The future cost of college is no joke. That's why parents like me are looking for a way to pay for college without student loans.

According to Vanguard, the average rate of inflation for college costs has been about 5% in recent years.

As an example, my alma mater, Michigan State University in 2022 costs $26,426 per year for an in-state student. This includes tuition, fees, room, and board. That’s around $100,000 for 4-years of in-state tuition if my son or daughter were to be going to school today.

Fast forward to the year 2030 when my daughter starts her freshman year of college, 5% inflation on that $100,000 in 2030 comes to $168,000! Oh, and then you add in my son who will be attending college in 2032 and he’ll need around $185,000.

That means I’m looking at around $353,000 for my two children to eat, sleep and learn during 4 years of college. AHHHHH!!!!

I don’t know about you, but that number makes my head hurt. So much so that I want to throw my hands up in the air and just quit.

But, I love my kids too much and I know how important college can be in this country. A study by Georgetown University found that college graduates earn $1 million more over their lifetime than high school graduates. College leads to more education, more connections and more money. I would not have the career and the privileges I have today if it weren’t for my time in college.

So … How are we going to cover $350,000 to pay for college without student loans?

Honestly, I have no idea, but here are 5 things we’re going to try.

1. Start a 529 College Savings Plan Early

Since the cost of college is rising at 5% per year, we’re going to need to chase that increase by investing in the stock market. That’s where the 529 College Savings Plan comes in.

This investment tool allows parents to invest in stocks, bonds and real estate through a state-sponsored program. Depending on how you invest the money, your 529 college savings plan has the ability to massively outgrow the interest made with a traditional savings account.

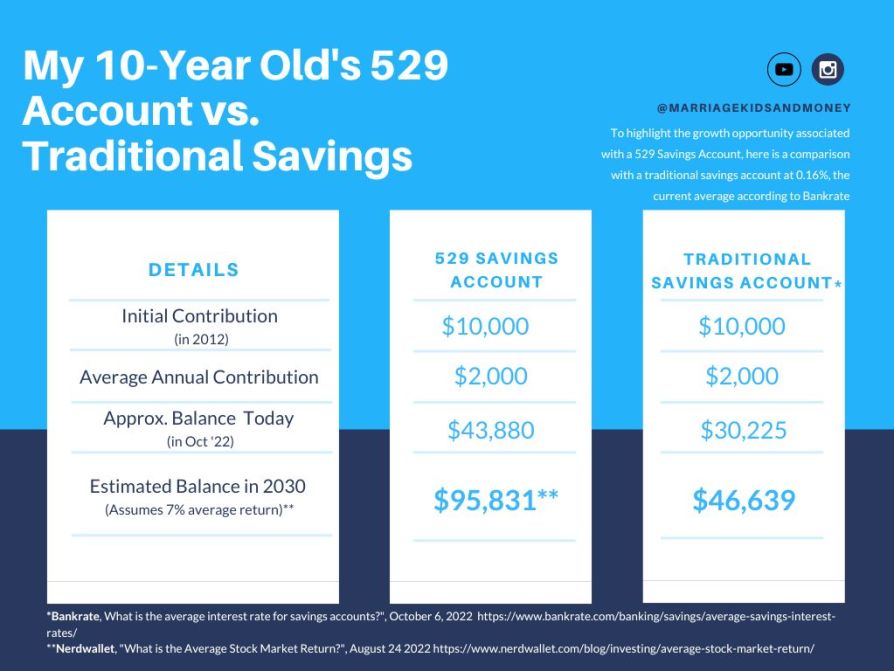

We started investing for our daughter in a 529 plan when she was born with a $10,000 initial deposit. 10 years later with additional annual contributions, she now has around $43,880 in her account. If we were to have just put this in a traditional savings account, making around 0.16% interest, her balance would be just around $30,225.

Fast forward 8 more years to when she starts school, the difference will become a lot bigger (depending on the market, of course). If our 529 account continues to grow at a conservative rate of 7% per year, she’ll have around $95,831 at the start of college. If we went the traditional savings account route, she’d only have around $46,639. Compound interest pays!

In short, to combat the rising cost of college, we need the stock market on our side. Besides taking advantage of the stock market, 529 college savings plans have many other benefits that can help you as well.

2. Encourage Kids to Work and Contribute at Home

Even with our ability to start our kid’s 529 plans early, we’re still not going to have enough to help them graduate college debt-free. That’s why we want them to understand that THEY are a part of this equation as well.

For the last few years, we’ve developed a chore and reward program for our kids. They complete two kid-sized, yet important chores around the house chores after school every day.

They receive $1 equivalent to their age. Zoey gets $10. Calvin gets $8. As they get older, the chores get more difficult and they receive more money.

Their money gets split up between multiple digital buckets:

- Spend

- Save

- Give (Family + Charities)

- Invest

By developing habits of contribution and allocating money to important areas of their lives, they will understand good money management skills and they will truly become a contributing partner in their future debt-free college life. When they are old enough to get jobs, we’ll encourage the same distribution of their cash.

Right now, I'm managing the process myself, but as the kids get older, we’ll look at debit-card-based systems like FamZoo. This will help us to keep better track of their money in this fast-paced digital world.

Related Article: 10 Kids Books About Money

3. Help Teens Apply for Scholarships

The easiest $2,000 I ever made was completing a college scholarship application when I was in my undergraduate at Michigan State University. Since I was making around $9 an hour folding ugly sweaters at Eddie Bauer during that time, $2,000 for a few hours of work was well worth it.

Not everyone hits the $2,000 jackpot on the first application, that’s why we’re going to encourage our kids to do A LOT OF THEM. It’s free money just waiting to be earned.

After interviewing Pam Andrews on how she helped her son earn $300,000 in private scholarships, I feel pretty confident that my kids can score at least 1/10th of that to support their academic plans. Pam had her son fill out 147 applications and he only received 6 awards but those 6 netted him $300,000! Talk about a full ride and then some!

4. Try Two Years of Community College First

If all else fails, there is absolutely nothing wrong with our kids attending a couple of years of community college. The average cost of community college tuition and fees (without room and board) in the 2021-2022 school year was around $3,800 while a 4-year public university came in at $10,740. That’s a huge difference.

For a lot of community colleges, you’re able to take a lot of the pre-requisite courses that can transfer over to the university level. This way, your kids would be taking care of the early coursework at a much cheaper amount.

There’s something to “figuring it out” in community college first in my opinion. Personally, I had NO freakin’ clue what I wanted to do at 18 years old (well, I still don’t at 40, but that’s beside the point). The point is, why spend top dollar when you’re just “figuring it out”?

5. Encourage Part-Time Work in College

It will be very important for our kids to work during their time in college. They don’t need a full-time job. Getting a part-time job and internships will give them a perspective on the real working world that college just won’t provide.

Also, by the time they are in their late teens and early 20s, we’re going to start transferring over some of the financial responsibility of college. We may have enough to cover their tuition, fees, and books, but if they want to rent a house with some friends during college, that part-time job will definitely come in handy as the “Mom and Dad bank” starts to run dry.

This will not only help us financially, but it might just help our kid’s grades. According to data by the Bureau of Labor and Statistics, students who work part-time (20 hours or less) receive better grades.

See?! It’s a win-win for everyone!

Final Thoughts on Pay for College Without Student Loans

Now, do I expect us to pull all 5 of these levers perfectly? Oh, heck no!

But if we’re semi-successful in each of these areas, I honestly think that’ll add up to a debt-free future for both of our kids. After all, they are worth every ounce of effort and every penny spent.

Are you planning to pay for college without student loans? What other higher education planning strategies are you using?

Please let us know in the comments below.