In late 2013 while I was traveling out of town for work, my wife Nicole found our “forever house”.

This home had everything she wanted, including an attached garage, an open floor plan, an updated kitchen, a walk-in closet, and a big backyard on a half-acre lot. She told me that this was THE ONE and I had to see it as soon as I got home from out of town.

My wife has excellent taste and we are in sync most of the time. I wasn’t worried about liking it. I was worried about getting a BIG MORTGAGE to pay for it!

Honestly, I had been burned before. My first home purchase was a disaster.

I bought more home than I could afford in 2004 and when the housing market tanked in metro Detroit around 2009, I owed more on the house than it was worth. I did not want to be in that position again.

Surprisingly, when I looked at the house Nicole found, I loved it too. It felt like home instantaneously. Even the neighbors were perfect.

We decided to go for it.

BUT… Given my history with mortgages and feeling overwhelmed by the realities of homeownership, I had some ideas that would help us to pay off our mortgage in 5 years. That way, Nicole would get the house of her dreams and I would get the mortgage-free life.

Our Family's Formula to Pay Off Our Mortgage in 5 Years

1. Get a 15-Year Mortgage

In our first house together, I had made a lot of uneducated first-time home buyer mistakes that I didn’t want to repeat. One of those areas I was bound to improve was the mortgage process.

My first mortgage was based on a 30-year payoff period.

30 freakin' years to pay it off! I'm sorry … That is just too long to wait to experience complete debt freedom.

This time would be different.

When we bought our new house in 2013, the rates were at an all-time low. We got hooked up with a $195,000 15-year mortgage at a 3% interest rate with no points.

This 15-year mortgage had higher monthly payments of around $1,900 (including taxes and insurance), but the bulk of it was going to the principal every month instead of our mortgage company's pockets. Nicole and I agreed that if we couldn't afford to pay the larger monthly payments of a 15-year mortgage then we shouldn't buy the house.

Looking back, the 15-year mortgage was one of the best decisions we’ve made so far.

Not only were we paying less interest to the mortgage company by going with the 15-year mortgage over the 30-year mortgage, but the mortgage principal also went down by a sizable amount each month.

2. Make Additional Principal Payments

My second nerdy money rule to crush our new mortgage in 5 years was to make additional monthly payments toward the principal each month. We would do this by reducing our expenses and increasing our income.

Reduce Expenses

Here are some of the ways we cut back:

- Fewer dinners at restaurants

- Packing my lunch for work

- Dialing back our grocery spending (we love Aldi!)

- Cutting the cord on cable

- Going with high-deductible insurance plans

- Saying no to family and friends more (this was the hardest)

Although these sacrifices felt difficult, we had a healthy household income of between $160,000-$180,000 during the mortgage payoff process. So it wasn't that much sacrifice really, it was more just us getting used to the “new normal”.

And we were prepared as well. A couple of years prior, we had eliminated our $48,032 of debt (car and student debt) by living on a lot less than we make. Having no debt definitely helped!

By reducing our expenses, we were able to make additional principal payments each month. This had a major impact on the dramatic reduction of our mortgage. Yes, we had a 15-year mortgage, but we wanted to turn it into a 5-year mortgage.

Increase Income

Bonuses

I didn't always receive bonuses at work. It depended on how my company was doing that year or how I performed. During the payoff process, I was fortunate enough to receive two bonuses for a solid performance. That unexpected money was also sent to attack the mortgage.

Estimated total mortgage payoff impact: $6,000

Sell stuff online

We also sold a lot of our stuff on Craigslist, eBay and Facebook Marketplace. A road bike, a moped, clothes, purses and furniture … anything we weren't using regularly and didn't make us happy was sold.

Estimated total mortgage payoff impact: $3,000

Live on less (Paycheck mind trick)

My company paid me 26 times per year (every two weeks) as opposed to 24 times per year (1st of the month, 15th of the month). Nicole and I agreed when we bought the house, we would only live off of 24 paychecks annually instead of the 26 we actually received.

So twice a year, we have made a BIG payment on the principal with those two additional paychecks. This consistent biannual payment took a huge bite out of the overall principal balance.

Estimated total mortgage payoff impact:: $30,000

3. Have a Monthly Budget Party

Nicole and I agreed to meet every month to create and review a monthly budget. I dubbed this the “budget party“.

She did not find it to be much of a “party” per se, but I figured if I call it a party she might be more willing to show up. (spoiler alert: it worked!)

Pick a Budgeting Tool

The monthly party consisted of pizza, a glass of wine and us developing a zero-based budget through Mint where every dollar that we earn each month is committed. This way we were controlling our money instead of our money controlling us.

After Mint went away recently, we moved over to Monarch Money. This modern money management tool is specifically designed to help couples track their finances together.

This “budget party” also helped us to discuss other important things like:

- Upcoming family events

- Weekend plans

- Date nights

- Future goals

With two little kids under 6 years old running around the house, we didn’t get enough time to talk. Our Budget Party helped with that.

Related Article: The Best Budgeting Apps for Families

Make Consistent Additional Principal Payments

Since paying off the mortgage was a big deal for both of us, we ensured that the extra principal payments were included in this budget each month. With the additional principal payments being automated, it became our way of life.

It's kind of like when you set up automated 401k contributions. You don't even allow yourself to realize you have access to that money. And then you look back years later, and you've made HUGE financial progress. In a sense, you set it and forget it.

