For those who are working to become mortgage-free, you might ask yourself if it makes sense to stop investing to pay off the mortgage faster. This can be a difficult decision to make.

That's where our friend Kevin is today. Here's his question:

“I’m really close to paying off the mortgage. I believe I can do it 6 months faster if I freeze my contributions to my 457 and add them to the mortgage to pay it off faster than resume normal contributions when done. What do you think?”

The benefits of a paid-off house can not only help you financially but emotionally as well. As a guy who paid off his mortgage almost 5 years ago, I know this joy firsthand.

Let’s discuss your question … Should you stop investing for your retirement to pay down your mortgage faster?

Instead of answering your question, I want to arm you with the information to answer this question for yourself.

That way, as you progress toward greater financial milestones like mortgage freedom and retirement, you’ll be able to adjust as things change and modify accordingly.

So here are some steps I want you to take.

Is Stopping Investing a Good Idea (If You Want to Pay Off Your Mortgage Faster)?

Calculate Your Total Retirement Balance

In order for me to say whether stopping your retirement contributions for a period of time is a good idea or a bad idea, it would be good to know where you stand financially.

Specifically, it would be good to know how much you’ve already saved up for your retirement needs. In your case, you mention a 457 plan which is similar to a 401k or 403b plan.

Outside of employer-sponsored plans, your retirement investments could also be in the form of an IRA as well. Our family is even using our Health Savings Account (HSA) with Lively as a retirement investment option as well.

Add all of these up and see where you stand.

Use a Compound Interest Calculator

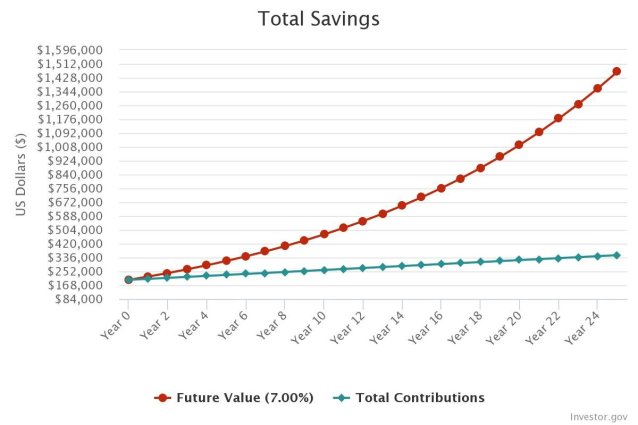

Let’s say you’ve totaled up your retirement investments thus far and you have $200,000 saved up. Since I don’t know your age, we’re going to pretend you’re 40 years old.

With this information, we can make a back-of-the-napkin guesstimate of how your investments will grow over the coming years.

If you continue to invest around $500 per month (again, since I don’t know how much you’re contributing, I’m going to make some guesses) and keep investing for 25 more years, you may have around $1.5 million by the time you’re 65.

This assumes a 7% interest rate which adjusts for inflation over the years.

Now, these numbers might not be your numbers! So use this compound interest calculator and insert your real numbers and see how it shakes out.

Use the 4% Rule

With the 4% rule, you can get a roundabout view of much much you can safely withdraw from your retirement portfolio each year to live on. This 4% rule is not an exact science, it’s a simplified way to see where you stand and how much potential retirement income you’d have.

So, if you have $1.5 million accumulated by 65 (again, this is adjusted for inflation), you’d be able to live on $60,000 per year.

$1.5 million X 4% = $60,000

If your compound interest calculation, gets you to $1 million by 65, then your potential annual retirement income would only be $40,000.

$500,000 by 65? That’ll net you $20,000 per year.

So, like with most things, the more you save, the more you’ll have in the long run.

Calculate Your Current Comfortable Lifestyle

All these calculations beg the question … well, how much do I need to live?

Great question!

While it’s difficult to predict what your needs and lifestyle will be like in retirement, it is easy to calculate how much you need now. So let’s start there.

If you don’t know how much you’re spending, I’d recommend getting a cheap or free budget app. These apps, make it easy to calculate how much you spend each month and help you to categorize that spending easily.

Maybe apps aren’t your thing. That’s fine. Use a spreadsheet and calculate it yourself by looking at your past credit card statements and bank statements.

Start with the big expenses like housing, transportation, and food, and then work down from there. Soon you’ll know how much you need to live your comfortable life currently.

As an example, my wife and I live comfortably on $60,000-$80,000 per year. This is without our mortgage by the way.

Could we dial things back if we need to? Sure, but we have the money now and this is comfortable for us.

