After 10 long years, our family has joined the double comma club! We are now millionaires!

While this feat is awesome and we feel really proud of it, it’s important to point out some privileges we’ve had right off the bat.

- Our average household income during this time period was $190,000

- My wife Nicole and I both had our undergraduate degrees paid for

- Our immediate family has been blessed with good health and has not had any major financial ramifications because of it

Now that you know what we weren't affected by and some of our numbers, I’d like to share another number with you.

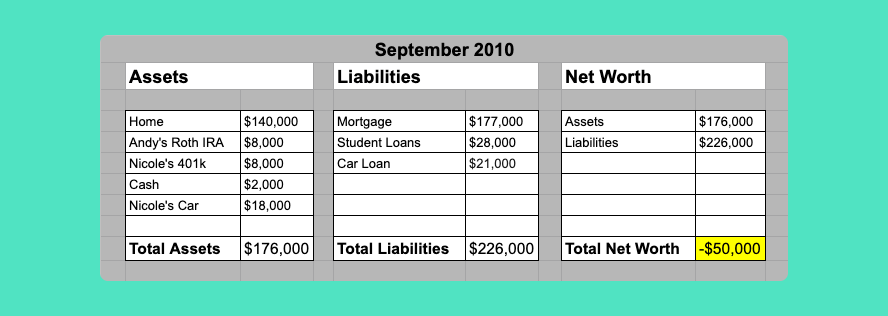

-$50,000

Yes, negative $50,000.

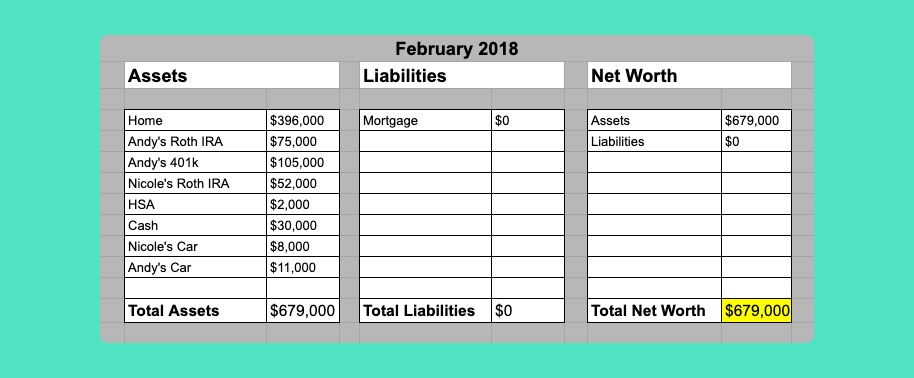

That was our net worth in 2010 when we started out over 10 years ago. We were just two 28-year-old newlyweds happy to be living and loving life today. No kids, no worries, and lots of time for fun.

We loved traveling together, eating out at nice dinners with friends, and attending concerts from bands we loved. Life was good!

It wasn’t until we started considering children that our mindset shifted from enjoying today to planning for tomorrow. After all, we wanted our kids to have the same opportunities that our families provided to us. We felt like that was our responsibility to strengthen our family tree for the next generation.

Also, we thought it’d be pretty freaking cool to be debt-free, mortgage-free millionaires in our 30’s too!

Here’s how we became millionaires in less than a decade and, hopefully, this can be a step-by-step process for you on how to become a millionaire in 10 years too.

1. Track Your Spending

To get out of the -$50,000 net worth trap we were in, we needed to start tracking our spending more carefully. Our income was around $130,000 in 2010 so we had a lot coming in, but we were enjoying mostly all of it. (No regrets at all. We had a blast!)

The money nerd in me developed a spreadsheet budget that helped us track our spending each month and track them against our goals. Some of those goals included:

- Paying off $30,000 in student loans (I decided to go back to school for my MBA)

- Eliminating the $20,000 Nicole still owed on her car

- Reducing our expenses enough to where Nicole could stay at home with our kids in the future

With those goals in mind, Nicole and I would meet every month for a “Budget Party”. This get-together included pizza, a delicious alcoholic beverage of choice, and my nerdy spreadsheet. During this meeting, we would talk about our spending from the previous month, our planned expenses for the current month, and how much we could save towards our big goals.

Nicole was not as geeked about my nerdy plans as I was. But the fact that there was pizza and an opportunity to not work at her job in the future so she could be a stay-at-home Mom, she eventually came around.

