Do you want to increase your net worth? Well, so did we. Let me tell you how we did it.

One fall night in 2010, my wife Nicole and I were watching the Suze Orman Show. (Yes, I used to DVR it). There was this fun segment where someone would call in and Suze would analyze that person's financial health and give them a grade. It was called How Am I Doing?

One term that we kept seeing over and over again in this segment was “Net Worth”. Since we were personal finance newbies, we had no idea what this meant. Nicole and I were making a combined annual income of $130,000 so we figured our net worth must be HUGE.

After the show was over, we decided to see how rich we really were. There was no doubt in our mind that we’d be better off than most of the jokers that call into the show and get an “F” grade from Suze!

We walked upstairs and started to write down all of our numbers on a big whiteboard. By separating our “assets” (what we owned) and our “liabilities” (what we owed) into two big columns, we started to discover that we weren’t rich.

We were kinda broke.

Although we were making a solid income together, our liabilities were much higher than our assets.

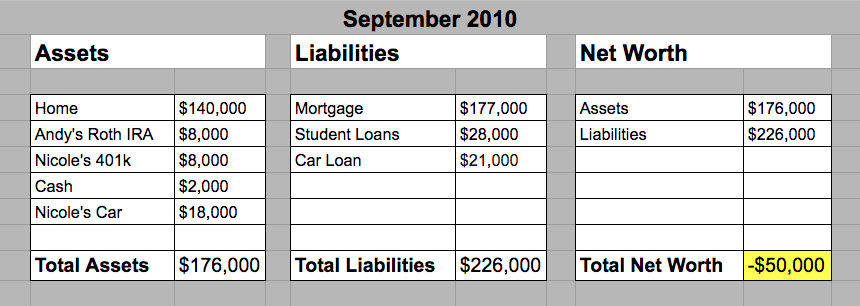

Here is a snapshot of what our numbers looked like back in 2010 (rounded educated guesstimates based on me losing some of our data along the way):

There’s no way we were going to get an “A” grade on Suze’s show with a –$50,000 net worth!

This epiphany moment was just the jolt of reality we needed to start making progress on our finances. Our short-term goal was to increase our net worth and get into positive territory ASAP!

It was time for us to make a change.

The Steps We Took to Increase Our Net Worth

Track Your Net Worth

Nicole and I quickly realized that we couldn’t improve our financial situation if we weren’t tracking our net worth. This number was going to be the barometer for our future financial success.

We took all of the numbers off of our whiteboard and inserted them into an Excel spreadsheet. From that point on, we updated our asset and liability totals to track our progress. Even just seeing the numbers helped!

(Side Note: Empower wasn’t around back then, but if it was, it would have made the whole net worth tracking process a lot easier. It’s free and it automatically updates your net worth by syncing up your accounts. We use it now and it is the best free tool out there for this.)

** Net Worth Total (September 2010) = -$50,000 **

Live on a Monthly Budget

Another monthly habit Nicole and I adopted around this time was living on a budget. We got the idea after reading Dave Ramsey’s The Total Money Makeover. He talked about the importance of living on a zero-based budget and giving every dollar an assignment.

Getting on the same financial page with Nicole before each month began was important for us as we started our marriage.

Each month, we’d do the following:

- Review our spending, saving, and debt balances

- Plan out next month’s budget

- Discuss our financial dreams and goals to ensure we’re headed down a path we’re both excited about

We eventually learned about a couple's budgeting tool called Monarch Money which automated the budgeting process much like Empower did for our net worth tracking. This tool has saved us a ton of time!

Related Content: Best Budget Apps for Families

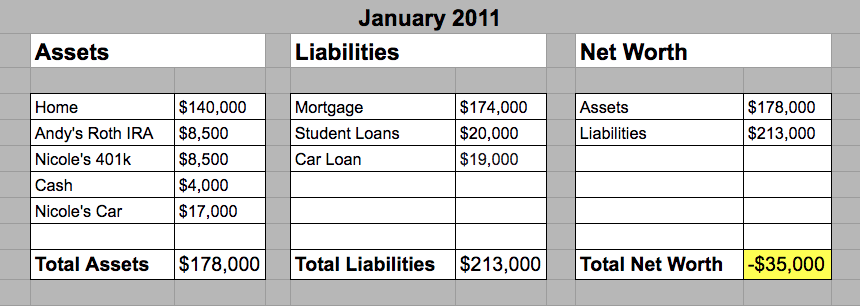

** Net Worth Total (January 2011) = -$35,000 **

Eliminate Your Consumer Debt

After being inspired by Dave Ramsey’s debt-crushing ways, we decided that becoming consumer debt-free would be an excellent way to increase our net worth.

