If you received a $1 million inheritance, how would that change your life? How could you take that blessing and make it your way out of a job you don't enjoy and retire early?

Recently, I received this question from an anonymous podcast listener asking me this exact question.

Here are the quick details of his situation:

- 40 years old, married, father of a 9 and 11-year-old

- Recently received a $1 million inheritance

- Works a “dead-end” Network Administrator role and wants out

He wants to know how he can use his $1 million inheritance and create a replacement income so he can leave his job.

In a situation like this, it makes a whole bunch of sense to meet with a financial professional who knows more details about your specific situation.

There’s a lot of other information that would be helpful in making an informed opinion here, but for the sake of entertainment, let's press on.

So with that fair warning, I’d like to share what I would do if I were in your position. Not what you SHOULD do, but what I would do.

How to Use a $1 Million Inheritance to Quit Your Job

Over the 5 years that I've had this blog and through the 300+ interviews I've done on my podcast, I’ve learned there are three major ways to find your version of family financial independence:

- Stock Market

- Real Estate Investing

- Small Business

I’m going to review all three of these options with the $1 million inheritance and then finish with what I’d do with the money if I wanted to leave my network administrator job.

Depending on where you live, you’ll want to research estate taxes and inheritance taxes. This may impact your inheritance.

For example, I live in Michigan. We have no estate tax or inheritance taxes.

If you were to live in Maryland, residents can be affected by both estate and inheritance taxes.

Stock Market Investing

One option for the $1 million inheritance would be to create a stock market portfolio that provides you with monthly income.

The average network administrator salary in our country is around $60,000. Perhaps you make more than this or less, I’m going to use $60,000 for this example.

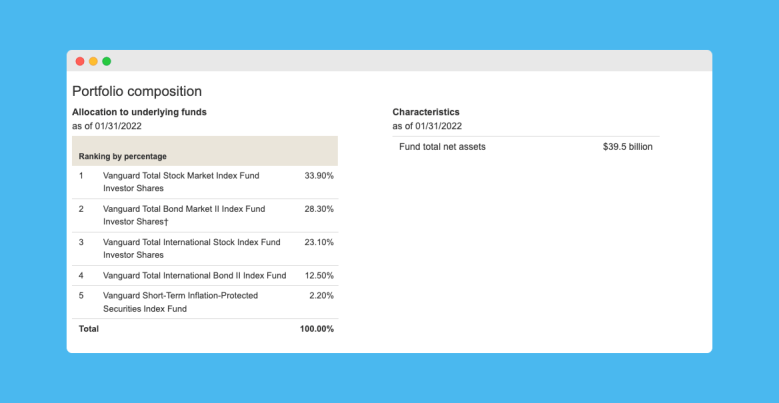

To replace a $5,000 per month income and a potential $1,300 per month allocation for health care and dental benefits, I would invest in a portfolio similar to Vanguard’s Target Date Fund 2025.

This fund is essentially a 60/40 portfolio. That's 60% stocks and 40% bonds/fixed income. Over time, the fixed income and bond allocations will increase providing the portfolio with less volatility.

Based on the average annual returns since the fund’s inception in 2003, the average return is 7.47%.

Let’s subtract the average inflation of 3% and bring that down to 4.47%. Yes, inflation has been higher lately, but on average, 3% still makes sense in my opinion.

According to this awesome calculator I found on NerdWallet’s website that helps you determine how long your investments might last, this portfolio could provide $6,300 of monthly income for around 18 years.

By that time, this person would be closing in on their traditional retirement years and hopefully be able to live off of your other traditional retirement funds like a 401k, IRA, or Health Savings Account (HSA).

$1 Million Inheritance in the Stock Market: Pros

- Very hands off and passive

- Allows the market to do it’s work

- Provides enough income to reach traditional retirement years

$1 Million Inheritance in the Stock Market: Cons

- You are not very involved as this is a very passive approach and you may want to be more involved

- This portfolio may not return 7.47% annually (because past market performance does not predict future market performance)

- You may not have any traditional retirement funds accumulated to date that you can use in your 60’s

Real Estate Investing

Perhaps you’d like to have a more hands-on approach with your $1 million inheritance. Well, real estate investing may be for you!