4. Have Fun

My wife is a good yin to my yang. She likes dreaming for the future with me and having a little less today so we can have more tomorrow. She also wants to make sure we're enjoying our lives today.

With the madness that sometimes came with my full-time job and young parenthood, we both agreed that if we were going to do this crazy “pay off our mortgage in 5 years” extravaganza then we still needed to have fun.

Everyone defines fun differently. For us, it meant things like:

- Having themed birthday parties for our kids

- Spending time together for a date night

- Driving to Northern Michigan to visit our family for the weekend

- Going to Detroit Lions games

- Getting babysitters so we could do a date night out every once in a while

The last thing we wanted to be was “house rich and life poor”. I can accurately say we still had fun during the mortgage payoff process. I think Nicole would agree.

5. Dream Big Dreams

To stay motivated and excited about paying off the mortgage, we constantly reminded ourselves why we were doing this. When we paid off our 15-year mortgage, we would:

Go on More Family Vacations

We would be able to go on an epic family vacation every year.

Perhaps we'd go to Mexico for a week during Christmas or Easter. The warm, beautiful sun would shine on our pale native Michigan skin while we lie on floating rafts in a picturesque infinity pool. Ah, so nice…

Help Our Kids Graduate Student Debt Free

With the $1.7 Trillion in student debt right now, we would do our best to help our kids graduate college without loans.

Our kid’s 529 college funds would grow and grow with the additional funds we have so that one day they could attend college and not have to worry about student loans. Wouldn’t that be an incredible gift?

Buy Our First Rental Property

We would be able to save for our first rental property and begin generating some true passive income. As the passive income builds over time, we would be able to reach financial independence and design a lifestyle we love.

Design a Part-Time Work Lifestyle

One of the best reasons to pay off our mortgage early was that we would both be able to design a part-time work lifestyle. We would work fewer hours at our jobs and spend more time doing the things we love.

Or better yet, we would keep working full-time, but do work we’re passionate about instead of work we HAVE to do.

Give More to Charities We Care About

Without a mortgage payment, we would find charities that fill up our hearts and become more giving. Having an open hand with our money would help us discover where our passions truly lie.

These dreams kept us motivated and excited about the day our mortgage would be gone for good.

6. Celebrate with the Family

If we kept consistent with our goal, made sure to still have fun, and kept dreaming of a brighter future for our family, we knew we’d pay off our 15-year mortgage early.

And we did.

On November 21, 2017, our family became completely mortgage-free. We paid off our 15-year mortgage in less than 5 years. In fact, it was just a bit under 4 years!

We had an epic mortgage payoff celebration together as a family to commemorate this big moment in our lives. Click the link in the last sentence to see what a “mortgage piñata” looks like!

7. Make Dreams Become a Reality

The sense of freedom we now have is incredible. Without a mortgage, my stress levels have decreased immensely. Our young family's future looks bright.

Here are some of the ways we are already bringing our post-mortgage dreams to life:

Travel More

The following spring after we paid off our mortgage, we took our family to Cabo San Lucas for a week of fun in the sun. We hit up Disney World, Los Angeles and Florida that year.

Now, we’re addicted to getting out of town when it’s cold in Michigan. Money well spent!

Give More

Our family charitable giving has gone from 1% to 5% (of our take-home pay). We’re proud to give more, but we’re more proud to highlight the fine people leading these charities.

Here are a few charities that I admire and I’ve had the pleasure to interview on my podcast:

- Together We Rise: Supporting children in foster care

- Thorn: Protecting children against sexual exploitation on the internet

- Sandy Hook Promise: Preventing gun violence in schools

- Feeding America: Helping 37 million Americans who face hunger

Design a 25-Hour Work Week We Enjoy

After becoming mortgage-free, Nicole took a part-time job that she enjoyed. After 5+ years as a stay-at-home Mom, she was ready to add something else to her life.

I decided to leave my full-time career in corporate event marketing and pursue my passion for helping young families build wealth full-time. It was a big decision to leave a six-figure career and become an entrepreneur, but we were financially prepared for the big leap and I was ready for a change.

Lately, we've both developed an incredible balance of family time, personal time and doing work we both enjoy at around 20-30 hours per week.

The Details of How We Paid Off Our Mortgage in Less Than 5 Years

Since we paid off our mortgage, I have received a lot of positive encouragement about our mission to become completely debt-free. I also received a lot of questions on how specifically we were getting it done.

To help provide clarity and satiate my nerdery for spreadsheets, I went back and tracked each monthly statement in detail.

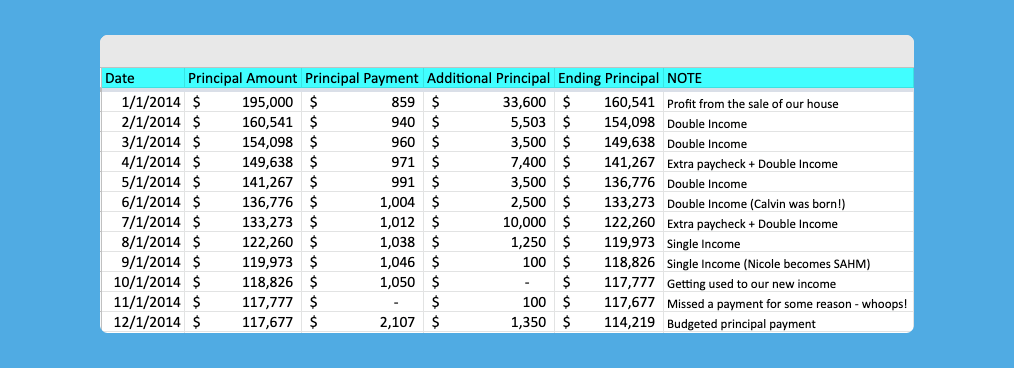

Year 1: 2014

Sale of Last Home ($195,000 – $33,600 = $161,400)

After living in my 1,100-square-foot bachelor pad for nearly 10 years, Nicole and I agreed it was time for an upgrade. Alas, we had some good memories there!