I hated having student loans and wanted them gone as soon as possible. My 6.8% interest rate did not help the process either.

Nicole loved her 2008 Audi A4 and thought it would be incredible to own it outright with no payments.

Through our monthly Budget Party, we discovered we could eliminate both of these debts by the end of the year. This would require us to live on my income and use Nicole’s to pay off the debt.

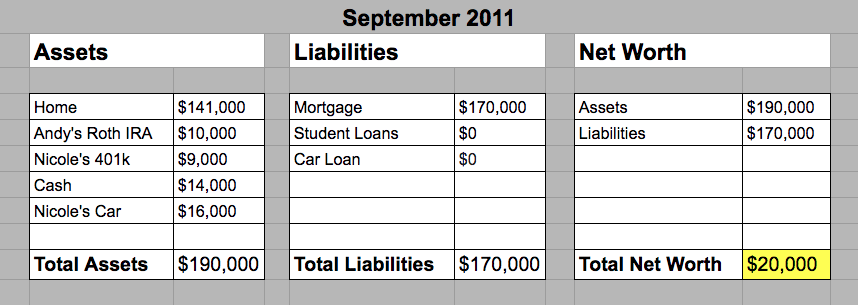

The plan worked! We were consumer debt-free by September 2011 and increased our net worth into positive territory.

After making the final payment on Nicole’s car, we took a joy ride in her paid-for Audi A4 on a beautiful fall night in Michigan.

** Net Worth Total (September 2011) = $20,000 **

Spend Less Than You Earn

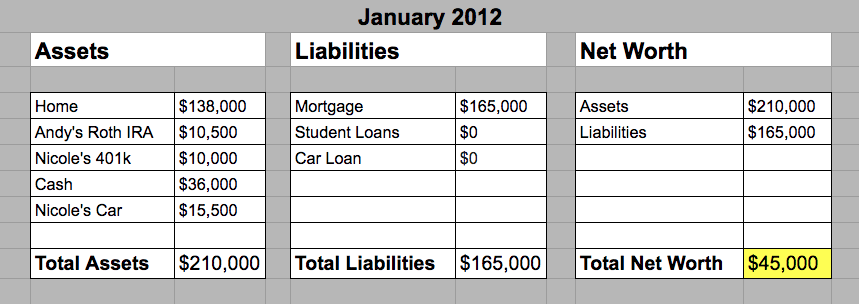

At this point in our marriage, we were a month away from having our first child. Our financial standing was looking pretty solid. We increased our income to around $170,000 by the end of 2011. Our little Zoey would be born into a debt-free family. That made us proud.

We liked our current home, but we started thinking about our family growing from 2 to 3 (to eventually 4). Getting into a good school system was very important for us. That being said, we knew that homes in our desired school district were expensive!

Our new goal became saving up as much money as possible for a big down payment on our dream home. Our plan was to save 50% of our income and live on the other 50%.

** Net Worth Total (January 2012) = $45,000 **

Increase Your Income

Luckily, 2012 was an outstanding year for us income-wise. We were both working full-time at our jobs and brought in the most money we’ve ever made as a couple together in one year … $280,000!

I had a commission-based sales job and achieved the company record for the most annual revenue brought in on our most important account (it was a small company).

