There comes a point in time when you ask yourself, “When can I stop investing for retirement?” Not only is this a possibility, but there's a whole entire movement around it. It's called Coast FIRE!

Recently, I received a question from “Anonymous on Instagram” about this very topic.

How do I figure out when we can coast?

We are maxing out Roth and 401k contributions yearly and have about $750000 saved, we’re 44. Want to “retire” ASAP but obviously keep working, just differently. We want to pursue profitable hobbies if that makes sense. He’s a mechanic and I’m a pharmacist.

Anonymous, thanks for reaching out!

First of all, congratulations on saving and investing $750,000 by age 44. That is an incredible amount of money.

According to Fidelity, the average American between 40 and 49 has around $120k saved for retirement.

So you, anonymous, are well above average.

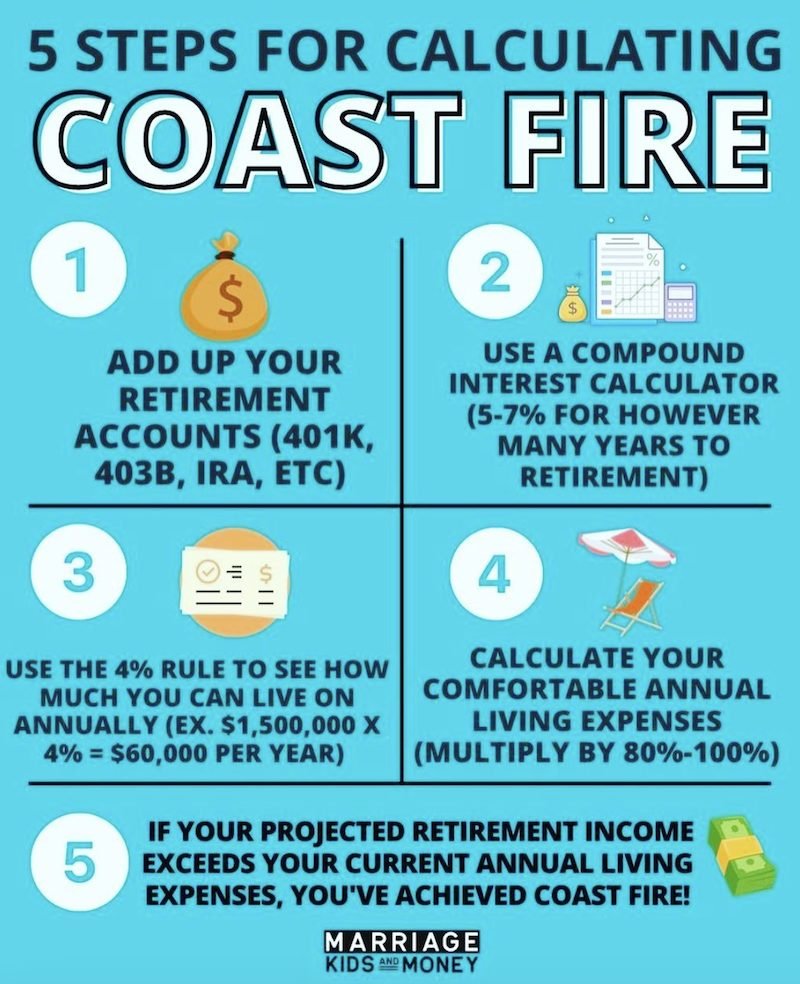

Let's answer your question … How do you know when you have achieved Coast FIRE?

Here’s how someone like you could find out if you’re Coast FIRE in my opinion:

1. Calculate How Much You Need Each Year to Live Comfortably

Not lavishly … comfortably.

Lavishly might make you feel like you’ll never have enough saved for retirement because there’s always MORE you can have.

Also, I didn’t say how much you need to “get by” or “survive”.

I think this number should be calculated based on how much you need to live comfortably.

For us, comfortable includes all of our household expenses, taking care of our children, multiple vacations, giving generously, and a bunch of other stuff that is important to us each year.

