There comes a time in our lives when we're ready to get off the sidelines and start investing. There are people building wealth all around us and we want in on the money-making action.

But where do we start with investing? There are countless routes and avenues that we can take including small business ownership, real estate investing and investing in the stock market.

Today, let's focus on stock market investing. That's one major route that has helped our family go from a -$50,000 net worth to now over $1,000,000 in 10 years.

If you're wondering how to start investing today, here are 10 simple steps to consider.

1. Define Your Purpose for Investing

If you invest (or even save) without a purpose, your zest for continuing can eventually fade. You’ll look back after a few months or years and say, “What am I doing this for again?”

So right off the bat, I suggest defining WHY you want to invest in the first place.

If you’re looking for a reason, I’ll give you one: Retirement.

It’s eventually coming and you want to be prepared. There will come a day when you want to stop working or are forced to stop working. You want to create an income for yourself so you can enjoy your later years in style.

And, the earlier you start investing, the earlier that enjoyment can start!

Right now, the median retirement savings for people in the US between the ages 35-44 is $60,000. If you take a 4% safe withdrawal of $60,000 per year, you’ll only have $2,400 per year to live on. That's PER YEAR!

Our family spends about $60k-$70k per year so $2,400 isn’t going to cut it for us. We’ll need around $1,500,000-$1,750,000 to live our typical comfortable year.

So if your retirement investing pot is lower than you'd like, it’s time to continue growing it.

2. Get Company Matching Funds

Do you work at a company that matches your 401k or 403b contributions?

If so, that is THE best place to start when it comes to investing for your retirement because that is free money!

For example, let’s say your company matches 50% of your contributions per year up to your first $5,000 of contributions. If you decide to do $5,000 of contributions, then your company will also contribute another $2,500. That’s $2,500 of free money.

Some companies are also doing this with their Health Savings Accounts (HSA) programs as well. If you contribute to your HSA, they may match a portion of your contributions.

My point here is to check with your company to see what matching benefits they provide for your retirement and your future health care costs. There may be some FREE money laying around waiting for you to snag it.

3. Invest with Tax Advantages

If you’re going to invest, you might as well save on taxes. That’s more money for you today and in the future.

Here are a few avenues to consider when it comes to tax advantaged investing.

401k or 403b

We mentioned these routes already for their matching benefits, but the 401k is also a great way to save on taxes as well.

If you go with a traditional 401k, you can invest pre-tax today and your contributions grow tax-deferred until you withdraw the funds. So if you’re in a higher tax bracket, your 401k contributions may allow you to pay fewer taxes today.

There is also a Roth 401k option that is growing in popularity as of late as well. This 401k option allows you to contribute after-tax money so when you retire you can withdraw your money tax-free.

With these two options, you’re essentially choosing when you want to pay the taxes. Now or later.

IRA

The IRA (or individual retirement arrangement) is another tax advantaged retirement vehicle that will help you prepare for best years and pay fewer taxes.

Just like the 401k, there’s a Traditional and Roth IRA option. You can contribute pre-tax or after-tax.

This investment option is not employer-sponsored so you’ll need to look into this investment option through a low-cost broker like Vanguard, Fidelity or Schwab.

Health Savings Account (HSA)

Don’t get fooled by the “savings” portion of the name here. With some HSA providers, you can invest too.

By contributing to an HSA, you can save on taxes today and save for future health care costs as well.

With the cost of healthcare rising and rising, it’ll be smart to invest and prepare for the inevitable.

If you end up being healthy and want to use your HSA for non-medical expenses in retirement, you can use it penalty free after the age of 65. You just have to pay taxes on it.

We chose Lively as our HSA provider of choice and have been a happy customer of theirs for a couple years now.

4. Keep it Simple with Index Funds

Now that we’ve talked about where to invest, let’s talk about how to invest.

If you want to keep things simple because you have a million other things to worry about, I’d recommend looking into index funds.

Index funds track an index, like the S&P 500, and they mirror their performance. Instead of buying a single stock and hoping for the best, an index fund owns a small portion of a whole bunch of stocks. This way you’re not relying on one, two, or three stocks to help your portfolio grow, you’re relying on hundreds or even thousands of them depending on the index you choose to mirror.

For example, let’s say you invest in an SP 500 index fund like Vanguard’s S&P 500 ETF Index Fund (with ticker symbol VOO). By buying one share, you are now an owner for 500 of the top US companies including Apple, Microsoft, Amazon, Tesla, Visa and many many more.

If one of those companies starts to do poorly and eventually falls off of the S&P 500 list, you automatically are not investing in that company anymore! As legendary author and index fund lover, JL Collins says, “it’s self-cleansing”.

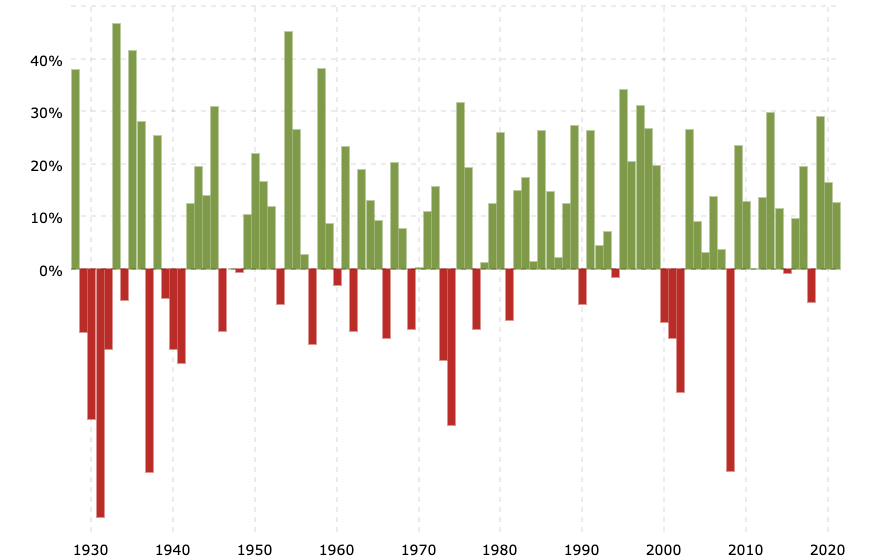

Also, over the S&P 500’s nearly 100 year history, it has a historic annualized average return of around 10%. That’s a great return.

