Target Date Funds are rapidly surging in popularity lately. Investors are flocking to this “set it and forget it” retirement tool as an easy way to diversify their portfolio and eliminate the fees of working with a high-cost broker.

According to the Wall Street Journal, around 40 million Americans have adopted this low-stress strategy.

Just as the name describes, the funds are designed around your target retirement date.

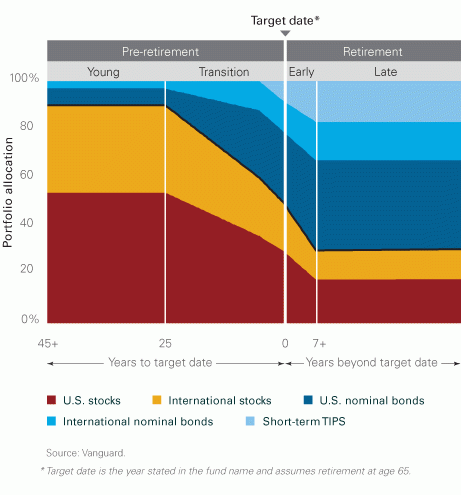

For example, if you're thinking you will reach the retirement promised land by 2045, you would invest in a fund like the Vanguard Target Retirement 2045 Fund (VTIVX). As you can see from the VTIVX chart below, your equity holdings will decrease as you get closer to retirement while your fixed-income holdings increase. This way you're decreasing your risk and volatility as you get closer to your target retirement date.

These funds sound like magical retirement options that have little to no downside. But there are always two sides to every coin. Let's take a look at the pros and cons of Target Date Funds.

Pros of Retirement Target Date Funds

Automatically Adjusts Holdings

As you approach your retirement date, the equity and fixed income allocations adjust according to the current date. Let's use a fictitious character named “Andy Hill” as an example:

- Andy is 39 and he plans to retire in 2045.

- Right now, his allocation is around 90% equity (stocks) and 10% fixed income (bonds).

- When Andy turns 59, his holdings will adjust to approximately 60% equity and 40% fixed income.

- The Target Date Fund automatically decreases his risk as he draws closer to retirement.

- Set it and forget it as they say …

Rebalances For You

An important action that every investor should take is rebalancing your portfolio.

A bull market for stocks, as we've seen recently, can increase your equity percentage and drive down your fixed-income percentage.

To maintain your original investment strategy, you'd need to rebalance your portfolio by selling off some equity holdings and purchasing more fixed-income holdings.

With Target Date Funds, this action is already taken care of. The funds will rebalance themselves so you don't have to worry about your correct asset allocation.

Can Invest in Index Funds

Target Date Funds, through a company like Vanguard, invest in index funds. Not all target-date funds take this approach though.

If your target-date fund does invest in index funds, that can give you the advantage of investing in the “Total Stock Market” or the “Total Bond Market” in a low cost and efficient way.

Let's use Vanguard’s 2045 Target Date Fund (VTIVX) as an example:

| Ranking by Percentage | ||

|---|---|---|

| Vanguard Total Stock Market Index Fund Investor Shares | 53.20% | |

| Vanguard Total International Stock Index Fund Investor Shares | 35.60% | |

| Vanguard Total Bond Market II Index Fund Investor Shares** | 7.90% | |

| Vanguard Total International Bond Index Fund Investor Shares 1 | 3.30% | |

| Vanguard Total International Bond II Index Fund | 0.00% | |

| 100.00% |

There are a variety of funds that make up VTIVX (US Stocks, International Stocks, US Bonds, International Bonds, and a couple more).

Essentially, you're getting a 90% equity and a 10% fixed income allocation and further diversifying by not holding all of your investments in the United States.

And since these are index funds, you're diversifying even further by spreading your investments across thousands of companies.

Low Cost

Since some Target Date funds (like VTIVX) invest in index funds, they inherently cost the investor very little compared to working with a broker or purchasing non-index mutual funds.

As a basis for comparison, the expense ratio for VTIVX is currently 0.15%.

If you work with a typical broker, you may pay 1% for their fees in addition to a 1% expense ratio of the mutual funds they are recommending to try to beat the market.

The difference is 1.85%.

That might not sound like a lot of percentage points, but over time it can truly eat up your overall returns and make retirement difficult to reach.

Cons of Retirement Target Date Funds

Less Control

If you're into having control of your overall portfolio and actively managing your equity and fixed income holdings, Target Date Funds may not be for you.

Some people enjoy the “set it and forget it” model, but others who are more active in their investing want to steer the ship per se.

Expense Ratios Could Be Lower

Although Target Date funds have super low expense ratios, you could get an even lower expense ratio if you invest in the underlying index funds.

Let's go back to VTIVX to explain.

One of the index funds that makes up VTIVX is called “Vanguard Total Stock Market Index Fund Investor Shares”.

If you choose to invest in this index fund alone, you'd only pay 0.04% for the expense ratio instead of 0.15%.

Again, this is a small additional percentage to pay, but it can truly add up over time.

Too Many Bond Investments

Some folks I've spoken to feel that Target Date Funds are too heavily weighted toward bonds overall.

They would prefer more of their investments to go into stocks to take advantage of the higher returns, especially during their younger years.

To each their own!

How Do I Find the Right Index Fund or Target Date Fund?

Robo-Advisor

One of my favorite ways to find the right funds for you is with a low-cost Robo Advisor. Services like blooom, will scan your current portfolio and make suggestions for optimization. I recommend this tool to a lot of people starting out.

Fee-Only Financial Planner

Outside of Robo advisor services, you could look into support from a fee-only financial planner through the XY Planning Network. These folks are sworn fiduciaries who focus on what’s best for you, not what’s best for them.

I love what they stand for and what they do for people. No sales, no minimum investments … just the support you need for a fee.

DIY Investing

Although I’ve partnered with financial advisors in the past, I don’t mind doing the DIY thing too.

If you’re going to go this route with your investing, make sure to keep a few things in mind:

Asset Allocation is Important

Just because you are investing in an index fund, doesn't mean it's the best thing for you at your stage in life. Make sure those index funds help you to hit your goals and you're okay with the risk associated with them.

Dollar-Cost Averaging Wins

Consistent investing over time will help your account balance grow. A good financial advisor will help you to stay the course even during the tough times… so if you’re going it alone, be your best advocate and remind yourself that your investments WILL go down, but they will eventually go back up. You won’t get hurt on the rollercoaster if you just stay on!

Patience is Key

Building long-term wealth doesn’t happen overnight. You need to be patient and realize that compound interest works its magic when it has time.

Final Thoughts on Target Date Funds Pros and Cons

If you want to “set it and forget it “, consider target-date funds. The hands-off nature, broad market diversification, and low costs make Target Date Funds extremely attractive.

Much better than working with a high-cost broker that sells you products you don't need!

If you want to have a little more ownership, responsibility and get a lower expense ratio because of it, create and manage your own portfolio. You can even mirror the index fund investments in your favorite Target Date Fund if you don't mind the bond investments involved.

Just be sure to rebalance your portfolio at least once per year to ensure you're not out of whack. If you work with a partner like M1 Finance or blooom, they take care of it for you.

Since I fall into the money nerd category where I don't mind a bit more responsibility, I'll probably keep consistent with my non-Target Date Fund approach toward my Roth IRA investing and 401k investing.

Who knows? When you're managing your own retirement portfolio, you always have the option to change your mind.

What do you think are some other pros and cons of Target Date Funds? Is this a smart way to go for your retirement investing needs?

Please let us know in the comments below.