Coast FIRE … You’ve maybe heard of this concept before, but perhaps you don’t know what it is.

That’s what YouTube subscriber Allen is feeling right now. He asked me to make some content clarifying how we achieved Coast FIRE and how others can too.

So that’s what I’m going to do today. And thank you Allen for asking me to do so!

What is Coast FIRE?

To me, Coast FIRE is when you have enough invested in your retirement accounts that you can decide to drastically slow down or completely stop new contributions and still retire comfortably in your 60’s.

When I’m talking about retirement accounts, I’m talking about your 401k, 403b, IRA. These accounts are focused on your future retirement needs. I don’t know about you, but I don’t have a pension waiting for me, and my faith in social security being enough (or even around by the time I’m 60) is not strong.

How Our Family Achieved Coast FIRE

Over the last decade of our marriage, we have invested in tax-advantaged retirement accounts to create a comfortable future retirement.

From 2013-2020, I maxed out my 401k contributions at work. Through time, compound interest, a strong stock market, consistent contributions and a 15% employer match, my account grew quite a bit. Not only did this increase our retirement investments, but it helped our net worth grow to over $1 Million.

Additionally, we have invested in Roth IRAs over the last decade as well. Between me and my wife, we now have around $550,000 invested for our future retirement needs. We’re nearly 40 years old and time and compound interest still have an excellent chance to work in our favor.

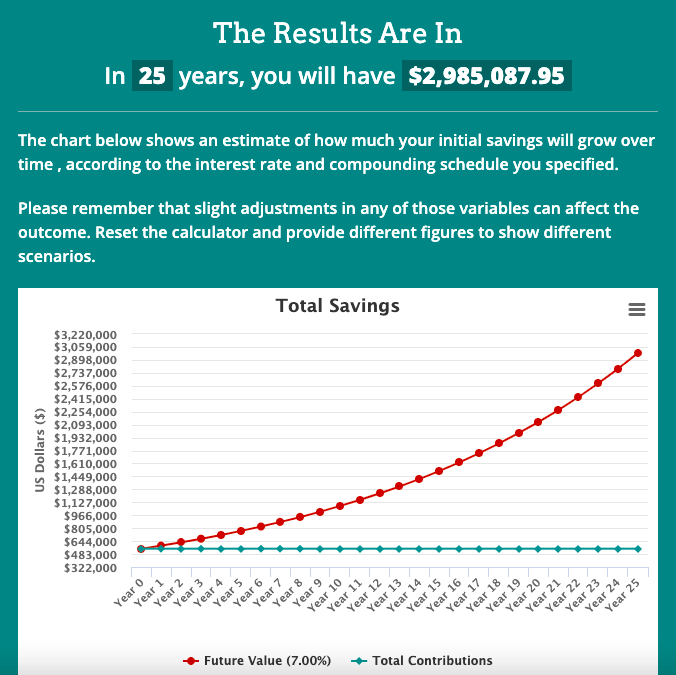

If our family simply did not add another dime to our $550,000, with a conservative 7% growth rate, we could expect to have around $3 million by the time we retire at 65.

Now, this math equation isn’t exact or perfect. There are many other factors to consider like taxes, inflation, and if the stock market will continue growing at its 10% average over the next few decades.

But even if I’m wrong by half, that still leaves us with $1.5 million at retirement time. With a 4% safe withdrawal rate, that will allow our family to live comfortably on $60,000 per year. And if I’m correct in my first calculation that we’ll be closer to $3 million at retirement time, we’ll be able to enjoy $120,000 per year.

If we land in that range, I believe we’ll be very comfortable and happy.

What To Do With Your Money After Achieving Coast FIRE

The options for what to do with your money if you’re not worried about investing for your retirement anymore are plentiful! This may be one of my favorite things to think about and plan for our family.

Here are just a few ideas:

Vacation More

With more money available, you can create some more memories with your family today. Our favorite way to do this is with an awesome vacation.

We live in Michigan so getting out of town in the winter is at the top of our to-do list going forward. Sunny weather, sandy beaches, and all-inclusive resorts are what we’re thinking.

This spring Nicole and I did a couples getaway to Jackson Hole (pictured above). Man, was that beautiful!

Invest More (Outside of Retirement)

Just because you stopped investing for retirement, doesn’t mean you have to stop investing for other important goals in life.

Nicole and I are now investing in two separate taxable brokerage accounts with different purposes.

The first account is being built up to serve as an early retirement account that would allow us to slow down working around 50 years old instead of 65.

The second account currently allows us to enjoy dividends today for things like back-to-school shopping and dinners with family each year. This came from a $30,000 inheritance we received from Nicole’s Mom when she passed away a couple years ago. Since Grandma loved doing back-to-school shopping with our kids, we decided to create a fund that would allow her to take them shopping each year even though she’s not with us. It helps us to have her memory live on.

Upgrade the Home

Since slowing down our retirement investing, we’ve taken the opportunity to plus up our forever home. Last year during the pandemic, we upgraded our kitchen and we absolutely love it.

In the fall, we’re getting a hot tub to enjoy year-round. Nicole has wanted a hot tub every since we got married, so I’m excited we’re finally making that dream of hers come true.