Index funds are not just for US stocks either. You can add these other asset classes to your portfolio mix:

- International Stocks

- Small-cap (US)

- Large-cap (US)

- Bonds (US)

- International Bonds

- And even real estate through REITs

Diversification is a smart move when it comes to learning how to start investing!

5. Choose a Low-Cost Brokerage Partner

If you’re committing to this investment journey, you’re going to want a partner that is going to help you succeed.

Go with a low cost and trusted broker like:

Those three firms are working hard to give you an experience that makes the process simple and keeps the fees low.

I’ve worked with both Vanguard and Fidelity for my family’s investments. Without a doubt, I’d recommend either one to help you invest for your future.

You can easily sign up online to open your account. If you decide your purpose is retirement investing, consider an IRA or Roth IRA.

If you want to invest for non-retirement purposes, look into a taxable brokerage account with one of these partners.

It’s can be a one-stop shop for your investment needs. Even Fidelity has an excellent HSA program!

6. Commit to Consistency

I’ve interviewed over 200 financially independent couples and millionaire parents on my podcast. One major key to their investing success is committing to consistently investing in good times and bad.

They set up a recurring investment each month and they invest when shares are low and they invest when they are high.

So decide how much you can commit to investing each month and be consistent with it. The three low-cost brokerage partners I mention above offer you the ability to automate your investments. This way, you set your plan and before you know it, your accounts are growing consistently.

7. Ignore the Noise

The news media makes money by getting you to watch, read and listen. What better way to do this than provide you with BREAKING NEWS UPDATES every 20 minutes.

BREAKING NEWS — the stock market dropped 200 points!

BREAKING NEWS — Elon Musk tweeted about buying a new cryptocurrency with a picture of the Ms. Pac Man on it.

When you’re a buy-and-hold investor, you need to be able to ignore the noise and stay the course. If you’re selling when you’re stressed or buying when you think you’ve got a hot stock tip, then you’re not an investor … you’re a trader.

Trading is paying attention to daily stock tips and movements in the market.

Investors relax, put their faith in proven long term buys and wait. Investors win long term.

Ignore the noise, invest for the long term and watch your account grow.

8. Diversify to Aid in the Relaxation

As mentioned earlier, your investments do not all have to be stocks. It’s important not to put all your eggs in one basket.

Look at ways to diversify your portfolio with other investments like bonds, international stocks and even REITs (real estate investment trusts).

As you get closer to retirement, you’ll want to consider a less volatile portfolio. Stocks tend to be more volatile while bonds are more consistent.

I like to use the quick math problem of 120 – Your Age = Your stock allocation.

So for me, that’s 120-40 = 80% stocks. That would give me an 80% stock and 20% bonds portfolio. When I’m 60 years old, that math problem would be 120-60 = 60% stocks and 40% bonds.

This is a just a quick rule of thumb and your situation may be much different than mine. So do your research and invest according to your specific situation and stage in life.

9. Be Patient

One of the simplest yet most difficult parts of investing is simply waiting.

In the beginning, your balance will be small. Depending on how much you put into your account each month, it may stay that way for a while.

BUT for those that stay in the game for the long term by buying and holding, those are the ones who become millionaire investors.

It’s not to say you can make money day trading (buying and selling stocks or cryptocurrency as the markets move up and down), but I don’t have time for that and I wouldn’t suggest it.

To me, that’s stressful.

So I recommend buying and holding for the long term. It’ll require a lot of patience but you’ll be much closer to your goals in the end.

10. Behold the Power of Compound Interest

To demonstrate how awesome compound interest is … Let’s say you have $10,000 to invest today and you simply let it sit in an S&P 500 Index Fund for the next 40 years making 7%.

40 years later, you’ll have around $150,000.

$10,000 turns into $150,000 through time, patience and compound interest.

Compound interest is when your money makes money for you … again and again.

Let’s say you decide to contribute $500 per month in that same example. A $10,000 initial investment, $500 per month contributions and 40 years of patience.

You could expect to have around $1,300,000!

So time, patience, consistent contributions and compound interest, that’s the recipe.

That’s how you set yourself up for a comfortable retirement and that’s how you become a millionaire.

And as you make more money, contribute more money. That’s how your wealth grows and that of your family and so on and so on.

Final Thoughts on How To Start Investing Today

I've gotten caught up in the “how do I get rich quick” mindset in the past. And usually the only thing I earned was a lesson in patience.

By creating wealth-building habits and sticking to them, that's when I've seen the best results. Our family became millionaires in our 30's from these habits and now we're looking forward to enjoying the fruits of our investing labor.

I hope these 10 steps help you as you kickstart your investing journey today!

Where are you on your investing journey? Do you have more questions on how to start investing today?

Please let us know in the comments below.