2. Live on 50% of Your Income

To hit our big goals, I proposed that we needed to live on around 50% of our income. Nicole agreed, knowing that we would hit some big milestones because of that higher-than-normal savings rate. After all, we had a higher-than-average income so living on a lot less than we made was more than reasonable for us.

This plan worked out great as we started to transition from Nicole working full-time to part-time when our daughter Zoey was born. We were now parents!

The income drop was significant, but nothing that rocked our worlds too much because we were used to living on less anyway.

As we made those adjustments, we would adjust our budget accordingly. Over time, we transitioned away from spreadsheets and moved toward online budgeting tools to make the process easier. Our go-to budget app now is Monarch. It helps Nicole and I communicate a lot more effectively about our money.

Related Content: Best Budget Apps for Families

3. Commit to a Debt Free Life

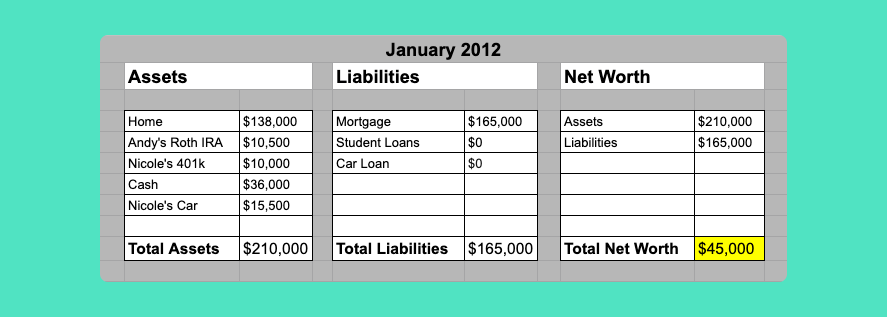

Living on 50% of our income helped us to not only transition Nicole to part-time but it also helped us become consumer debt-free. That’s right! We eliminated our student loans (well, my student loans) and Nicole’s car debt in less than 1 year with this plan.

$50,000 of debt crushed in 12 months!

From that point forward, we vowed to never go into debt again. It was something that didn’t fit our life plan anymore. Not only was it financially freeing, but it was also emotionally freeing. One less thing to worry about in our already busy new parent lives.

We were having a difficult enough time trying to figure out how we could get Zoey to sleep through the night. The last thing we want to deal with is another bill!

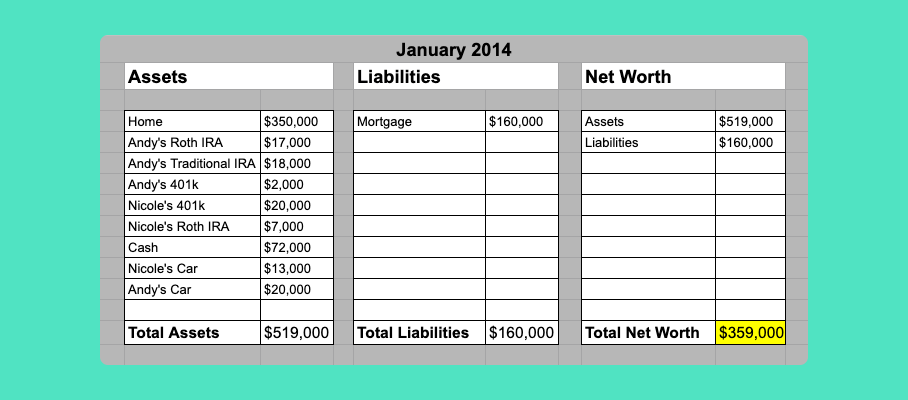

4. Take Advantage of Company Retirement Options (401k and ESOP)

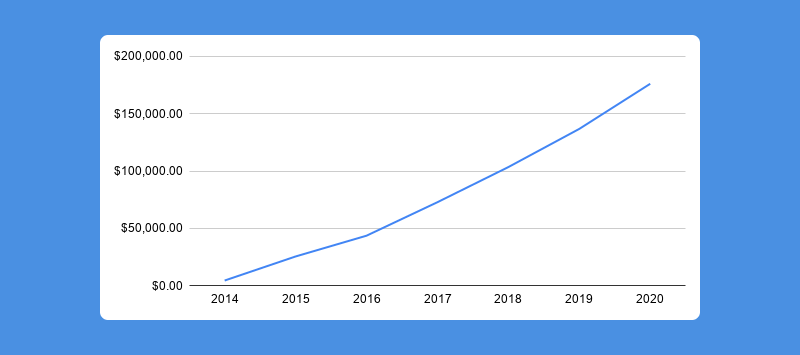

Starting in 2014, I began to max out my 401k at work. As a lovely bonus, my employer matched 15% of my contributions. That means when I contributed $19,000 per year, they would give me $2,850.