We ended up saving way more than 50% that year. Here are some highlights of what we did with our money:

- Saved over $100,000 cash

- Updated my bachelor pad into a family home

- Bought my first car with cash

- Funded our daughter's 529 Savings Account with $10,000 when she was born

- Traveled to Puerto Rico for a nice getaway over the holidays

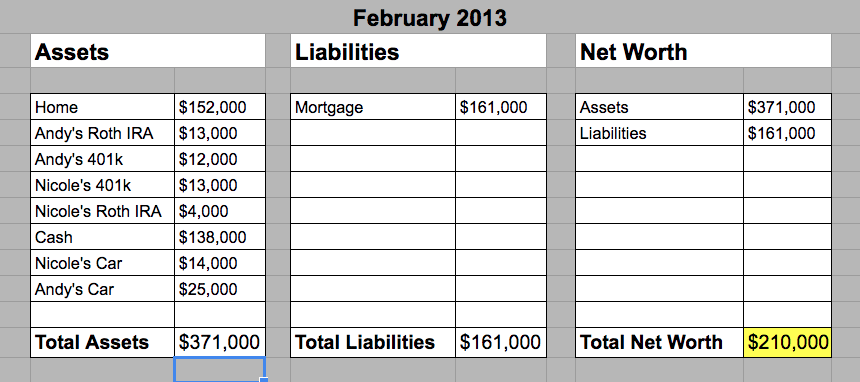

** Net Worth Total (February 2013) = $210,000 **

Get a 15-Year Mortgage

When we finally bought our dream home, the cash savings we amassed allowed us to have a 45% home down payment. This cut our new mortgage principal by a sizable amount immediately.

We planned to pay off this mortgage in 5 years!

We went with a 15-year mortgage through LendingTree and got a super-low 3% fixed rate. This helped us to put more toward the principal balance each month and push toward our goal of becoming mortgage-free.

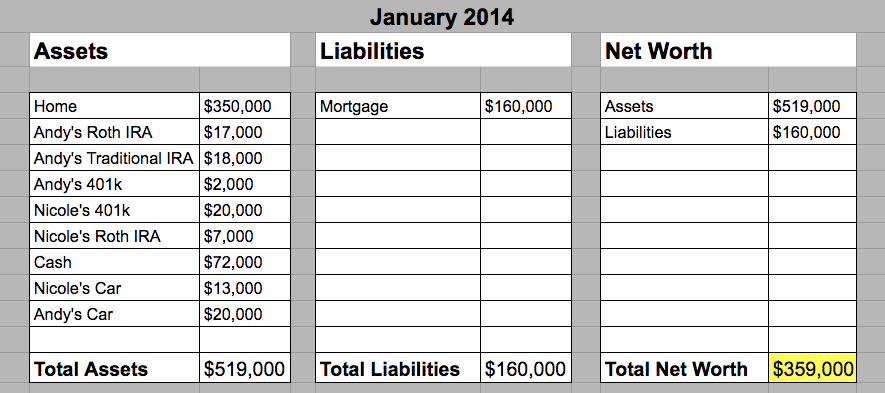

** Net Worth Total (January 2014) = $359,000 **

Be Flexible Because Life Happens

When our second child (Calvin) came into our lives, we decided it was best to have Nicole stay home and raise our two kids. Since we’d been living on one income for quite a while, it wasn’t that big of a life shocker for us. My income was still very comfortable at around $160,000 that year.

This income change did slow our net worth growth quite a bit, but honestly, those previous few years were unicorns! We’re just happy we saved like we did so Nicole could spend more time with our kids. It was one of the best decisions we ever made as a family.

