If you're fed up with your job, you may be considering early retirement. As a FIRE Movement fan, I like the idea of piling up assets like stocks and real estate and diversifying your income streams so you can retire early!

But realistically, that can take a whole lot of time and effort and for most of us, we won't be able to retire early. But what if there was a much easier way to get out of that job you don't like or that career path that's going nowhere?

Well, I think there is … and it's called FU Money!

What is FU Money?

FU Money is money stashed away in a savings account that allows you to say goodbye to a job you don’t like. By saving enough money, you can cover your expenses for a while.

It is essentially a bridge that helps you transition from a place of hardship and stress to a place of peace and prosperity. When you have enough money set aside, for a period of time of your choosing … you can say FU!.

(FU of course stands for “Forget U” job! Why? What were you thinking?!)

FU Money Examples

I’ll share a couple of personal FU Money examples and then another example that could potentially help with your situation.

My wife and I both used FU Money to transition into new careers and new lifestyles.

Become an Entrepreneur

A few years ago, I was a well-paid employee with great benefits, but I really didn’t enjoy the work. I had been in the corporate event marketing industry for 15 years and I was tired of it. My passion was gone and I wanted something else out of life.

To prepare for my leap out of my corporate career and into a life as an entrepreneur, we saved up $100,000 of FU Money in a savings account. This was WAY more than we needed to cover our family’s expenses. But it made me feel comfortable knowing that my family would be protected if things didn’t go as planned.

Two months after I let my employer know I was leaving my secure job, the pandemic came in and the whole world went sideways. My small business income plummeted! I lost solid client contracts, my advertising dollars decreased, and my hopes for a prosperous first full year as a business owner were crushed.

I was so glad I had my FU Money to help us during this crazy time. Not only did it help us take care of our family’s expenses for a few months while my business was right-sized, but it allowed me not to panic and jump back into my old career that I didn’t like.

Fast forward to today, I’m a six-figure business owner working 20 hours per week and I LOVE what I do for a living.

This would not have been possible without my FU Money!

Pursue a New Career Path

After years of doing the stay-at-home Mom thing, my wife Nicole was ready to go back to work. Checking emails at a desk and drinking coffee sounded like heaven compared to having no time to yourself at home with toddlers.

She started working in the advertising industry as an Office Manager and found the work to be enjoyable and not too overwhelming.

When the pandemic hit, everything seemed to change quickly. Her relaxing and manageable job became stressful and demanding.

She transitioned to another company in hopes it would be better, but it was more of the same. Nicole knew that this industry was not for her and she wanted to change career paths altogether.

For a long time, Nicole wanted to transition into a job where she could use her hands, get out of the email grind and truly help people. She had her heart set on becoming an esthetician.

That’s when our FU Money came in handy. Since we still had over $30,000 of FU Money left, we decided that we could use this money to help cover our expenses while Nicole went back to school for 6 months.

Nicole is now one week away from graduating as a licensed esthetician and is thrilled about her new career adventure!

Transition from a Double-Income Household to a Single-Income Household

Now, I’m going to share an example of a hypothetical situation I’ve come across over the years I’ve been coaching and interviewing couples where they’ve used FU Money to better their lives.

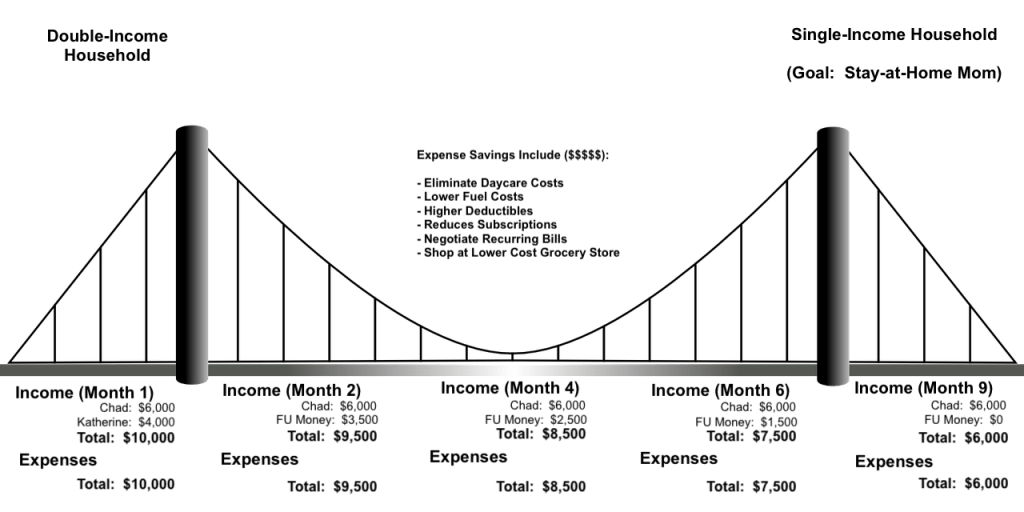

Let’s discuss a couple, Chad and Katherine, who wanted to transition from a double-income household to a single-income household.

