About a decade ago, I started a new job with excellent pay and benefits. My salary was $160,000 and the company matched 15% of my 401(k) contributions.

After learning about the magical powers of compound interest over time, I decided that I was going to max out my 401(k) each year. This would require my family to live on less, but the long-term benefits were hard to pass up.

Eventually, I decided to leave that job after around six years of employment. Evidently the pull of creating family finance content full-time was too strong for me to deny! At that time, I walked away with $178,000 in my workplace 401(k).

That decision to max out my 401(k) for only six years pushed our family to become millionaires in our 30s that year.

The 401(k) Employer Match Is Powerful

These simple 401(k) actions were something I completely ignored when I got my first job. I used to say things like … “Retirement? Future?! Nah, I’m in my 20s. I don’t need to worry about that.”

I wish I would have at least contributed to my 401(k) up to the employer match right from the start of my career. That way, even if I didn’t contribute the max to my 401(k), I would be taking full advantage of this common employee benefit.

401(k) matching often gets forgotten, but it can be a powerful tool for building long-term wealth. Here’s the loose calculation of the free money I received from my employer during the six years of employment mentioned above:

- Year 1: $2,625 ($17,500 x 15%)

- Year 2: $2,700 ($18,000 x 15%)

- Year 3: $2,700 ($18,000 x 15%)

- Year 4: $2,700 ($18,000 x 15%)

- Year 5: $2,775 ($18,500 x 15%)

- Year 6: $2,850 ($19,000 x 15%)

The total 401(k) match from my employer during those six years was $16,350. That’s $16,350 of free money that my employer gave me just for contributing to my future retirement.

Automation Is Key

While I made a lot more money working than my investments made during my employment, I definitely worked harder for it. I spent so many hours and hours selling, presenting, networking, and emailing (oh, the emailing!).

The beauty of investing and utilizing automation is that once you set it up, there’s not a lot of work to do after. You set it up and relax knowing that your investments will soon start making money for you.

I sought out index funds to keep my fees low and my diversification broad, set my investment amount to max out my 401(k) for the year, and hit go!

Throughout the year, I did nothing to my investments. I didn’t panic sell when the market got bad or try to time the market to maximize my returns. I just let automation do its thing and saw how dollar cost averaging rewarded that patience.

This gave me more time to focus on my career growth, my family, and my health.

Investing Fees Matter

I know not all 401(k) plans are made equal. In fact, some of them are so laden with fees that it makes it hard to grow your nest egg.

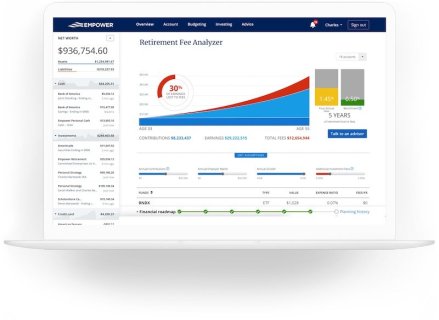

While on my 401(k) building journey, I used Empower’s fee analyzer tool. It helped me to understand the fees associated with my 401(k) and areas where I could save.

It was amazing to see how much fees can really eat into your returns. With just 0.85% of fund fees paid each year, you could lose up to $140,000 in returns over the lifetime of your investment. This could be two years of your retirement lost!

Luckily, the investment options available through my employer had fairly low fees. But understanding the impact of those fees made me more knowledgeable as I continued investing after my employment ended.

Compound Interest Is A Long-Term Wealth Builder

When you start investing for the first time, your balance may feel small and insignificant. This is especially true when you’re shooting for a 7-figure retirement number!

But over a long enough period of time, your balance will start to really grow. That is if you keep your fees low, take advantage of 401(k) matching and consistently contribute to your account. At least, that’s how things worked out for me.

Here’s the overall growth of my 401(k) during that time frame and where it has the potential to grow in the future:

During Employment

- Year 1: $21,000 (31 years old)

- Year 2: $38,000

- Year 3: $67,000

- Year 4: $105,000

- Year 5: $125,000

- Year 6: $178,000 (leaves employer)

After Leaving Employer

- Year 7: $213,000

- Year 8: $258,000 (39 years old)

Growth in the Future (assumes 7% interest rate, no further contributions)

- Year 20: $581,000 (51 years old)

- Year 30: $1,143,000 (61 years old)

- Year 40: $2,248,000 (71 years old)

As you can see, the balance really adds up over time. And when I’m much older and really need the income to live on, it should be plenty given our comfortable standard of living today.

Final thoughts on maxing out my 401(k)

If you have a healthy income and the ability to max out your 401(k), it could really help you get a big headstart on your retirement goals. Taking advantage of these moves when you have decades and decades before retirement can make them even more powerful.

While maxing out my 401(k) wasn’t absolutely necessary to meet our family financial goals, it has allowed me to relax more, work less and rest easy knowing that one important box has been checked.

If you're looking for a free tool to see how much you're paying in 401k fees, check out the free Retirement Fee Analyzer tool from Empower.

What do you think about maxing out your 401k? Are you just getting started with investing? Or have you been at it for a while?

Please let us know in the comments below.