Yep! Free money!!!!!

Luckily enough, the stock market had a lovely BOOM over the next 7-ish years. Compound interest, combined with my maxed-out contributions and employer's matches, helped my 401k balance to soar over $100,000 in less than 5 years. A far cry from millionaire status, but we knew time and compound interest would take care of the rest.

Here is my 401k balance each year that I contributed:

I took advantage of low-cost index funds that were available to keep my fee expenses low and my diversification broad. I learned about the importance and simplicity of index fund investing and diversification from great books like:

These books and the gurus behind them helped me realize that investing does not have to be complicated. It’s something you can do yourself if you have the interest and determination to stick out the highs and lows of the market.

Another INCREDIBLY GENEROUS perk from my employer at the time was an ESOP program. The ESOP (or Employee Stock Ownership Program) provided employees with 15% of their annual compensation in company stock. And since our company stock price averaged a 20% growth over the years I was there, we were able to add a nice chunk of change to our overall net worth!

5. Invest in Tax-Advantaged Retirement Options

Outside of my 401k at work, we invested in multiple other ways to grow our wealth and help our family have a bright future. Some of those included:

Roth IRA

Both Nicole and I took advantage of the tax-saving retirement awesomeness of the Roth IRA. The benefits are awesome!

For starters, your retirement account grows tax-free. Anytime you can get Uncle Sam out of your pocket, you’re winning when it comes to retirement savings. You can also withdraw 100% of your contributions at any time without penalties or taxes.

We maxed these out for a few years during our peak earning years and that really helped us to grow our net worth. The low-cost brokerage partner we went with was Vanguard.

Knowing how important it is to start early with retirement investing, I’ve encouraged two of my nephews in their teenage years to start Roth IRAs too. I’m excited to see how their balances grow over the years!

HSA (Health Savings Account)

One of my favorite stealth retirement savings options is the HSA (Health Savings Account).

If you have an employer-sponsored HSA, you’re able to contribute pre-tax like your 401k. In my situation, my employer did not have an HSA option but I could still take advantage of a deduction during tax time.

Also, your money can be withdrawn tax-free if you use it for qualified medical expenses. And if you don’t need the money for health care expenses, you can use it penalty-free after the age of 65 for whatever you want.

Lively has been our partner for this super tax-saving investment option. They are a true ‘no-fee’ platform for individuals like us and they have a really user-friendly interface.

6. Continue to Grow Our Income

While eliminating debt and investing in the stock market was very helpful in our young millionaire journey, growing our income was the most significant factor in reaching this family milestone.

Everyone’s employment situation is different, but there were a few income growth strategies I used to continually increase my salary from 5 figures to 6-figures.

Go Above and Beyond Your Job Description

When I would get my job description and understand what was expected of me, I would do my best to go above and beyond. This way, I was always showing my employer my best effort and, in turn, achieving or exceeding our business goals.

Ask for a Raise When You Deserve It

When I would go above and beyond and not see my compensation increase, I would ask for it. This tactic almost always worked.

In a written letter, email, and in-person meeting, I would …

- Thank them for the opportunity (genuinely detailing what I enjoy about working there)

- Detail my accomplishments

- Ask clearly for what I wanted salary-wise

- Thank them again and let them know I'll continue working hard

On multiple occasions, this helped me to increase my income and my position within the company.

Take a New Position Outside of Your Employer

There were times when I knew my position did not have any upward mobility or my zest for my employment there had faded. That was when I knew it was time to leave my job and seek out another one.

Moves like these can also help you receive a fast promotion and potentially a 10-30% salary increase if you play your cards right. It worked for me.

7. Pay Off Your Mortgage Early

Since we were used to living on 50% of our income and loved eliminating the debt from our lives, we decided to pay off our mortgage early as well. The idea of never making a mortgage payment ever again was an incredible notion on our young millionaire journey!

