Does it make sense to pay off your mortgage if you lose the mortgage interest tax deduction? This is a common question people struggle with who are considering paying off their mortgage.

Will my paid-off home be worse for my tax situation?

It's no wonder this is a common question. Unless you're a tax professional, taxes are super confusing!

For most people, this is a real question that people should know the answer to before going down the mortgage freedom path.

Let’s break it down.

Will I receive a mortgage interest tax deduction this year?

To find out if you will receive a mortgage interest tax deduction this year, let’s first discuss the 2017 Tax Cuts and Jobs Act that changed things around a bit.

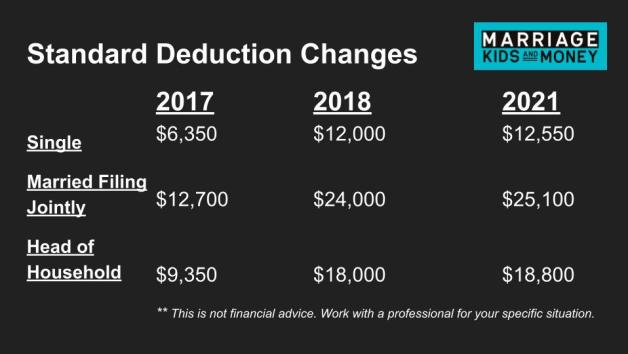

With the passage of this Act, the standard deduction increased significantly.

It was around $6,350 for single filers and for single filers this year the standard deduction is $12,550.

For married filing jointly it went from $12,700 to $25,100 for those filing their taxes this year.

I’m going to stick with the married filing jointly numbers because of the whole “marriage kids and money” theme I’ve got going here.

This overall change decreased the need to itemize mortgage interest deductions for the majority of Americans.

Example: Standard Deduction with a Mortgage

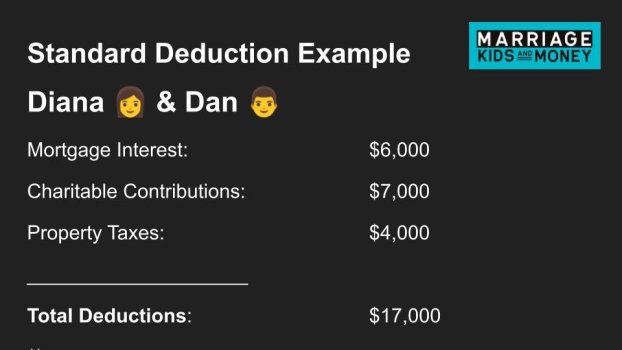

As an example, let’s say Diana and her spouse pay around $6,000 in mortgage interest this year. They also give $7,000 to charity as well. And their property taxes were around $4,000. Their total deductions come out to $17,000.

Since they are married filing jointly, their total deductions fall well below the standard deduction. It makes more financial sense for them to take the standard deduction. They are going to save more on taxes this way.

Example: Standard Deduction without a Mortgage

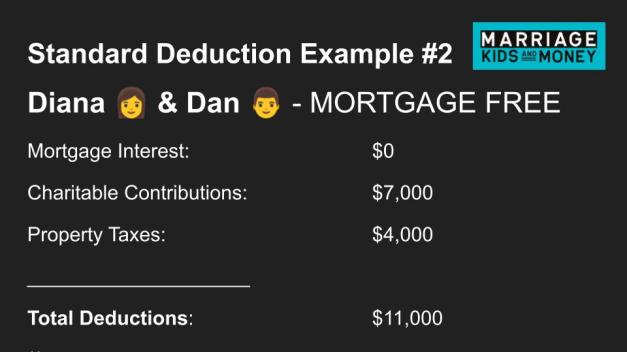

Now, let’s assume Diana and her spouse decide to go mortgage-free after years of paying down their principal.

Their mortgage interest deductions would be $0, let’s assume their charitable nature continues at $7,000 and their property taxes are $4,000. Their total deductions come out to $11,000.

Again, well below the standard deduction.

So, in both cases, Diana and her spouse would NOT receive any more special tax treatment because they kept their mortgage.

Other Deductions You Can Itemize Other Than the Mortgage Interest Tax Deduction

Now, are there other things you can itemize for deductions when it comes to tax time? Yes.

According to the IRS, itemized deductions include amounts you paid for:

- State and local income or sales taxes

- Real estate taxes

- Personal property taxes

- Mortgage interest

- Disaster losses

- Gifts to charity

- Part of the amount you paid for medical and dental expenses

This could be a factor for some Americans on a special year, but on a year-to-year basis for the everyday American, not really.

To see how the newer standard deduction affects your tax situation, I’d suggest answering these quick questions and calculating the result.

How much …

- … Did you give in charitable donations last year?

- … Was your annual mortgage interest last year?

- … Student loan interest did you pay last year?

- … Property taxes did you pay last year?

- … Did you pay in the other categories I mentioned earlier?