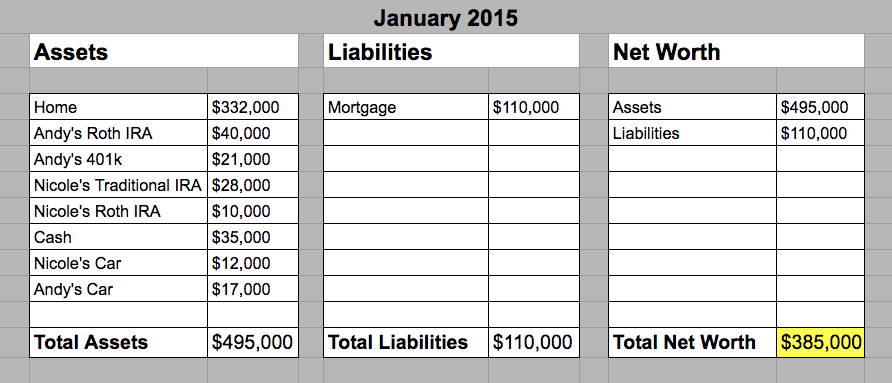

** Net Worth Total (January 2015) = $385,000 **

Max Your Retirement Savings

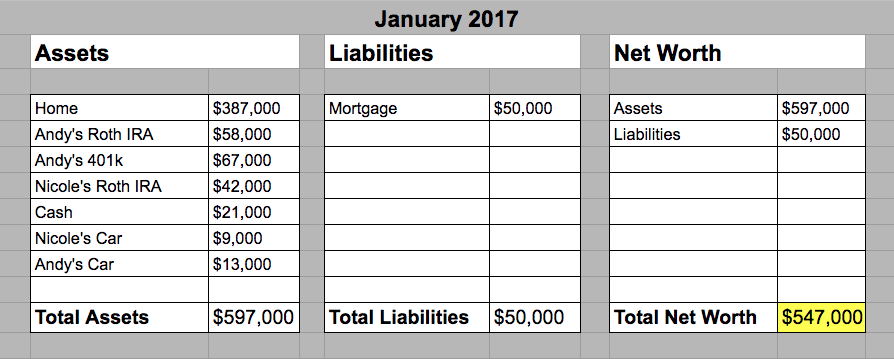

In 2016, we decided that maxing out all three of our retirement accounts (401k, my Roth IRA and Nicole's Roth IRA) was a smart move to further increase our net worth. My workplace 401k had been maxed since 2013, but we had not been doing the same for our Roth accounts.

In addition to clobbering our mortgage principal, this tax-advantaged plan helped us break the half-million mark in our net worth journey!

By this time, we were fully into Empower to help us track our progress. It became quite addicting actually. Here's a full Empower Review detailing the free tools included. Their free “investment fee analyzer” was very helpful as we grew our portfolio!

** Net Worth Total (January 2017) = $547,000 **

Pay Off Your Mortgage Early

In November 2017, we paid off our 15-year mortgage in less than 5 years. One year ahead of schedule!

Nicole, Zoey, Calvin, and I had an epic mortgage freedom celebration together that we’ll never forget. We wanted our kids to remember this important moment in our lives so they too could be inspired to live without debt in the future.

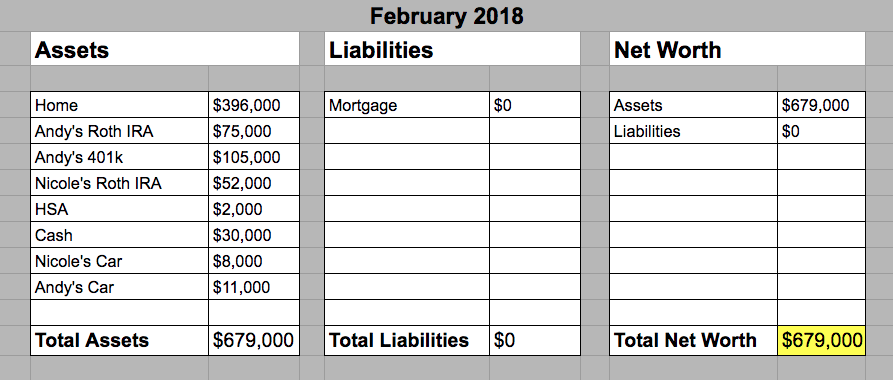

After becoming mortgage-free, our net worth has increased steadily. The incredible stock market surge in 2017 helped as well!

** Net Worth Total (February 2018) = $679,000 **

Save For First Rental Property

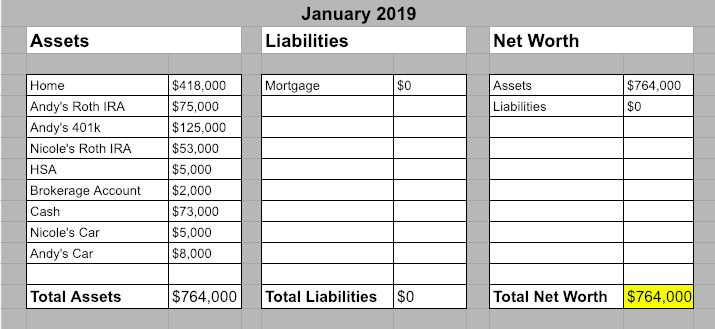

Although 2018 saw an overall drop in the stock market, we weathered the storm and kept up a high savings rate. Most of our extra money went into a savings account to build up enough money to buy our first rental property.