As a busy parent and a former landlord, I really want nothing to do with real estate at this time in my life besides taking care of the house I’m in. But you may love the idea of managing homes, fixing them up, designing layouts, and helping tenants to find their homes.

I’ve spoken to dozens of real estate investors and there are varieties of ways to get into real estate from single-family or multi-family buy-and-hold rentals, to real estate crowdfunding, commercial real estate, syndications, house flipping and so much more.

Given your desire to replace your monthly income, buy-and-hold rentals could be a smart option. To get the most bang for your buck here, you’ll want to find investment homes that provide you the highest income return for the lowest price.

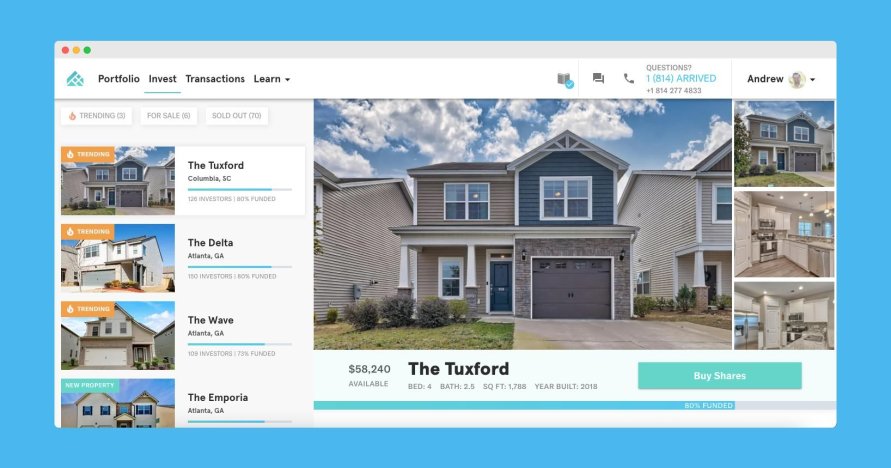

If owning real estate but managing the property sounds painful, consider a partner like Arrived Homes. They allow people to buy shares of rental properties in profitable areas of the country, sit back and earn income (and property appreciation).

Let’s say you go with single-family rentals, there are estimates that show this type of investment can yield around 7.7% per year (that's before taxes). Factor in average inflation over the decades and we’ll call it 4.7%.

That 4.7% income dividend won’t provide enough annual income to cover your income and your health care costs. Instead of $6,300 with the stock market option, you’d look at around $4,000 per month (when you factor in inflation and taxes over time).

But the awesome thing with real estate is that your assets grow over the years too! With $1,000,000 in real estate and an average appreciation of 3.8%, in 20 years, your $1,000,000 portfolio could be a little over $2,000,000!

So if you didn’t have a lot of traditional retirement investments, as we discussed in the first example, you’d have plenty more assets with this real estate option.

$1 Million Inheritance in Real Estate Investing: Pros

- Compared to the more conservative stock market approach, the overall return can be higher with real estate investing

- You are more involved in the decision making process

- The real estate appreciation can provide quality assets in retirement

$1 Million Inheritance in Real Estate Investing: Cons

- This approach may not cover your monthly income needs over the long term

- Income is based on tenants and rent payments. There is a major human element to this approach and may be out of your control over the long term.

- Depending on which approach you go with, it may be a lot more work and risk than passive stock market investing.

Small Business Ownership

As a small business owner who is crafting his 25-hour schedule and doing work that he loves, I like this option a lot.

Your $1 million inheritance can work as seed money to get your business off the ground. This could be your chance to provide a solution to something you’ve been passionate about for years but never had the chance until now.

Successful business owners can not only create a healthy living for themselves, but they can work fewer hours and solve important problems in their communities and potentially across the world.