Katherine wants to become a stay-at-home mom and raise her two small kids before they go off to school full-time. They decide that using FU Money will allow them to have a bridge out of Katherine’s corporate 9-to-5 job.

The couple is used to spending $10,000 per month to live their comfortable lives. Without Katherine’s income, they would only have $6,000 per month.

Jumping directly from a monthly budget of $10,000 per month to $6,000 per month would have been quite difficult for them. So instead, they decided together to use an FU Money bridge that would allow them to slowly but surely get used to living on less.

By saving up $18,000 in an FU Money Fund, they were able to utilize the funds as a bridge to become a single-income family.

FU Money Bridge

Each month, they would find ways to decrease their spending by $500.

In the beginning, it was easier because they found immediate savings by eliminating daycare costs. With less commuting to work, there were savings on gas. They found ways to save on their insurance by going with higher deductibles.

And as the months rolled on, they got more thrifty with grocery shopping and overall just paid more attention to where their money was going.

Over 9 months, they would be ready to live on the $6,000 per month. But during their time of transition, that FU Money helped ease them into their new lives. And Chad was able to increase his income over time as well.

In the end, Chad and Katherine were able to transition to a single income successfully. It was tough and required some partnership, but the plan worked.

How Much FU Money Do I Need?

The answer to how much FU Money you need is truly personal. It needs to be personalized based on how much your expenses are each month and your end goal.

This FU Money isn’t going to allow you to quit your job or stop working forever, but it could give you a much-needed break or the time you need to transition to a better life.

So let’s see how much time we can buy!

Calculate Your Monthly Expenses

First things first, you need to understand how much you’re spending, saving, giving, and investing each month. Find your monthly baseline number of comfortable spending.

For our family, that’s around $6,000 per month right now. We are mortgage free and we’ve hit Coast FIRE so we’re not contributing much to our retirement anymore so take that number with a grain of salt.

If you don’t know much you need to live a comfortable life today, I’d suggest using one of our best budget apps for families. They will help you get a better look at your financial situation.

Construct Your Family “Why”

After understanding your monthly expenses, it’s time to sit down with your partner and get clear on your current “family why”.

What is the reason you’re going on this financial adventure?

Why are you getting laser-focused on your finances?

A few reasons to consider for building up FU Money would be to:

- Take a much-needed unpaid sabbatical

- Transition from one industry to another (and go back to school)

- Leave a stressful higher paying job for a lower-paying less stressful job

- Ease into life as a small business owner

- Make time to raise a new child

With that “family why” nailed down, you’ll be ready to build up that FU Money. And when you’re thinking of giving up on your FU Money plans, you can always turn back to this “family why” as a reminder of why you’re doing what you’re doing.

Determine How Long You’ll Need FU Money

Let’s say your “family why” is to leave your job, go back to school and start work in a new industry.

The courses and classes will take you one year to complete if you go full-time. During that one year, your take-home pay would have been $50,000.

Instead of piling up money to retire early, you decide to grow your FU Money so you can change industries and find more joy in your work today. By saving around $2,000 per month for two years, you’ll have enough to cover your income for a full year.

Tuition, books, and materials are another cost you’ll need to think about as well – you could consider a 529 plan if that has extra funds in it.

Either way, a high-yield savings account with a partner like Ally can make your dreams of saying FU to a job you don’t like a reality.

Final Thoughts on FU Money

I enjoy the FIRE Movement, but retiring early through stock market investing, real estate investing, and small business ownership is difficult for most people in our country.

I’ll continue to support families as they grow their knowledge and assets in these areas. Having simpler tools to access your version of family financial independence is important too.

And that’s what FU Money is to me. FU Money allows someone to break free from the mindset that the only way I can get out of this toxic job is to retire early.

You don’t need to retire early. All you need is some cash that gives you a bridge out of something toxic to something better.

So if you’re feeling frustrated with your job or direction in life, give FU Money a try!

What do you think of FU Money? Are you on the FIRE Movement path and getting frustrated?

Please let me know in the comments below.

2 Comments

Is FU money separate from an emergency fund?

I believe it is separate from an Emergency Fund, but that can be up to you!