This was not an easy decision though. We had to decrease our expenses a bit more to make this happen because, at this time in our marriage, Nicole took the plunge into being a full-time stay-at-home Mom. This was an awesome sacrifice on her part because being a stay-at-home parent is really freaking HARD!

We continued to do our Budget Parties each month while raising two young kids and trying to give them as much attention as possible. It was (and still is) hard!

Ultimately, we were able to pay off our $195,000 mortgage early in just under 4 years. On average, we put an additional $3,000 toward our mortgage principal each month to make this a reality.

8. Make Room For Fun

During this stretch of time, we did our best to keep the fun alive in our marriage. It was difficult with two young kids in the picture and my demanding work schedule that often had me out of town.

When we became mortgage-free, we knew we needed to celebrate a little more than we had been. After all, without a mortgage and the extra principal payments we were doing, we had around $35,000 extra to use each year!

The year after we paid off the mortgage, we traveled to Cabo San Lucas with our kids in the Spring, a solo couples trip to California in the Summer, and Disney World in the fall. What a year!

Now, of course, being the frugal dude that I am, I found some ways to get maximum fun for minimum dollars by using credit card rewards and airline miles. We got our $6,000 all-inclusive family vacation to Cabo San Lucas for only $350!

9. Give Back

One realization we had around this time was that we weren’t giving as much as we’d like. We had accumulated all this wealth and were pushing toward being young millionaires, but we were only giving 1% of our income.

We made a goal to increase this to 3% in 2018 and then ladder up to 5% in 2019.

Through this process, we had some incredible conversations with our kids about the importance of charitable giving and we started to develop some fun family traditions around it.

Also, we learned about organizations that made us feel more than happy to give away our money. I was lucky enough to interview them on my podcast too!

While giving away money didn’t increase our net worth per se, it felt like a good progression toward the type of true wealth we wanted our family to have.

10. Follow Your Dreams

After giving away more of our money and planning for more family fun each year, we still had money left over. Our original plan was to save up a bunch of money to buy our first rental property. After a couple of years of saving and learning what it really takes to invest in rental properties, we decided that wasn’t for us.

Instead, with around $100,000 in cash saved up, we decided it was time for me to leave my corporate career and try out a life of entrepreneurship. We would use this cash as a runway to get my small business off the ground and cover our monthly expenses for a period of time.

I had been working in corporate event marketing for around 15 years and I was ready for a change. After 4 years of side hustling on this blog and podcast, it was time to go for it full-time!

Will I fail and need to go back to full-time employment? Maybe.

Will I have fun trying? Absolutely.

The Secret Weapon for How to Become a Millionaire in 10 Years

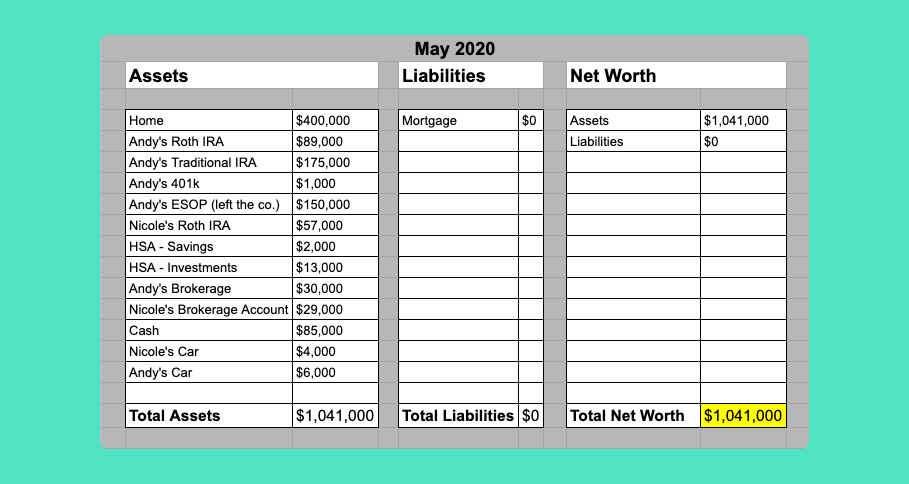

Our net worth currently sits at over $1,000,000 and continues to rise with the long term growth in the real estate market and stock market.