We also did fun things like updating our home and traveling on some epic family vacations.

** Net Worth Total (January 2019) = $764,000 **

Create a 4-Day Workweek Lifestyle

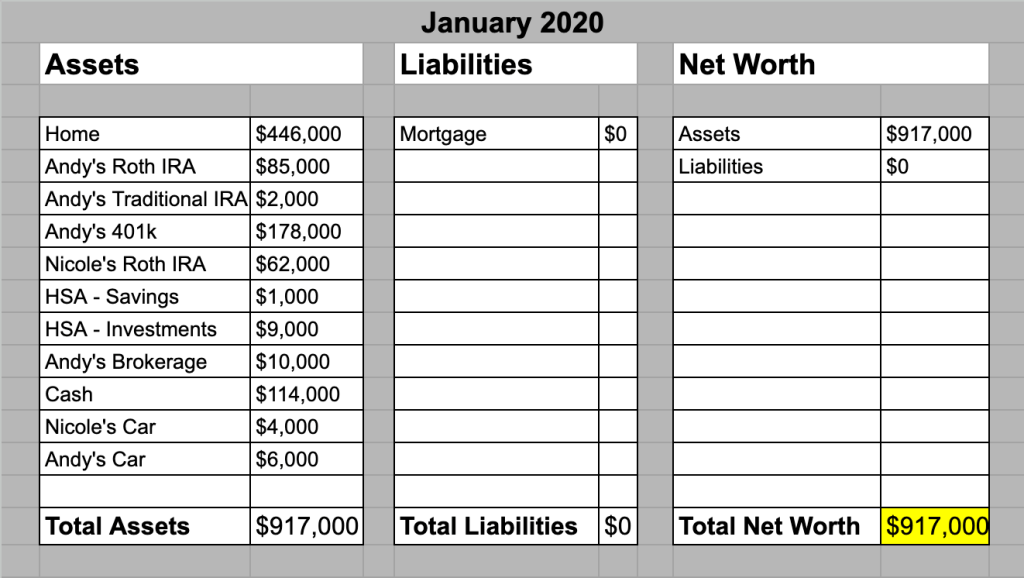

Recently, we decided that buying our first rental property was not something we wanted to do. The responsibility of managing a rental property (even with a property manager) wasn't something Nicole and I were thrilled about. We weighed the pros and cons of rental properties and decided against them (for now).

Instead, we chose to use our cash as a runway for me to work on my small business full-time (or part-time rather). My goal is to work 3-4 days per week so I can spend more time with family, take care of my health, and enjoy more life today.

My wife has done the same thing too recently! She went back to school to become an esthetician and she's working part-time doing work she enjoys. Her commute is short, her workload is reasonable and it’s a nice change of pace for her.

** Net Worth Total (January 2020) = $917,000 **

Give Back

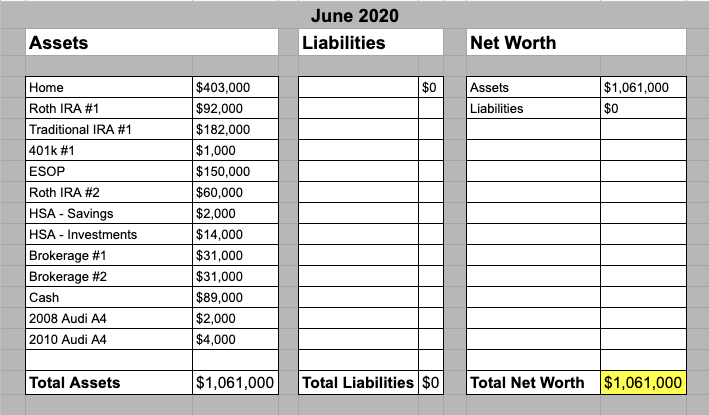

After becoming debt-free and paying off our mortgage early, we realized we wanted to give more. There were charities and causes that we felt passionate about and given our financial situation we were ready to be the change we wanted to see in the world.