When we sold that house shortly after we bought our forever home. We used the proceeds from the sale ($33,600) to further pay down our mortgage to $161,400.

15-Year Mortgage ($161,400 – $11,977 = $149,423)

We decided to go with a 15-year mortgage to allow for higher principal payments and an overall shorter window for paying it all off. We got a 3% fixed rate with no points.

Going with a 15-year mortgage versus a 30-year mortgage was a no-brainer for us. In year one, our principal payments were $11,977 alone!

Additional Principal Payments ($149,423 – $35,203 = $114,220)

Nicole and I were both still working at this point so we continued to use our double income to make major additional principal payments. That is until … This adorable blessing came into our lives.

Around halfway through the year, we decided that Nicole would stay at home with our two kids and put her career on pause. Although life as a stay-at-home Mom can be difficult, she was excited about the change and the ability to closely bond with our young children.

As you can see from the chart above, this loss of income brought down our additional principal payments dramatically. No problem. He was worth it. We're keeping him.

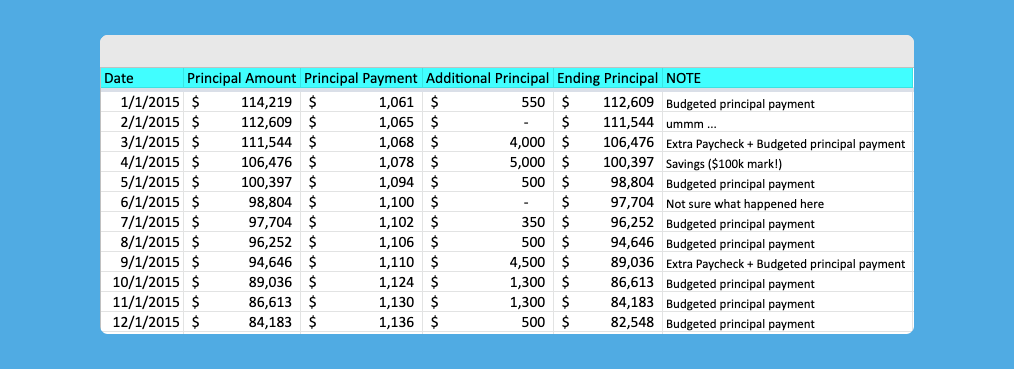

Year 2: 2015

15-Year Mortgage ($114,220 – $13,172 = $101,048)

At this point, the regular principal payments were well over $1,000 per month making the pay-down process that much easier.

With the aggressive mortgage schedule from our 15-year mortgage, our balance decreased to $101,048.

Impatient Debt Crushing Guy ($101,048 – $5,000 = $96,048)

I don’t know why I started to get impatient at this point. Perhaps it was our decreased income. I decided to take $5,000 out of our savings account and pay down our mortgage so we could break the $100,000 mark in our mortgage balance.

This decreased our Emergency Fund savings from 6 months to 5 months. I wouldn’t recommend this move especially when you’re the sole breadwinner with an infant at home. Not smart, Andy!

Additional Principal Payments ($96,048 – $13,500 = $82,548)

Compared to 2014, we drastically reduced our additional principal payments due to going to a single income. Despite that, Nicole and I worked closely together to keep paying down the principal where we could.

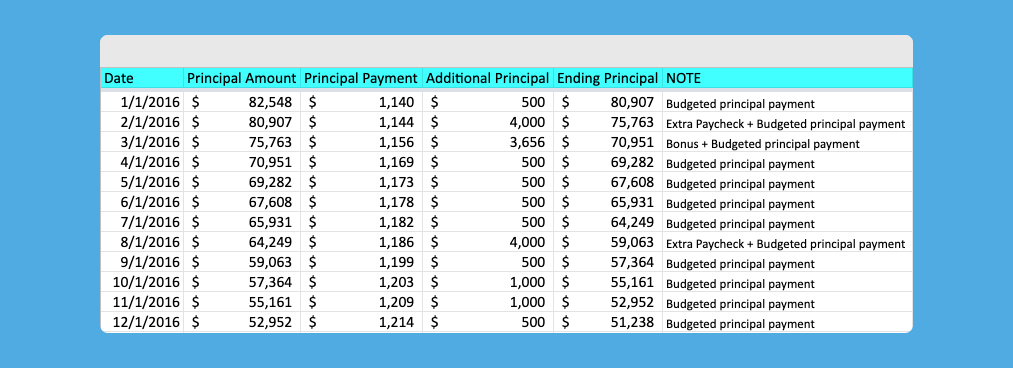

Year 3: 2016

15-Year Mortgage ($82,548 – $14,154 = $68,394)

Even without extra payments, the 15-year mortgage clobbered our principal by itself. Payments consistently exceeded $1,100 monthly and totaled $14,154 for the year.