That comfortable number is currently around $80,000 per year.

Your number may not be $80,000. You may need far more than this to live comfortably.

Or you may need far less.

For our family, we need around $80,000 to have a comfortable year.

Will that change in the future when we’re retired? Oh absolutely!

We’ll spend less on summer camps, 529 contributions and soccer clothes. And we’ll probably spend more on travel, giving and get-togethers with friends.

If you don’t know where to start with calculating how much you need each year to live comfortably, I’d recommend starting and living on a budget. This will help you use your money in accordance with your family goals and values. Use one of these best budget apps to keep the process simple and get started!

Related Content: We Achieved Coast FIRE! How We Saved $500k by 40

2. Decide When You Want to Use This Money

I know you said you want to “retire asap”, but I believe you’re not really talking about retiring in the “ceasing to work” sense. You’re talking about easing into work you enjoy.

The sooner the better right!?

Well, for this discussion, let’s say you choose 65 for your traditional retirement age.

At that point, you’ll have a much larger sum of money than you do today due to time, compound interest, and any additional contributions you decide to make.

3. Play Around With Calculators

This is the fun part! This is when you can see how you’re doing on this Coast FIRE journey and how much you need to slow down or stop your retirement contributions.

Now there are a lot of opinions on the right interest rate to choose for your calculations.

I choose 7% and here’s why.

Average Stock Market Return

The average market return over its history is around 10%. Does it return that every year? No, but on average, it’s around 10%.

Average Inflation Rate

Inflation, which has been in the news so much this past year, is something to consider as well. Even though it’s been much higher than normal lately, on average, inflation is around 3%.

source: tradingeconomics.com

With the stock market average of around 10% and 3% of inflation, that’s where I get the 7% interest rate.

Is it perfectly accurate? No. It’s a guess. But at least it’s an educated guess.

If you feel that 7% is too aggressive, then try 5% for your calculations.

Let’s run your numbers with the 7% for fun.

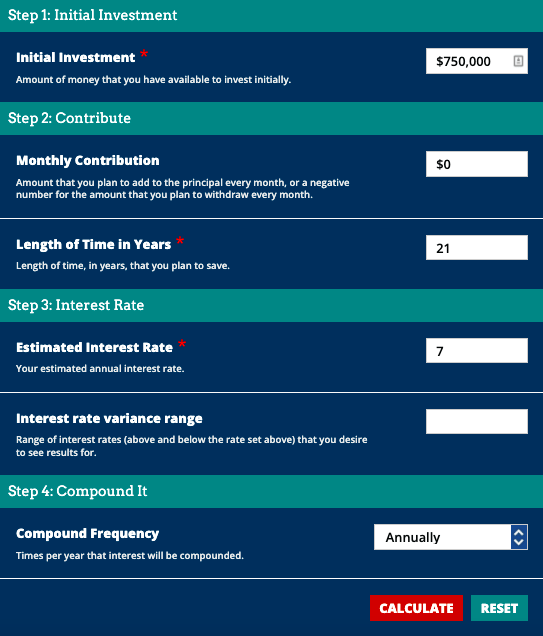

For an initial investment, we insert $750,000. This is the amount that Anonymous has currently.

For the monthly contributions, we insert $0. This assumes that Anonymous adds nothing from this point on.

The length of time … we insert 21 years since Anonymous is 44 years old and they’ll traditionally retire at 65.

And for your estimated interest rate, we’ll put in 7% as we discussed already.

We hit the magic calculate button and … voila!