On the flip side, around half of businesses fail after their first 5 years. This can be due to poor planning, lack of financial support or not navigating the market well.

For me, I’ve been working on my small business for around 5 years now. I'm happy to report that I haven’t failed yet! Woo hoo!

I pay myself a salary of around $50,000 per year with a goal of $60,000 by the end of the year.

And I definitely did not have a $1 million inheritance to start.

My ramp-up period to get to this $50,000 salary was about 5 years though so consider my experience into your plan. That’s just an example from me. There are dozens of successful small business owner stories that have gone on to do incredible things and majorly profitable things a lot quicker than I have.

For a general income reference, the average small business owner's salary in 2021 was $62,000. So given your needs, over time, this could be a good option for you to consider.

$1 Million Inheritance in Small Business Ownership: Pros

- You have a chance to follow your passion and make enough to cover your former salary and benefits

- The growth opportunities are limitless with small business ownership

- You may have to live off of your inheritance for the first few years before your business grows to become an income source

$1 Million Inheritance in Small Business Ownership: Cons

- May not provide income right away

- Your business could fail and you will have eaten into your $1 million inheritance

- This approach is not passive at all. You will be highly involved in creating your income.

What I Would Do With a $1 Million Inheritance (if I Wanted to Quit My Job)

Well, considering I absolutely love what I’m doing now, it may not come as a surprise that I would recommend small business ownership as your path to replacing your income at work.

Creating your own business, on your own terms and with a schedule you love is incredible. Also, you can develop a business that allows you to move toward an area you’re passionate about.

I love helping families build wealth and happiness so that’s my business now!

But it’s not all sunshine and rainbows here at Marriage Kids and Money headquarters. Making money each month is HARD and it takes a lot of work. I’ve been open in the past about the disadvantages of entrepreneurship.

It can be stressful and it can weigh on your ego. Where you were once an expert as an employee, you’re now a novice as a business owner.

What you have in your favor though is a $1 million inheritance!

Take Time Off

In the 3 months, I’d just take some time off from work and think about what you want the second half of your life to look like. Get a journal, make some goals and discuss these plans with your partner and kids.

I’ve found that when I give myself time and space to think, I come up with some great ideas.

If time alone is important to you, take that time. Perhaps travel is important, do that!

I wouldn’t suggest rushing into any decision, especially one as big as this. During this time of contemplation, you can live off of your inheritance and cover your former salary and benefits. Don’t go crazy here! This is time for contemplation, relaxation, and thinking about your future.

Invest Most of it in the Stock Market

If it were me, I’d put $750,000 of the $1 million inheritance in the stock market as described in our first section. This can potentially cover your previous salary and benefits for 12 years. That’s plenty of time to ramp up your business and create an income stream (and purpose) that you enjoy.

Work with a brokerage partner you trust. I recommend partners like Vanguard or Fidelity. Also, meeting with a fee-only financial advisor is a smart move. Connect with a fiduciary through XY Planning Network, that way you can get someone who is paid for their time, not for the products they push on you.

Ramp Up Your Small Business

With your mind open and your income taken care of, you’ll be ready to start your small business. Since a lot of the reasons small businesses fail are due to financial reasons, you’ll be WAY ahead of the game given your investment income.

How you do business ownership is up to you! I’d recommend studying up on small business ownership by reading books, listening to podcasts, or watching YouTube videos from creators you like. That’s how I started my business.

Over time, you’ll get smarter, your business will help more people and you’ll become more profitable. I’ve found that to be the case with my small biz.

Final Thoughts on What to Do With a $1 Million Inheritance

You’ve been given a true blessing. Take it and live the life you’ve always wanted.

Also, if there’s a way to give back along the way, I’d recommend it. I believe more money amplifies who you already are as a person so if you want to help people now, you’ll be able to do that even more with your $1 million inheritance.

If you wanted to quit your job, how would you use a $1 million inheritance? Which of these 3 options would you choose?

Please let me know in the comments below.