Additional Principal Payments ($68,394 – $17,156 = $51,238)

In 2016, we were consistent with the previous year’s additional principal payments. The only difference is that I received a bonus at work for crushing my sales goals.

That pay increase from work became more fuel for the mortgage-burning fire!

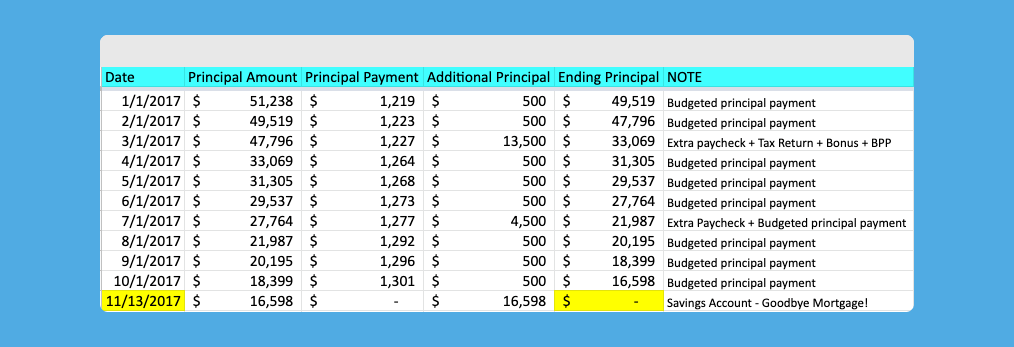

Year 4: 2017

Late in 2016, I declared on my blog that we’d be paying off the mortgage by Christmas 2017. I had no idea how it was going to happen given that we didn’t have enough money to do that. I figured I’d put it out there and find a way to make it a reality.

15-Year Mortgage ($51,238 – $12,639 = $38,599)

The 15-year mortgage principal payment went into overdrive in the final year. $12,639 was eliminated by the time we asked the mortgage company for our payoff quote.

Additional Principal Payments ($38,599 – $22,000 = $16,599)

Our regular monthly principal payments continued, but this year we were graced with a nice tax refund (good mistake).

My excitement about paying off the mortgage early improved my performance at my job. So much so, that I received another bonus! Like I’m trying to teach my daughter when she’s doing her chores, hard work does equal reward.

Return of the Impatient Debt Crushing Guy ($16,599 – $16,599 = $0!)

So remember when I said that I shouldn’t have taken out of our Emergency Fund to pay down the mortgage? Whoops. I did it again.

But in reality, our Emergency Fund doesn’t need to be as large anymore. Without a mortgage, our expenses are dramatically lower. So the 5-month Emergency Fund that we had before magically turns into a 6-month Emergency Fund. Poof!

Am I using the magic of math to justify my actions? Ab-so-freaking-lutely…

But …

We’re MORTGAGE FREE!

More Stories from the Mortgage-Free Movement

After paying off our mortgage, I thought it would be fun to learn from and feature other families who did the same. The freedom and options these families have, because they are now mortgage-free, are incredible. Check out these stories below and find one that resonates with you.

- Pay Mortgage Early on Less than $50,000 Per Year – with Jessi Fearon

- How the Great Recession Motivated Me to Pay Off My Mortgage Early – with Christin McKamey

- How our Kids Helped Us Become Mortgage Free – with J'Neal McCoy

- Pay Off the Mortgage Early or Invest More? – with Kevin Hooper

- Mortgage Free: Complete Debt Freedom During a Financial Crisis – with Keith Robinson

These are just a handful of the stories we've collected about families paying off their mortgages early. If you're interested in listening or reading more stories about how to pay off your mortgage early, click here.

And hey, if you've paid off your mortgage, I'd love to hear from you. Sharing your financial wins could inspire others to win too. More inspiration. More mortgage-free families. And so on. What a wonderful mortgage-free world that would be!

How would paying off your mortgage early change your life? Is a paid off mortgage in 5 years realistic for you?

Please let me know in the comments below.

Carpe Diem Quote

“It takes two flints to make a fire.”

Louisa May Alcott

58 Comments

Let’s be realistic here – you had a small mortgage. I live in NYC. My mortgage is $321,000. I refied my mortgage from a 30 year (6%) to a 20 (3.5%) to a 15 year (1.99%). I was hoping to have it paid off by the time I retired at 62. Unfortunately the fates decided to screw me over by having my husband lose his job not once but THREE times leaving us with only my salary to pay all the bills. Despite all that I managed to max out my TDA (403B) contributions at work every year. I transferred all credit card debt to 0% cards and paid them off before I retired in 2019. When I retired I bought myself a new Subaru outback because I know they last. I had one in the past & I won’t be driving much in retirement. I took a 5 year loan (1.99%) to be cautious. I have been paying extra principal on it every month & will have it paid off 2 1/2 years ahead of schedule. Then I can concentrate on the mortgage. I hope with adding an extra $1000 each month to have it paid off in 10 years.

This is the post that pushed me over the edge to go gang-busters toward paying off our house. I’ve been paying on my student loans steady for the last 6 years. I told myself that when I saved enough that I’d pay them off in full. Well, the savings has been there for a while—I just never pulled the trigger. I ponied up and paid off $42,000 in a lump sump a couple months ago. We now are only left with our $163,000 mortgage. No car payments, no credit cards.