We increased our charitable giving from 1% to 5%. In total we give 10%, but just in our own way. We have designed an alternative to 10% giving which is our unique way of giving on our path to financial independence:

- 5% for charitable giving

- 4% for family and friends giving

- 1% for random giving

While it may seem counterproductive on a path to increase your net worth, we now feel that building true wealth involves some sort of giving. There's a lot for us to learn and explore here and we're excited to see where it takes us.

** Net Worth Total (June 2020) = $1,061,000 **

In Conclusion: After Increasing our Net Worth for 10 Years

We’ve come a long way since our -$50,000 net worth in 2010. I’m so proud of the hard work that Nicole and I put into increasing our net worth. Without my wife’s partnership, none of this would have been possible.

After crossing over the $1,000,000 net worth mark, my first thought was … it’s just a number. On the surface, it doesn’t mean anything.But when you peel back the layers and find out what’s inside, that’s when you discover what our net worth is made of.

Our home, our cars, our retirement savings and our emergency savings are all things that bring our family joy and security. These assets will allow us to live happy, healthy and purposeful lives. They will also allow us to give generously of both our time and our money.

With some hard work and a little luck, our kids will see our example and continue to build generational wealth in the future.

Get started on your journey to increase your net worth through Empower. Their free tools helped us immensely on our millionaire net worth path!

What are you doing to increase your net worth? Where are you on your financial journey?

Please let me know in the comments below!

37 Comments

My husband and I were at the end of our rope in early 2015, and at the end of our credit. We had opened a cafe just outside San Francisco in 2013, it still wasn’t making a profit, and we had poured everything but our 401K into it. We were charging our groceries, and soon we wouldn’t be able to afford them! I was thinking we have to figure out how to manage our debt, and I found a podcast to listen to on the way to work. It was this crazy guy, Dave Ramsey, who wasn’t talking about how to MANAGE debt, he was talking about getting OUT OF debt. When my husband and I added up our debts we owed more than $500K not counting our mortgage. Throw that in and it was $1.2M. I made a good salary, but we weren’t bringing in enough to pay our bills, and the cafe was just on the cusp of breaking even so we didn’t want to throw in the towel. The first thing that made a difference was paying attention to our money. Until we woke up, we simple looked at our bank balance and spent what was there. The second thing was getting on a budget. But the biggest thing was signing up for Airbnb and hosting travelers in the upstairs suite in our home. We were 20 minutes from SFO and a mile from the beach. It was early days for Airbnb, and we worked hard to be model hosts. We made $32K in one year and put it all (plus more) on the debt, sold a home in Tahoe we couldn’t afford, and honestly I don’t remember what else we had to do, but a few things happened after that fateful day that I listened to my first Dave Ramsey podcast. The cafe broke even, became a local treasure, and we just sold it for a solid profit. We got completely out of debt in 2.5 years and we’re still budgeting today. We refinanced our home on a 15-yr fixed, payed the mortgage down by $150 K in the last couple of years, and the house is being sold right now for what we hope will be a profit of $750K. Just like you, we have gone from a negative net worth to being worth over $1M today. Yes we have the crazy San Francisco housing market to thank for a lot of that, but without Dave Ramsey and his guidance we would probably be deep in debt today. God bless that man and the people who work for him. God bless you and your family too. Great blog!

This is an incredible story!! Your persistence is so admirable.

It wouldn’t have been so easy to give up, but you didn’t!

Thank you for sharing with me.

Andy, great story and appreciate sharing your financial journey with your loved ones to accomplish multiple financial milestones. I wonder if you considered the concept of leverage for house as an investment. Also, what hurdle rate did you consider when you made the decision to burn down your debt? Given tax deduction nature of primary home mortgage, your effective interest rate should be less than the mortgage rate (e.g. if your current mortgage rate is 4% and your effective tax rate is 20%, your effective interest rate for mortgage is 3.2%). Of course, if you don’t have any investment vehicle that can generate above 3.2%, the best thing to do is burn down the debt as soon as possible.