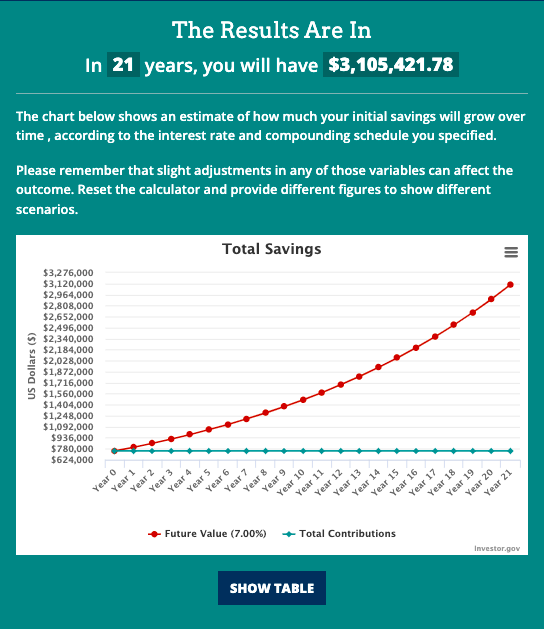

Anonymous will potentially have around $3.1 million by the time they retire at 65 years old.

Woo hoo! That sounds like a ton of money, right? Well … that’s all personal.

Let’s move on to #4.

4. Use the 4% Rule

The 4% rule is a rule of thumb for retirees that helps them understand how much they can take out from their retirement nest egg each year.

Although this percentage is also debated vigorously, with some saying 3% is safer, and others saying 5% is plenty … I’m sticking with 4% for now.

Perhaps another major market downturn like the Great Recession will damage my optimism in the future, but for now, 4% is fine.

4% Rule

With this potential nest egg of $3.1 million, let’s multiply that by 4% to see how much you would have each year in this scenario.

3.1 million x 4% = $124,000 per year (adjusted for inflation).

3% Rule

Let's say you think 4% isn't safe enough for you. No problem! Go with 3% for your calculations instead.

$3.1 million x 3% = $93,000 per year (adjusted for inflation).

5% Rule

And still, there are others who think 4% is going to leave them with too much money in the end. Perhaps there's a Die With Zero crowd out there!

$3.1 million x 5% = $155,000 per year (adjusted for inflation).

So anonymous, if you fall between $93,000 and $155,000 for your comfortable living expenses, I’d say you’re Coast FIRE already. You have the option to stop or slow down your retirement contributions.

5. Make Yourself Feel Comfortable

If the idea of stopping your retirement contributions sounds like crazy talk to you, then I’d suggest not doing it.

On the other hand, if Coast FIRE sounds interesting but going all the way to a full-on stop makes you feel nervous … I’d suggest adjusting your contribution rate away from retirement and towards something you’re excited about today.

That could be toward a business venture, real estate investing, or even a taxable brokerage account that could be used for pre-retirement investment goals.

As an example, my wife and I went from a 50% savings rate to around 10% savings recently. We still take advantage of company matches with my wife’s 401k and we are investing in a taxable brokerage as well.

Also, to your point earlier anonymous, I’m investing in my profitable hobby as well! This blog!

I made my profitable hobby my only source of income. Yes, my wife works full-time and currently makes more than me, but I’m hot on her trail!

My goal is to make more than her this year. This is a goal she fully endorses.

Final Thoughts on Coast FIRE

In the end, the point is not to waste away money you’re not investing for retirement. It’s to use it to enjoy more life today.

If you’ve been investing a huge amount of money to hit big retirement goals and you’ve hit those big retirement goals (factoring in time and compound interest), then have some fun, enjoy your life, and make memories with the ones you love.

Perhaps you’ve been putting off going on that family vacation until later. Or you’re saying to yourself, “I’ll go on that trip when we’re in our 60’s.” Well, when that time comes around, you may not want to go on that trip. Or you may not be healthy enough!

It’s a balance of course. But if you’ve hit Coast FIRE, I’m all about enjoying more of that money.

The goal (at least for me) isn’t to die with millions of dollars. I want to live, experience, make memories, and give back as much as I can while I’m here.

So, find your right numbers Anonymous, and decide how you want to move forward.

I can’t tell you what to do and maybe another REAL financial advisor might give you other numbers to look at, but in the end, you have to decide what type of life you want to live.

But given the INCREDIBLE savings you’ve done so far, I think you’re on track for a good future either way.

What do you think of Coast FIRE? Is this a FIRE concept you’re interested in?

Please let me know in the comments below.