Your post resonated with me—especially the reduction of stress. As the sole income earner in our home, I feel an immense pressure to provide and make good choices. I feel that eliminating my mortgage will eliminate a huge emotional burden and open up some additional opportunities (part time schedule, as you mentioned). My wife and I agreed to a plan to eliminate the mortgage in under 3 years. Can’t wait for the final payment!

Thanks again for the inspiration!

From a fellow Michigander. :)

I LOVE THIS MESSAGE! Thank you so much for commenting Troy.

The fact that I contributed even a small amount to your journey makes me feel so happy. Thank you for this blessing today.

AND please let me know when you pay this mortgage off. I want to celebrate your victory on my podcast.

Took my 30 year and refinanced this summer to a 10 year… BEST DECISION. Already paid off $10K in 6 months! $75k to go! Your article makes me feel like I am doing something right with my money. What a great feeling! Feel you on the winters, born and raised in Windsor.

Awesome! Keep rocking it, Rory.

Keep us posted on your progress so we can celebrate you!

Hi Andy, Thanks for the insight and encouragement. We are on a single income and on a 30 year (3.625% int. Rate) mortgage ($1377/month w/tax) and have 26 years to go ($207k principal left). A 15 year at current rates(2.6-2.8) will be a stretch on the finances. Would it be ok to go for a 20 year(3% rate)? We have no other debts and with the car payment gone, we have extra $500/month. Current contributing around 8.5% towards retirement and $300/month towards a 529 plan. Thoughts?

You’re doing great!

If it’s a stretch for your current income, go with what feels right. If you get additional income, you can always through it at the principal and beat down your 20 year or 30 year mortgage (and essentially make it a 15 year!).

Over time as your income grows, you can save more for retirement and pay more towards the mortgage. Keep at it!

Hi Andy – I hope you see this reply, as I know the article is a few months old. My husband and I are in the midst of paying off our 15-year mortgage. Our goal is to pay it off by the end of 2022, which will be 11 years early! I am contributing $2,500/month extra toward the principal. It’s amazing seeing the total principal lowered each month. It stands at $146,700 but with our budgeted amount (plus savings set aside later on to pay it off in one big payment) we will be done by October 2022. I am so excited that we are finally hammering away at it, and the end is in sight. Barring any unforeseen circumstances, I will be debt free by 34. I often pull up your articles and success stories to inspire me.

That is a HUGE goal (11 years early!!) and I’m so glad to hear you’re moving along well with it!

If you want some motivation and you’re on Facebook, join us in our Thriving Families Facebook Community. There are other like-minded families there who are pushing toward Mortgage Freedom too. It’s free and motivating – MarriageKidsandMoney.com/FBGroup

Good luck with your goal!!

Thank you for the kind words! The 26 paycheck mind trick works well … Living on less than you make helps with so much!

Awesome tips! I think reducing expenses is a super underrated way to save money. There’s almost a cheaper option for everything we purchase!

Completely agree! The time it takes to discover the lower price is well worth it.

Hi Andy, overall I think paying down ones mortgage tends to be a peace of mind type decision for some folks. Ultimately there’s nothing wrong with that. I currently have a 30-Y Mortgage at 3.125% (2014) and I have no desire of accelerating my payments because I’m driven by numbers and also because I don’t want to tie that much cash to an asset that’s not generating income (as opposed to a rental property). I like the fact you’re not sacrificing investing in tax deferred vehicles to pay down your mortgage but one wonders about opportunity cost. The one thing I will say is that we’ve setup bi-weekly payments (our lender allows for that) which in the end equates to 13 payments/year. I’m Ok with that. Best of lucks.

I appreciate your opinion on this one. You are absolutely right that paying off your mortgage gives you great peace of mind. Knowing that I don’t owe anyone a dime makes me feel really content.

I’m happy to hear that you have a plan that works for you. That’s what so great about Personal Finance… there’s no right or wrong. Just what personally works for you.

Hi Andy,

I find myself in a unique position. I understand the steps you’ve outlined in your article, I’ve read a few books on that process by Dave Ramsey. What advice would you give to someone who lives in a very high cost area? Both my husband and I make decent salaries that would be considered upper middle class in most areas but where we are they are just average middle class. Housing costs are very high in my area and property taxes/insurances are around 15K/year. I’ve read so many articles on the subject but they always quote mortgages for homes around 200K. Where I live you couldn’t even get a 1 bedroom apartment for that cost. I want to sell my current starter house (that I paid 378K for over 10 years ago) and upgrade for my growing family but a 15 year mortgage (with 20% down) with taxes will put us around $4600+ in payments, with nothing extra to principle, and limiting our potential to save. It seems impossible to get ahead and keep my children in a nice neighborhood near family. Please don’t misunderstand “nice” does not mean luxury, this price is about average. We don’t live lavishly, have any car payments, or take big vacations, I have about $500/month in student loans. We have a 30 yr mortgage now that I pay bi-weekly and pay about $500 month extra toward principle, my total payment is about $3700/month for a basic 3 BR ranch house that we’ve put a lot of work into ourselves. I’m also currently paying about $1100 for school tuition for my children (5 and 3) because the schools where I live now are not so great. I would really like to live debt free but feel like its impossible.

My kids are 5 & 3 too. I’m right there with you Raquel!

