If you're looking to retire early, real estate investing may be your FIRE Movement ticket to success. Devon Kennard not only believes this, but he's banking on it.

Knowing that the average NFL career only lasts around 3 years, Devon has been investing in real estate to support his eventual early retirement. He's now able to step away from the game he loves knowing that his income from his investments will pay for his family's needs (and then some).

Overview: Real Estate Investing Beats Stocks for Early Retirement w/ Devon Kennard

Devon Kennard reviews the following:

- Why he started investing in real estate

- How he keeps his real estate investing passive

- Why Devon prefers real estate investing over stocks

LISTEN AND SUBSCRIBE ON:

Key Takeaways

Here are my top three takeaways from my conversation with Devon Kennard.

Invest with the End in Mind

Devon knew his career in the NFL was going to be shorter than most careers. Because of this, he needed a plan to replace his income when his career was over.

He took most of his earned income and invested in real estate. That way, he could build up enough passive income when he retired from the NFL.

This example is extreme for most of us. Our careers will more than likely last longer than 9 years and not many of our incomes will reach 7 figures in a year. That being said, if we have aspirations for retiring early or even earlier than the traditional retirement age, then we need to start investing with the end in mind.

Whether that’s real estate, stocks, or your own small business.

Real Estate Beats Stocks for Early Retirement

If you want to retire early, real estate and the cash flow that comes with it are better than investing in stocks. You’ll see more cash flow with real estate on average than you will with stocks.

The value of the asset grows better with stocks on average, but not the income or the dividend. You might see a 3% dividend with a 6% appreciation with stocks over the long term. And the flip of that with real estate. You may see a 6% dividend (or rent payment) with a 3% appreciation.

The same 9% but real estate gives you more of the income earlier.

Obviously, interest rates climbing can throw this whole math equation for a whirl, but overall, I do believe real estate investing is better suited for early retirees.

Related: How I Bought 20 Rental Properties in Cash (w/ Rich Carey)

Tackle the Big Expenses (and forget the little ones)

If you’re looking to make room in your budget for more investment opportunities, then look at the big expenses first.

- Housing

- Transportation

- Debt payments

These expenses have a bigger impact on your life than your coffee and your Netflix subscription.

Reducing or eliminating the BIG expenses can help you make the most progress in growing the gap between your income and your expenses.

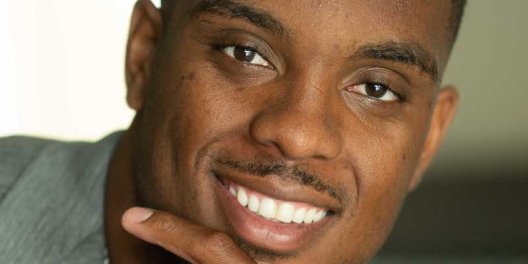

Guest Bio – Devon Kennard

Devon Kennard is an NFL linebacker (9th season), RE investor, entrepreneur, and philanthropist. He earned both his Bachelor's and Master's degrees in Communication Management in four and a half years at USC.

Devon is a mentor and advocate for elevating personal financial well‐being and building generational wealth through passive income strategies, informed by his own work in building a real estate portfolio of over 50 income‐generating properties throughout the US.

His investments include single‐family and multifamily properties as well as real estate syndication investments ranging from residential properties, storage facilities, hotels, senior living centers, and industrial properties.

Devon provides financial guidance to NFL players including through the NFL Players Association, as well as via his philanthropic and charitable work promoting youth education and financial literacy, which earned him a landslide nomination for the 2019 Walter Payton Man of the Year Award.

Resources – Devon Kennard

Devon Kennard (Instagram)

It All Adds Up (Book)

Podcast Resources:

- Make My Kid a Millionaire Course: Want to make your kid a millionaire? Learn more about my course!

- Family Wealth + Happiness Guidebook: Get the 10 steps to young family wealth and happiness for free by signing up for our bi-weekly newsletter. This 39-page PDF gives the tools, guidance and resources to achieve your own version of family financial independence.

- MKM Coaching: Looking for someone to walk alongside you on your financial independence journey? Grab your free 15-minute consultation today.

- Corporate Financial Wellness Presentation: Contact me to discuss how I can support your company's overall financial wellness.

- Recommended Resources: You won’t reach your financial goals without the right tools. Here are my suggestions!

Carpe Diem Quote:

“Some people want it to happen, some wish it would happen and others make it happen.” – Michael Jordan

What do you think of the advice from Devon Kennard? Are you planning an early retirement as well?

Please let us know in the comments below.