Upgrade the Car

Nicole owned her car for 14 years. Since we had more money available, it was time to upgrade.

We went with a slightly used Acura MDX — more room for our growing kids and a lot of nice features that make driving more enjoyable.

Now, I’m excited about upgrading my car too. It’s about 11 years old so we’ve started a “car fund” for my next ride. I like the Ford Mustang Mach-E. Have you seen this one? I love the look and I’m excited to go fully electric.

Pay Off the Mortgage Early

We ended up becoming mortgage-free in the midst of our investing journey. For others who have reached this Coast FIRE milestone, eliminating the largest monthly payment you’ll ever make could be something to consider.

This is a personal decision for sure, but paying off our mortgage early was one of the best decisions our family ever made.

The freedom we now have is incredible.

Design a New Lifestyle

With no debt, no mortgage, and no need for additional retirement contributions, we’ve adjusted our work lifestyle as well.

In early 2020, I left my corporate 9-to-5 and I’m now working part-time as a content creator. Making videos on the internet, writing articles, and creating podcasts. I absolutely love my new job! And I love the flexibility it gives me to be a present Dad and husband as well.

My wife does work too which makes things a lot easier regarding health insurance and with her income too. Between the two of us, we’re pulling in around $100k per year as an administrative assistant and a podcaster.

That’s plenty for us to pay for what we need and enjoy life a lot of awesome extras like vacations and summer camps for our kids.

Give More

This past year, we started giving 10% of our take-home pay. We give …

- 5% to charities and causes we believe in

- 4% to family and friends in the form of gifts, cash and surprises

- 1% to our hard working neighbors in the service industry during the holidays

The ability to give a $100 tip to someone going the extra mile to give their families a better life makes us feel incredibly happy.

How Do You Know When You’ve Achieved Coast FIRE?

If all this sounds interesting to you, you may be wondering how you can reach Coast FIRE too!

To understand when you’ve achieved Coast FIRE, you need to first find out two important numbers — (1) Your annual expenses and (2) when you want to retire

Your Annual Expenses

Your “annual expenses” is just a fancy way of saying how much do you spend each year.

If you don’t know this number, that’s okay. Not a lot of people do.

The number most people know right off the bat is how much they make each year. I believe that knowing how much you spend each year is even more important. Because you can make a million dollars per year, but if you spend $1.1 million, you’re in the hole by $100k each year and you’re not building wealth or setting yourself up for a comfortable retirement.

If you don’t know this number, create a budget, start tracking your spending and find out.

Nicole and I love Mint. It’s our budgeting tool of choice, but there are dozens of other budget apps out there to make budgeting and understanding your annual expenses a lot easier.

When You Want to Retire

For our Coast FIRE calculation, I chose 65 years old.

You may want to be more aggressive and choose 59.5 years old as that is when you can access your 401k and IRA without penalty. The earlier you retire, the less compound interest has time to work in your favor.

If you choose 70 years old, then you’ll have even more money! But perhaps that’s waiting too long to enjoy your money. After all, the average lifespan in the US is only 78 years old. 75 if you're a man, sorry fellas.

When you want to retire … That is a decision only you can make.

Play Around With Calculators

Once you’ve determined your annual expenses and your desired retirement age, you now have the two most important numbers.

To see where you are, use calculators like this awesome Coast FIRE calculator. Or just even a compound interest calculator.

These calculators may not give you the exact answers you’re looking for, but they’ll help you see if you’re on the right track.

Final Thoughts on Coast FIRE

After playing around with the calculators, you may find that you need to do a lot more investing for retirement after all. And don’t worry if that’s the case.

The majority of America is there with you.

According to GOBankingRates, 64% of Americans are now expected to retire with less than $10,000 in their retirement savings accounts.

If you spend more than $10,000 per year, that retirement savings wouldn’t even last a year.

So, if Coast FIRE sounds awesome and living on less than $10,000 per year sounds horrible, then it’s time to get rocking with your retirement investing my friends.

Check out this step-by-step guide to get started with investing today.

What do you think of Coast FIRE? Is this a FIRE Movement step you appreciate?

Please let me know in the comments below.

2 Comments

Love your content! For clarification, are you actually stopping your retirement contributions or you are just celebrating that you could if you wanted to? We are in a similar boat as you (paid off house, one person working with health insurance tied to that, nearing 40, etc.) but I can’t bring myself to stop contributing to retirement even though we are technically coast fi. The FIRE movement is awesome because all of the options that open up but it is also overwhelming given all the options it opens up. We aren’t really sure what our next moves are but even if we stopped retirement contributions altogether I think we would just redirect that to our taxable account for the RE part of FIRE but then we lose the tax benefits and employer match so it feels like that is not a good option. I guess I just want to see what others are actually doing so I can compare notes haha! Thank you for your time!

hi Jess! There is no one “right” answer here. For us, we’re going to keep taking advantage of 401k matches at work (because it’s essentially free money) and then divert our other investments to taxable brokerage and my small business. This way, we can invest in areas that will help us create passive (or semi-passive) income to enjoy today.

I hope that helps!