Another question I have is on your net worth in 2018 which increased compared to 2017 when the stock market (indices) lost 4-6%. Did your investment in stock and mutual fund increased during 2018? If so, what was your investment strategy?

Hi David! It all comes down to our definitions of financial prosperity. For me, having a mortgage made me feel stressed. I was constantly worried about performing at my job to ensure I would “be able to make the mortgage payment”… Now that it’s gone. I don’t feel that stress anymore and I love it.

Also, the market has been doing incredible over the past 10 years and we’ve taken advantage of that as a family as well. For a long period, we maxed out our IRA’s and my 401k. That helped us to develop a large enough pile retirement funds that will hopefully grow and grow as we approach our late 60’s — 30 years to grow!

Now the market is not guaranteed to grow continually as it has been … That’s why lowering our household expenses (eliminating our mortgage) makes me feel confident and comfortable in the case of another downturn.

As for my increase during 2017, I would say, it probably had to do with us maxing out our 401ks and Roths … our contributions exceeded any loses. I was investing around 90/10 (stocks/bonds) at that time.

Hi David! It all comes down to our definitions of financial prosperity. For me, having a mortgage made me feel stressed. I was constantly worried about performing at my job to ensure I would “be able to make the mortgage payment”… Now that it’s gone. I don’t feel that stress anymore and I love it.

Also, the market has been doing incredible over the past 10 years and we’ve taken advantage of that as a family as well. For a long period, we maxed out our IRA’s and my 401k. That helped us to develop a large enough pile retirement funds that will hopefully grow and grow as we approach our late 60’s — 30 years to grow!

Now the market is not guaranteed to grow continually as it has been … That’s why lowering our household expenses (eliminating our mortgage) makes me feel confident and comfortable in the case of another downturn.

As for my increase during 2017, I would say, it probably had to do with us maxing out our 401ks and Roths … our contributions exceeded any losses. I was investing around 90/10 (stocks/bonds) at that time.

How did you asses the value of your home in these calculations?

I use Zillow.

Great post. I am curious why you have decided to purchase your first rental property with cash when you have so many other options on the table (i.e. Heloc, traditional mortgage, etc). By financing the rental, it would allow you to purchase 3 properties for the price 1, reduce your tax liability, and and make the same amount of income. If you did this using a Heloc, it would allow you to hold on to your current cash holdings.

Lastly, what are your plans for college tuition?

Thanks for connecting Jeff!

We’ve definitely thought about leveraging our first rental, but the simplicity of having no mortgage feels right for us. We only really want a few homes to help cover our living expenses.

As busy parents, less feels like more lately. Less obligations, less commitments and less debt feels right. This gives us more time (physically and mentally) to enjoy life.

As for college, we’re saving up in 529s for our kids. Based on predicted in-state college costs, we’ll have about half of the money needed by the time they are 18. We’ll supplement the rest with scholarships, our kids working and community college classes if needed.

Great post. How did you get the value of your home? I’m inspired to figure out my net worth!

Thanks Tracey! I use Zillow.com to get a value for my home. I’m so glad to hear you’re going to start tracking your net worth. Good luck and let me know if you have any questions I can help with.

Hi Andy,

Great post! I’m interested in how much you made v. how much your expenses were in the years after you paid off consumer debt and only had your mortgage. As you were paying it down, did you cut costs more to have more money to put toward the house or just earn more?

Currently saving for a 20% down payment on a house but as we live in an incredibly expensive market it will likely be close to what yours was or more. Would love your perspective on how you guys saved even more aggressively.

Thanks!

Maureen

Saving up can be tough! We did our best to grow the gap between our income and our expenses.

During our mortgage pay off time, we made between $100,000 – $200,000 annually. That number went down when Nicole started to stay at home with the kids.

As for the pay down process, it was a combination of cutting costs and making more money.

Savings:

– We decreased our grocery budget from $900 per month to $600 per month by switching from Kroger to Aldi and using a list.

– We went with some high deductible insurance plans that helped us save monthly.

– Spent less on entertainment (going out, eating out, cut the cord on cable, vacation less)

Income:

– Sold a bunch of stuff at our house (moped, bike, purses, clothes, electronics, etc)

– Received bonuses at my job for exceeding my goals

– Started a side hustle (writing, podcasting, blogging) to make extra money

I hope this helps!

