000. How can we improve?

Our first question of the month comes in from Julie. Well, it’s really a half question/half statement but nevertheless, here we go … Try this on: $92,000 income family with one baby. We live in…

How I Bought 20 Rental Properties in Cash – with Rich Carey

Some people choose to take out loans to buy their rental properties and others choose to pay cash. Today, we're going to explore why you might want to consider buying in cash and how to…

How Becoming a Parent Helped Me Retire at 41 – with Chris Mamula

There comes a point in a parent's life when they want to own more of their time and spend it with the ones they love the most, but financially, it's not always the easiest to…

Why I Left My $400,000 Wall Street Salary After Having My Baby – with Chelsea Brennan

Life changes rapidly when you have a baby. One minute you're crying with tears of joy and the next you're crying because work, parenthood and life have suddenly become very complicated. I've invited someone on…

How to Prevent Gun Violence in Schools – with Nicole Hockley

For our “Be The Change” segment this month, we are featuring Sandy Hook Promise. This is an organization dedicated to preventing gun violence in our nation's schools. I've invited the Co-founder and Managing Director, Nicole…

How to Complete Dave Ramsey's Baby Step 1 in One Week

For the past few years, I've been volunteering at my church to coordinate Dave Ramsey's Financial Peace University course. It's a 9-week course that helps people get out of debt and get into strong financial…

Pay Off the 30-Year Mortgage Early or Invest?

Our first question of the month comes in from Patrick from California: Hey Andy, can I pick your brain real quick about paying off your mortgage? I just bought a house here in San Diego…

How I Paid For My $40,000 Wedding Without Debt – with Stefanie O’Connell Rodriguez

With many lending companies offering convenient (yet high interest) wedding loans these days, it can be tempting to borrow money to have your ideal wedding day. After all, the average cost for a wedding is…

How We Got Motivated to Pay Off $40,000 of Debt Fast – with Regan and Ryan Whitlock

There's a moment in people's lives when they decide it's time to become debt-free. For me and my wife, Nicole, it was when we learned we were going to be parents. For some, it's when…

How Paying Off Our Mortgage Got Us Closer to Financial Independence – with Julien and Kiersten Saunders

On our Mortgage Freedom Series today, we're going to interview a couple that paid off their mortgage in less than 3 years and is now one step closer to financial independence because of it. Julien…

Creating a Flexible Work Schedule to Live Your Best Life Today – with Angela Rozmyn

Saving for our future financial independence important. Embracing the present moment is important as well. So how do we find a balance that helps us achieve both goals? I’ve invited Angela Rozmyn on the show…

How Embracing Minimalism Makes Parenthood Easier | Nicole Hill

This is one of my favorite times of the year. Every 50 episodes, I have the extreme pleasure of interviewing the most important people in my world … my family. With it being episode 150…

Having “The Money Talk” with your Parents as they Get Older – with Cameron Huddleston

As our parents get older, their money problems can sometimes become our problems if we don't plan ahead. And if we're raising our children at the same time, there's a reason they're calling us the…

How House Hacking Helped Me Pay Off My Mortgage Early – with Steven Donovan