What a great question … you are in a unique spot as you say. If your major motivator is to live debt free, have more options in your life (vacations, family fun) and be less stressed about money, I have a 5 thoughts:

1. Consider Moving to a Lower Cost of Living Area of the US: When the family size grows and the desires for the future do as well, a lot of families move to a place where the taxes are lower and you can “get more house for your money”. It sounds like the part of the country you live in will make that difficult for you right now and in the future. There are lower cost of living areas in the US that have excellent schools (no more school tuition when they hit Kindergarten), beautiful “reasonably” priced homes and your taxes could be 1/3 or less of your current cost.

2. Make More Money: If moving is completely out of the question (family, specific job skill set, etc), you need to find a way to bring in more money to keep pace with your lifestyle. Ask yourself some questions:

– Are you due for a raise at work? If so, ask for it. Make sure you lead with your accomplishments and your contributions to the company instead of your personal need.

– Do you have upward mobility in your career? Do you see a path for you to continue making more money in your current career path? If not, I’d consider seeking out another position to increase your income.

– What can you do on the side to make money? Do you have a hobby that you love that you could pursue during nights and weekends that would help you pay down your student loans? A side hustle is a great way to pay down debt, have some fun and create some freedom in your life.

3. Reduce Your Expenses: You may feel like you’re not living lavishly, but it couldn’t hurt to do an analysis of your overall spending to see where you might be able to reduce, trim and save. Look at all of the line items in your budget and prioritize what is most important to you. Consider eliminating or reducing some costs to give you some breathing room. Nicole and I changed our grocery spending last year and saved $3,500. We cut cable and saved over $1,000. Little things like this could help you at least pay down your student loan debt.

4. Analyze Your Current Debt Pay Off Strategy: It looks like you’re paying extra on your mortgage right now. Is your interest rate higher on the student loans than the mortgage? If so, I’d recommend paying down the student loans first before paying extra on your mortgage.

5. Consider Refinancing the Loans: Depending on your interest rate for both the mortgage and the student loans, it may be time to consider refinancing to a lower interest rate. For your home, check out LendingTree and for your student loans check out Credible. You could save thousands of dollars per year with some simple button clicks.

It may seem off for me to say this given that we’ve just paid off our mortgage, but there’s nothing wrong with having a mortgage. You don’t need to pay it off ESPECIALLY if you have a low interest rate. Millions of Americans have a mortgage for 30 years + and still have happy, healthy lives. We chose to pay it off, but that doesn’t mean that you have to. There are many other ways to build wealth for your family and experience financial freedom.

I hope these ideas help you and your family Raquel!

Hi Raquel, I can definitely relate to what you’re saying. My wife and I have young children and also live in a high cost area. It’s been an endless source of frustration for me that I can’t have everything I want LOL, including saving aggressively for retirement, the nice house, and being able to travel. Though we make a decent income, there’s only so much income to go around, so we’ve had to make trade offs. Our trade off currently is that we remain living in a place that’s kind of small and not that nice, but it’s insanely cheap compared to the other housing options available. Having low housing costs enables us to save a large chunk of our income and do fun activities with the kids throughout the year. We keep reminding ourselves of Dave Ramsey’s mantra: “Live like no one else so you can live like no one else”. We’re sacrificing on the housing today so we don’t have to sacrifice on the lifestyle in the future.

This is pretty freaking awesome! You guys are my heroes! My wife and I are planning to start our mortgage pay off 1/1/2019 due to house updates and planning for another kid. Can’t wait to start!

You’re going to crush it Omar! It’s a fun adventure to do together with your wife.

Hi, I really liked your post , but I have some questions , I am 20 and planning to buy my house ( I know it sounds too early, but I really want it ) . But I don’t understand a lot of things , like , do I need a bank loan to buy my house ? Or I just need enough money to afford the down payment ?

Thanks for touching base Deborah! I don’t think buying at house at 20 is too early. That being said, I would highly recommend you spend some time learning about everything that goes into the home buying process as well as the home ownership process. It is one thing to have enough of a down payment to buy a house, but its a whole other thing to take care of a house. I’d recommend going to your local library and reading 3-5 books on how to buy a home and home ownership. You cannot put a price tag on a good education — unfortunately, they don’t teach us these things is school!

To answer your questions more specifically … Let’s assume the house you are considering costs $100,000. Unless you have, $100,000 saved up, you will have to take a loan out from a bank to buy your home. You’ll want to put at least 20% down (or $20,000 with our sample home). We saved up 40% before buying our home because we wanted to have a monthly mortgage payment.

Go to a mortgage calculator to understand how much you’re going to pay each month (just Google “mortgage calculator” and you’ll find a good one). Insert the “mortgage amount” which is the amount you’ll be borrowing from the bank – not the total cost of the home, but the amount you’ll be borrowing. So in our case, that would be $80,000. For easy numbers given today’s low rates, assume your interest rate is around 4% at 30 years as a conservative estimate . This will give you an understanding of how much this home will cost you each month for the next 30 years of your life.

Costs that are not factored into this mortgage payment are … taxes, insurance, gas bill, electric bill, internet, cable, home maintenance, repairs, updates, furnishing, HOA fees (if condo or townhouse), etc. Again, making sure you understand ALL of the costs associated with the home buying process is crucial.

I bought a house when I was 22 and didn’t fully educate myself of what I was getting into. I could barely make the mortgage payments each month. I ended up taking on 2 roommates to help me pay the mortgage each month. That helped a lot. Do you have friends that would live with you and pay you rent?