Great read! Now I want to calculate my family’s net worth!

It’s a fun way to track your progress. Happy wealth building!

Great progress!

How did you manage to get a $177k mortgage on a $140k house back in the day? Did you buy before 2007-2009 and the big crash?

Thank you Wade! I bought the house in 2004 for almost $200k. At one point the “value” (according to the bank) went down to $116k! It was a rough time in the housing market in metro Detroit. But now we’ve bounced back big time!

This post was a fun ride! I like how you had milestones along the way. I’ve been tracking my network with my wife’s for a little over a year now, and it’s rewarding to see it go up from negative to positive, and continue to grow.

It is a fun way to track your financial success for sure. Tools like Personal Capital and Mint make it fun and easy. I hope your net worth soars in 2018 Joe!

Great story, full of really helpful lessons. I love that you can really see the progression each year as you guys learned more and started gaining more freedom and flexibility because of your increasing net worth. The real numbers are super helpful, too. BTW, loving what I’ve heard so far of the podcast. Keep up the great work!

Thank you Andy! I like when articles I read include actual numbers – I wanted to do the same. I’m so glad to hear you’re digging the podcast too. I’d love any feedback you have.

Really interesting post. Not a traditional frugal/optimized path perhaps and still got it done. Shows there are many ways to FI. Would be great (and maybe it is in other posts) to share strategies on how your earned more. It seems that earnings must have really ramped up and you guys definitely didn’t inflate expenses too much, even with a new house and kids. Amazing.

Great feedback! I will definitely work on a post about increasing income at work. It’s a huge piece of the financial freedom puzzle. I really appreciate the kind words. Thank you!

Nice post. Illustrates how smart decisions with money compound well over a long-period of time, albeit only seven years. We tackled our student loan debt quickly, but are leaving our mortgage outstanding as we believe the ROI in the market will beat the post-tax interest expense. That tax deduction for us is very valuable.

You’re smart to take advantage of the market like you are … if I knew what the market was going to do from 2013-2017, I might have gone all in on a brokerage account. Gotta love that bull run!

I’m a mommy blogger and I stumbled upon this article accidentally in Sunday morning. Your post inspired me to revise our financing. A few years back we really cut out our expenses by spending our money only on necessities and we saved for down payment. But along the way we stopped tracking our expenses. Thank you for inspiration.

I’m so happy to hear the article helped give you a jolt! Automation and online budgeting tools like Mint and Tiller have been huge for us. Let me know if you have any questions about getting re-started. I’m happy to help.

Early on, we were really inspired by Suze and Gail Vaz Oxlade. In early 2017, I binge-watched several seasons of ‘Til Debt Do Us Part. LOL. That show helped us get started on our debt repayment journey.

We started tracking our net worth only verrrrry recently, when we signed up for Personal Capital (which I love). Of course we’re still in the red, but we’ve also seen that number get closer to zero, and pretty quickly at that.

Zero was one of favorite milestones! It meant we turned the page of debt and started accumulating assets. I’m excited to follow your journey – I’m glad we’re connected on Twitter!

You and Nicole are so inspiring! I hope my husband and I have a paid off house and a debt free family in the future.

Thank you J! I know you will. Your story of income diversification inspired me to grow my side business. Keep up the great work! You’re helping so many people.

Suze catches a lot of flack but I was behind her checking into the same hotel once, she was keynoting whatever event I was at. The desk clerk did not recognize her and was totally ignoring her and treating her in a dismissive manner. I watched thinking I would see the stereotypical celebrity meltdown but Suze was sweet as an angel and amazingly patient. She was kind and courteous in a situation where nobody was watching, which is where people show their true colors.

She’s alright with me! People like Suze and Dave Ramsey have helped millions of people start to think more proactively about their finances. They were both great Personal Finance “gateway drugs” for me! ?

Great post, Andy! You have a really inspiring story. I’m just a little older than you, but you’ve really set your family up for future financial security at a young age. Really awesome!

Thanks so much Mike! I’m glad you enjoyed it. We’re working hard and having fun too :)