Decide if Stopping is a Good Idea

With this information you’ve gathered, you’ll now be able to determine if stopping retirement investing to pay off the mortgage faster is a good idea or not.

Let’s recap our fictitous numbers (rounded):

- Current Retirement Investment Balance: $200,000

- Age: 40

- Target Retirement Age: 65

- Monthly Contributions: $500

- Interest Rate (factoring in inflation): 7%

- Total Retirement Balance at 65: $1.5 million

- Annual Retirement Income: $60,000 / year

Let’s say you have calculated your comfortable living expenses at $80,000 per year (and that’s with your mortgage principal and interest). And you’re starting to get a little worried because your retirement projections aren’t looking great.

Well, then you should calculate what your comfortable living expenses are without your mortgage principal and interest. Make sure to leave in your taxes and insurance because you’ll still need to pay those!

For our example, let’s say this takes you down to $70,000 of comfortable living expenses per year.

Still, even without your mortgage, your retirement numbers aren’t looking that solid.

To solve this, you would need to increase your monthly contributions or extend your retirement timeline to later than 65 years old. If that sounds difficult or unpleasant, then that’s a reason that you should NOT stop retirement investing … even for a period of time, to pay off your mortgage faster.

When Can I Stop Retirement Contributions?

These fictitious calculations and the final result may have taken the winds out of your sails with your mortgage freedom path. Don’t get me wrong, I love a paid-off house! But I love ensuring my retirement is safe and comfortable first.

So for that reason, let’s discuss when you can feel comfortable stopping your retirement contributions.

That’s a little lovely place I like to call Coast FIRE!

Coast FIRE is when you have enough invested in your retirement accounts that you can decide to drastically slow down or completely stop new contributions and still retire comfortably in your 60s.

When I’m talking about retirement accounts, I’m talking about your 401k, 403b, 457, IRA, and even your HSA. These accounts are focused on your future retirement needs.

I don’t know about you, but I don’t have a pension waiting for me, and my faith in social security being enough (or even around by the time I’m 60) is not strong.

So if you’re like me, it’s on us to create our own pension! That’s what Coast FIRE is to me. It’s my pension that I get access to in my 60s.

How to Know When You’ve Achieved Coast FIRE

Let’s do a roundabout example of how the math can work with Coast FIRE. I’ll use our situation.

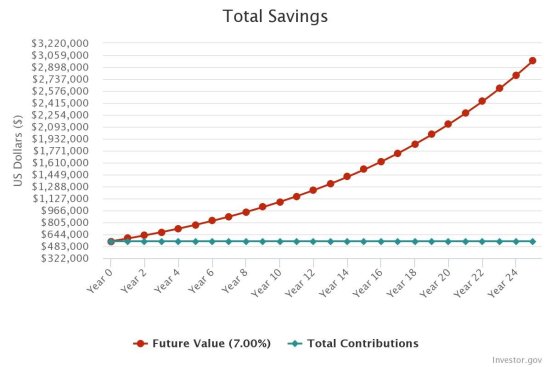

We have around $550,000 saved up for our retirement and we’re 40 years old.

If we simply let this account grow at a 7% annual growth rate (that’s the market average minus 3% for inflation), we could expect to have around $3,000,000 by the time we turn 65.

That’s without adding any more contributions to our account for 25 years!

If we use the 4% rule with our $3,000,000, we should be able to live on $120,000 per year. That’s MORE than enough for us to feel comfortable!

Given that, we’re not planning on adding much to our retirement accounts going forward.

I mean, why would we? For an even cushier retirement?

Nope! We want to enjoy more of our money today.

So if you find yourself in this position now or you’re projected to be Coast FIRE in the near future, then, I’d consider paying down low-interest debt like your mortgage.

Coast FIRE combined with Mortgage Freedom is a beautiful thing!

Final Thoughts on Stop Investing to Pay Off the Mortgage Faster

Remember that this Coast FIRE calculation isn’t perfect. It’s best to meet with a financial professional about your specific situation and ensure you’re on target.

But being armed with the concept of Coast FIRE for those meetings with a financial advisor might not be a bad idea. It’s good to know that you don’t need to save for retirement forever.

There is an end to investing for retirement. It’s not a permanent state.

So yes, meet with a professional, but also do the Coast FIRE calculations for yourself too.

Factoring in taxes and changes to inflation over time will be important. As the Consumer Price Index shows inflation growing higher and higher month after month, your calculations may need to adjust.

Do you think it’s okay to stop investing to pay off your mortgage faster? What do you think of being mortgage free or achieving Coast FIRE?

Please let me know in the comments below.