Please email me with any other questions Deborah. Here is another post I wrote that may help you as well … https://marriagekidsandmoney.com/5-ways-to-avoid-becoming-house-rich-and-cash-poor-in-a-sellers-market/

Best of luck!

I have a question. I heard you on the Good Dad Projecf and have been checking out your blog. I like what I am doing, but please help me understand the math and your method. In August 2017, you said that your mortgage balance was $21,000, and that your standard payment is around f $1,900 per month. You further said that you’ve paid an additional $500 – $1,000 extra per month on this debt consistently, and that you will pay off the $21,000 mortgage balance by December.

How does this math work? Even at 0 interest, simple math would show that that your total monthly payment needs to be $4,200 per month for 5 months to get you to $21,000. That’s significantly above even $1,900+ an extra $1,000 per month.

Can you help me understand what you are doing through the end of the year, and how you got here? Are you simply paying additional principal or are you doing something like the HELOC method that is intriguing but terrifying to me.

Hi Michael!

For some reason, your comment got caught in my spam filter. I have no idea why. I’m sorry that this has taken me so long to respond.

I totally understand your confusion on how we’re going to pay off the $21k we have left on our mortgage. Let me explain… (in fact, I’ll update my article to clear up the confusion too) This month, we’re down to $20k. We’ll pay it down $16k by November. At that time, I’ll request a mortgage pay off quote from my lender. We’ll use $16k from our savings account to completely pay it off by Christmas.

Simple. Just cash savings. There may be fancier ways of doing it that I’m not aware of.

No HELOC for me. I’ve been down that road before and I used it like an ATM too much. I’m not a financial expert, but I really enjoy this debt free method. The freedom and flexibility we’ll have in 2018 will be very exciting for our family.

I appreciate your comment and question. Thanks!

Wowsers, just found this article. Crazy!

We’re in the process of building a home right now and will be getting a 30 year mortgage. We couldn’t comfortably afford a 15; probably too much house. Still, we’re going to plan on paying it down early. I believe we can save/invest enough money while paying down the mortgage in 20 years. Of course, we could pay the mortgage off earlier, but I like having the balance there.

What we did agree upon was that any side hustle money will be put toward the mortgage. That’s given me some incentive to make a few extra bucks. I know the math, but hate the debt. For me it’s more of an emotional decision.

Your plan sounds like a smart one! I’m working on a similar strategy to your side hustle saving. With my extra dough, we’ll be saving for our first rental property. Here’s to financial freedom for the both of us!

I googled this idea to see if what I was doing was a good idea! My wife and I may be doing it a little differently. We have just about the same income and we use mine to pay off our new car and the mortgage. We use hers for the fun stuff, monthly house bills and her monstrous school loans. No kids though, 2 dogs! I brought up the idea to her to skimp today and have more shortly down the road! Good luck in your final home-pay- off stretch!

It sounds like you two are on the fast track to financial success Kevin! Congratulations!

While I applaud your frugalness and ability to stick to a plan, I’ve got to tell you I think this is awful advice. Have you ever run the numbers on what would have happened had you invested the extra money you put into your mortgage? You could have made some IRA contributions, Roth IRA contributions, or even back door Roth IRA contributions. Heck if you would have invested your money into a taxable account, and taken out a 30 year fixed mortgage when rates where at all time lows, I’d be willing to bet you could pay off your mortgage with the assets you accumulated rather than paying down your mortgage. Additionally did you ever think what would have happen if you or your wife or both lost your jobs or became disabled. It’s great to have your home paid off, but with no income and a large part of your wealth tied up in your home, how would you make ends meet. I get the appeal of paying off your mortgage, I just don’t think it was a very smart move given the low rates available, the fact that the interest on mortgages is tax deductible, and the returns that were/are available in the market. Think of it this way, if an investment advisor told you he had a great investment for you. The returns would barely beat inflation and you money would be hard to get to if you needed it. Would you consider that investment?

Thanks for the thorough and candid feedback, Michael! You’re right. The stock market has been a GREAT place to have your money lately. That’s why I’m paying off my mortgage AND investing in the stock market as well. Right now, I’m currently maxing out my 401k, my Roth IRA and my wife’s Roth IRA. (We recently switched over to Vanguard from Fidelity. I like their transparency and their roster of of low-cost index funds.)

As for the security of my family, that is always a concern for sure. We have around 6-months in emergency savings (cash) right now so if I were to lose my job (my wife stays at home with the kids) then I’m hopeful that I would find a new one within six months. That’s never guaranteed, right!? That’s why I try to bust my butt at work everyday to exceed the goals set for me.

Overall, I’m trying to decrease my family’s expenses so I don’t have to make as much money to retire. AND, it’ll feel great in December knowing that I don’t owe a dime to anyone… for the rest of my life.

Thanks for bringing up these points, Michael! I love talking about it (as you can see from my blog ramblings).

Thanks for taking the time to reply, Andy. I do appreciate it. I know you will be fine, and being mortgage free is a great feeling. But there are other ways to pursue financial independence. I’m not a big fan of debt. But I do think there is good and bad debt. Bad debt is taken out for consumption, and far too many Americans have accumulated that type of debt. Good debt is debt used to purchase a productive asset whose income is enough to cover principal and interest payments. A rental property would be a good example of this type of debt if the rent is more than enough to cover housing payment and continuing maintenance. I wonder what you will do when you obtain a rental property for passive incOn my way. Will you pay extra on that mortgage or will you save the funds for the down payment of the next property. Mortgages allow you to leverage your returns. I know leverage can be scary and damaging if your investment goes awry, but having 20-25 equity should protect you from future declines in housing. Just my two cents. Best of luck to you Andy.