I know that without Nicole’s sacrifices, becoming millionaires in less than 10 years would not have been possible. Here are just a few of the reasons why …

- When we started our marriage, my wife helped me to pay off my student loans and my home equity line of credit that I brought into our relationship.

- I was able to build my career because she gave up hers to raise our children.

- We would not have the dream house we have if she didn’t find it.

- On top of her responsibilities as a stay-at-home Mom, Nicole side hustled as a home organizer, sold things on Facebook Marketplace and eventually went back to work part-time to support our family when I transitioned out of my career.

- Oh, and in our 14 years of marriage, she’s always had my back. Always.

Now that we’re in the next decade of our marriage, it’s time for us to focus more on fun, enjoyment, and relaxation! After all, if the theories of Coast FIRE are correct, we don’t really need to save for retirement much anymore. And we don’t have a house payment or any debts.

It’s time to relax more and work fewer hours each week.

Nicole and I now both work part-time in our respective career paths and have more time for our marriage and our kids.

The future looks bright for our young family. I’m excited that I get to experience it with Nicole.

What would you do with your money if you didn’t need to save for retirement, make a mortgage payment or any other debts?

Do you think it is worth the sacrifice to become a millionaire in less than 10 years?

Please let me know in the comments below!

CARPE DIEM QUOTE

“It is our choices … that show what we truly are, far more than our abilities.”

J.K. Rowling

19 Comments

I don’t know you, but congratulations. If there is one thing I’ve learned about becoming a millionaire, no one does it alone and it takes time and sacrifice.

You are absolutely right. My wife is my rock and I love her so much.

What a beautiful family, wife, and journey that you have. Thank you for sharing. My husband and I have 16 y/o daughter. Trying to teach her how to invest now and manage her finances at an early age. Looking forward to following your videos and blogs. Keep posting…

Thank you for the kind words!

I’d highly recommend looking into a Roth IRA for Kids if your daughter is earning income — https://marriagekidsandmoney.com/how-to-open-a-custodial-roth-ira-with-vanguard/

Hi Andy,

What an inspiring post! I am a mother of four and intend to share your story with my twenty-three-year-old twins.

I love how you stress the importance of exceeding expectations, and later, asking for a well earned wage increase.

So simple, and yet I think this pragmatic approach to getting things done too often escapes people!

Thank you Teresa! If your 23-year olds start investing now, they could be millionaires before my age. Compound interest is amazing!

Wow, congratulations! What an amazing feat. Even more so given that you started in the crash and with negative net worth!

This is a really good read with so many tips, too, thanks.

All the best,

J

Thank you! Yes, started in a crash and now we’re in another one of sorts!

A small correction: HSAs can’t be used tax-free for anything after age 65. They can be used penality-free, but you still need to pay income taxes on the withdrawals for non-health related uses.

Thanks for the catch! Updating now and providing a backlink to source.

Congrats on joining the double comma club

Thanks so much! Happy to be a part of the group!

Awesome breakdown Andy, love seeing this.

And I’m with you on Coast FI. You are WAYYY ahead of the game, and even without any extra investments, you will retire early, no doubt!

With $600k invested, at age 38, even at 8% (assuming 90/10 with DRIP), you’ll have a cool $2,3 Million at age 55. That’s with NO EXTRA INVESTING.

You’ve put in the work, time to enjoy yourself and the fruits of your labor!

I love it!! Thank you for doing the math for me!

Time to contribute to that “hot tub savings fund”!

Interesting share. What is your net worth in dollars right now? That is missing in this share

We’re hovering around $1,050,000 now! You’ll see the detail in the last net worth chart.

I added some text in as well so it wouldn’t be missed. Thanks!

We recently switched our kids chore system to the Busy Kid app. They now have a debit card and it automatically distributes the money into spend save and donate funds. They can also invest in fractional shares of stock if they choose to. It cost $8 per card per year. So it’s almost free. Check it out. PS how did you get your nephews to listen? I have 8 niece’s and none of them seam to be interested in saving for the future. If I had someone talk to me about finances and savings at the age 18 I think it would have saved me from a bunch of mistakes. Lol

Busy Kid sounds like a great app! I’ll have to reach out to them!

Honestly, my nephews both had an interest in investing. That helped a lot. Also, I helped my 17-year old nephew buy his first ETF too.