Total these up and see if it’s higher than the standard deduction. If you’re below that level, keeping your mortgage for the tax deduction benefit doesn't make sense.

Again, if your deductions calculate to be below the standard deduction, you are not saving anything extra by keeping your mortgage vs paying it off early.

Now, Could Diana have a much higher mortgage interest than described in my example? Absolutely!

Most Americans don’t, but let’s just say Diana did for our next section.

Is it worth it to keep my mortgage (if my total deductions are above the standard deduction)?

For most Americans, the answer will still be no.

90% of Americans opt for the standard deduction when they file their taxes.

So for the 10% that don’t take the standard deduction … is it financially worth it to keep their mortgage for the tax savings?

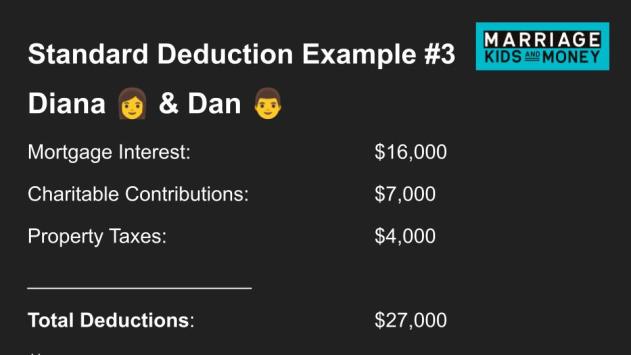

Let’s say Diana and her spouse paid $16,000 in mortgage interest last year, gave $7,000 to charities and paid $4,000 in property taxes. Their total deductions in this example are $27,000.

Since their deductions are over the standard deduction, it makes sense for them to itemize.

That additional $1,900 of deductions will lower their taxable income by $1,900. Let’s say they are in the 24% tax bracket and this saves them around $500.

Their total out-of-pocket cost for their mortgage interest is now around $15,500 instead of $16,000. Nice!

But if they were mortgage-free, their total out-of-pocket cost for their mortgage interest would be $0.

Paying $0 in mortgage interest is better than $15,500 in my opinion!

So based on these financial breakdowns, I believe in almost all cases, when it comes to the question of “Should I NOT pay off my mortgage because of the mortgage interest tax deduction?”

I say … Nope! Pay it off.

Not only will you experience better financial benefits, but you’ll receive SO many emotional benefits as well.

5 Emotional Benefits of a Paid Off Home

Let's briefly discuss 5 of those real-life emotional benefits that can come with mortgage freedom.

1. The Ability to Go Down to Part-Time Work

When our family became mortgage-free, we owed a lot less money each month. Since we owed a lot less money, we didn't need to make as much money. Therefore, we could change our work situation to better align with our family values.

For us, that's meant my wife Nicole going from full-time work to part-time work. This was at a time when she wanted to spend more time with our kids.

Or more recently, I went from a stressful 40-50 hour per week job to a 25 hour per week business. I'm more present with my family and my kids and I have more opportunities to pursue hobbies and interests I enjoy.

2. Reduced Decisions

You know how we're constantly making decisions all of the time?

There's something to never worrying about something ever again, that's really emotionally refreshing. I will never again worry about paying my mortgage. And I will never again worry about refinancing my home when rates go down or up or sideways.

It's done. This is a decision our brains will never have to worry about ever again.

3. Ownership Pride

Owning anything outright can fill you with personal pride.

When I bought my first bike with my own money, I felt proud.

The same with the first car that I bought with cash. The car just drove differently than my previous leases.

My paid off HOME … oh man, I feel that ownership pride through and through. I want to care for it more. I want it to be a place my kids will always call home.

Mortgage freedom gives me more pride in my home than I've ever had before.

4. Retirement Isn't As Stressful

Between our family achieving Coast FIRE and our mortgage freedom, a comfortable retirement doesn't feel so out of reach now.

Our investments will continue to grow to provide us with the income we need to enjoy our retirement. And our paid-off home will always give us somewhere to live.

I'm looking forward to retirement, but knowing that I love my job, I'm not in any rush.

5. Showing My Kids How to Live Free

I love that our kids have seen us go on this mortgage-free journey.

We even celebrated the big victory with them by smashing a mortgage pinata filled with candy and prizes. They remember that celebration fondly and I'm hopeful that they will want to experience the same sense of freedom we have as well. That way, our family tree will continue to be strengthened for generations to come.

Check out how our family celebrated our mortgage freedom and 5 other ways to celebrate the big day as a family.

Final Thoughts on Keeping the Mortgage for the Mortgage Interest Tax Deduction

So those are my thoughts on whether people should keep their mortgage for the tax savings! I hope that helps as you’re making the decision.

Paying off your mortgage early is a big decision. Ultimately, this is a personal decision that only you can make.

What do you think of keeping your mortgage for the mortgage interest tax deduction? Are you pro-mortgage freedom or against it?

Please let me know in the comments below.