Thanks Michael! I really appreciate the dialogue. When it comes time for the rental properties, we’ll weigh the pros and cons of leveraging versus buying with cash. I have a ton to learn about the rental business! I’m excited for that step in our family’s financial journey.

Andy, if you ever want my input you can reach out to me. I am in the mortgage industry, and I can help. I have a strong desire for people to understand the financial products. I vote in Bankrate.com’s weekly survey of industry experts on the predicted movement of mortgage rates and host a local radio show on Saturday mornings. If you need an email address to contact me let me know.

That’d be great to connect Michael! I’m at Andy “at” MarriageKidsandMoney. I actually have a great idea that you may be interested in.

Andy go to Biggerpockets.com and check out that site for great info on rental property investing. Michael is right with mortgage rates as low as they are your much better off paying the current rate on a 30 year mortgage on a 70% LTV on your house and invest the loan proceeds on rental properties that you could be making 8-10% return or greater. You can still pay your house off quickly (even more quickly) using the cash flow from rentals. Once your house is paid off from your rentals (if that is what you really want to do) you will have even more freedom! If you can borrow at 4% and use that money to make 8-10% wouldn’t that be a great thing to do?

Completely agree with you! If we’re making 8-10%, paying 4% isn’t bad at all. Better than the 1% in my bank!

Are you following the Dave Ramsey plan?

Sorta kinda. His debt freedom plan was extremely motivating for us and that helped a lot. We are okay with credit cards and appreciate passive index fund investing as well.

“Michael Becker says:

May 10, 2017 at 11:28 am

Andy, if you ever want my input you can reach out to me. I am in the mortgage industry”

Yep, we all guess that already. Thank you.

I see what you did there! ?

This is awesome! I love reading how someone is destroying their mortgage. My wife and I are trying to do the same thing. It’s a challenge for sure. But the relief at the end I’m sure will be worth it. Don’t let up. Great article.

Thanks so much Chris! Only 6 more months and it’ll be a reality. I appreciate the encouragement. A little sacrifice now for a lifetime of debt freedom. So pumped!

Awesome!! I’ve yet to come to terms with paying off my mortgage. I have the cash available… However, at 3% I’m still making more on the cash I have then I am paying the mortgage so I continue to hold and make small additional payments. Rounding up to the next 100 and calling it good.

That is also a very smart move! The stock market over the past 7 years has been an excellent place to have your extra money. What a return! For me, I’m excited for the day that I do not owe a dime to anyone. Complete debt freedom just sounds like a place I’m excited to live in.

Thanks for the comment Tim!

When I paid off my mortgage in 2012, I noticed a huge sense of relief and contentment. While I still have a ways to go for Financial Independence, the extra monthly cash flow really helps to supercharge the investments. It also allows us to loosen the purse strings once in a while, while still saving >60% of our income for retirement.

The one thing that I did differently than you is that I saved/invested the money in a separate investment account instead of paying more directly to the mortgage. I value liquidity and in the event of an interruption in your income, even though you only have $53,000 left, you are still contracted to pay that monthly payment based on the original 15-year mortgage. Either way is fine and gets us to our goal, but I preferred to have the liquidity of the investment/savings account until I had amassed enough to pay off the entire balance and wipe that monthly obligation from my cash flows.

Great job thus far… maybe you can have an extra topping on that pizza when the mortgage is paid to zero? :)

Today our balance is down to $33k … December payoff here we come! More toppings for everyone ;)

Ty, I absolutely love hearing that you feel a huge sense of relief and contentment. That is the major goal for me and my family. Relief, contentment and more freedom.

Congratulations on saving 60% of your income for retirement! You are going to be made in the shade my friend. Thanks for the thoughtful comment!

Awesome read. Timely, too, as we’re in the middle of refinancing our 30 year, 6.75%, almost 20 years left mortgage to a 15 year, 3.375% mortgage. We’re going to knock off almost 5 years and about $90K in interest.

I’ve been reading about folks accelerating their mortgages, but not in the way you’ve written about. I like your ideas and am sure that we’ll putting some in place, especially the Pizza Party. :-)

Seriously, you offer some great ideas and I’m going to pass them along.

Thanks for the great info!

Great feedback Keith! Thank you so much!

Smart move on the refinance – you’ll save a ton of cash with that lower interest rate. Isn’t it insane when you look at the numbers about how much we pay to these mortgage companies?!

Cheers to keeping more of your hard earned money Keith!

Love this and will share. .remember me when you are ready to buy an investment home. .I’m ready and waiting to help you find your little piece of paradise! ! Spent my first 17 years in Birmingham/Bloomfield when I came here from UK ..Go Wings!

Thank you Gillian! Let’s stay in touch. I’ll need the help. We’ve lived in Bloomfield Township for the past 3 years and are loving it. Great schools, incredible neighbors and close to everything.

Let’s be honest here…the pizza has even disappeared from said budget “parties.” But honestly, even though I begrudgingly go through the exercise each month I know it’s really important and I’m glad we do it.

She speaks the truth people! Where art thou pizza!?