For the past year or so, I’ve been talking about the freedom that comes with achieving Coast FIRE.

This is when you accumulate so much in your retirement investment accounts that you can simply coast to your desired retirement income level without contributing anything more to your account.

When you’re not worried about additional retirement contributions, you can focus on other family and lifestyle priorities.

But with the market downturn as of late, is the idea of Coast FIRE still a possibility?

I thought I’d share some details on our family’s situation and maybe that will help you as you run the numbers too.

When We Achieved Coast FIRE

Last fall, I published some content about our family achieving Coast FIRE.

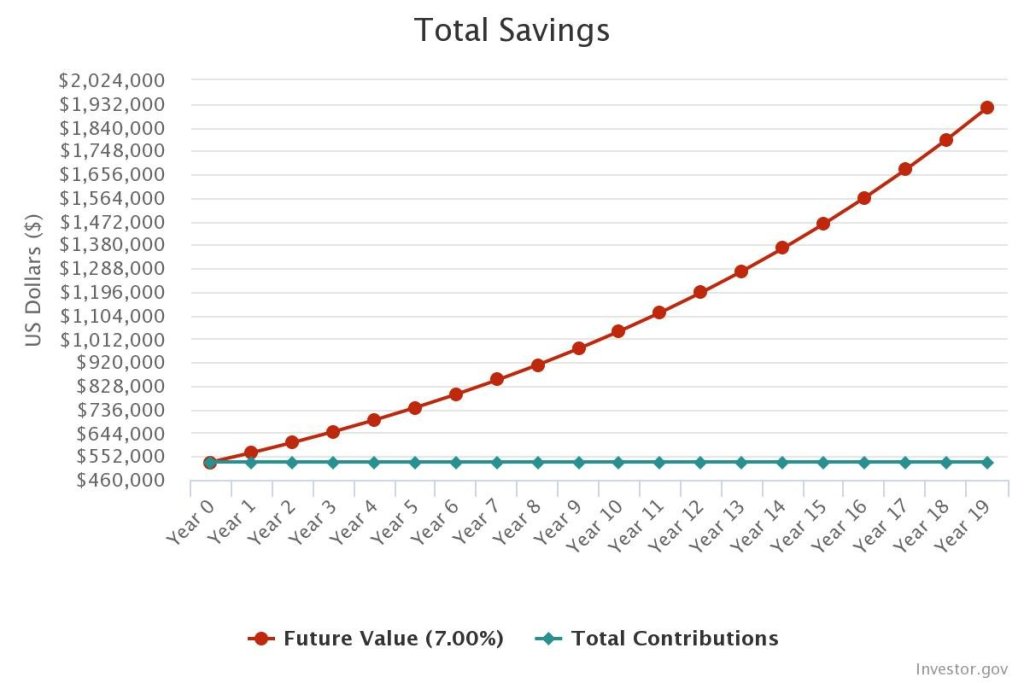

We had accumulated around $550,000 in retirement accounts – those are tax-advantaged accounts like the 401k, IRA and HSA.

At that point, if we didn’t contribute another dime to our retirement accounts, we could expect to have around $2.1 million by the time we retire at 60 years old. This assumes a 7% growth rate over 20 years' time since we are around 40 years old.

Using the 4% rule, our $2.1 million could provide us with $84,000 per year in income (adjusted for inflation).

Given that we live comfortably on around $70k-$80k per year now with two kids in tow, we felt very comfortable with taking our foot off the gas of retirement contributions.

Things got even better with our retirement account balances over the next few months as the year concluded. Looking back at our family net worth chart, we had around $600,000 accumulated by year-end 2021.

How our Coast FIRE Numbers Have Changed with the Downturn

Recently with the stock market going down significantly, our retirement investments have gone down significantly as well. Although we are diversified amongst different asset classes and even within asset classes, our portfolio has still taken a major beating.

Our retirement portfolio has gone from $600,000 in December 2021 to $530,000. That’s a $70,000 DROP in about 6 months!

Regarding our Coast FIRE calculation, not only have we lost $70,000 but we’ve lost almost a year as well.

Our projected retirement nest egg at 60 years old is now closer to $1.9 million instead of $2.1 million.

That makes our projected retirement income $76,000 instead of $84,000. It might not seem like a lot but we’ve now gone from “surplus” territory to “sufficient” territory.

How We’re Keeping Our Coast FIRE Dreams Alive

If the stock market continues to drop, our projections will continue to look even grimmer. To combat this grim future outlook, we’ll be doing the following to keep our Coast FIRE dreams alive.

Realizing This Market Volatility is Normal

I definitely love when the market continues to rise and rise year over year, but the reality is it can’t last forever.

The growth over the last decade has done amazing things for our family. We’ve become 30-something millionaires and achieved Coast FIRE at 40!

But long-term investing comes with its ups and downs. This is a down time.

Depending on how things go, we could see ourselves in a recession and a bear market. That’s an extended period of time of price declines that severely affect our portfolios.

The good news is that they are normal and the average length of a bear market is 289 days. On the other hand, bull markets average 991 days.

So if we hold and continue buying more shares (if we choose to), then our good market days will outweigh those bad market days by more than 3 times.

That’s where we get our average stock market return of 10%! If we stick with it and don’t sell, the positive days outweigh the bad ones.

Continuing to Contribute

While stopping retirement contributions completely sounds nice and relaxing, I will more than likely continue contributing to my Roth 401k. Additionally, we’ve been buying shares in our taxable brokerage accounts as well.

I have a mid-term goal of creating an account in my 50s that funds annual family vacations. I’ve been doing this with my new M1 Finance account for the past year and it continues to grow (despite the recent downturn). These continual contributions will allow us to buy less expensive shares during the downturn.

For example, when I started my M1 account in October, I bought a share of VNQ (which is a Vanguard Real Estate ETF) for $101. Now that same ETF is going for $98.

Another example is VTI – Vanguard’s Total Stock Market ETF – the price today is the same as the price it was in March 2021.

So essentially, we’re getting stock index fund and ETFs on sale!

Realizing We Won’t Need As Much Retirement Income

According to Investopedia, “Most experts say your retirement income should be about 80% of your final pre-retirement annual income. That means if you make $100,000 annually at retirement, you need at least $80,000 per year to have a comfortable lifestyle after leaving the workforce.”

So even though we’re living off of $70k-$80k now, we might not need all of that in the future.

Our kids will be out of the house, the college situation will be taken care of, no summer camp bills, soccer enrollment fees … more money for us.

Admitting There Will Be Some Type of Social Security For Us

According to GOBankingRates, by 2035 the number of Americans 65 and older will increase from about 56 million today to more than 78 million, putting a greater strain on social security.

With those additional costs, I believe it’s likely that the amount of money that we’re being told we’ll receive will end up being a lot lower.

I don’t think the program will go away completely. With so many Americans not ready for retirement, removing social security would be a major national disaster.

Given that, I do feel like we’ll get something, but maybe not the $30k-$40k we’re projected to receive as a couple.

If you’re wondering how much you’re projected to receive for social security, go to SSA.gov and check it out. This information could help you on your Coast FIRE journey.

Continuing to Control Our Expenses

With inflation high and the stock market low, it’s important for us to continue to analyze where our money is going.

We do this through Mint (as it’s one of our favorite budgeting tools). I categorize expenses through the Mint app every morning for about 5 minutes. My wife and I get together once a month for a larger budget party where we discuss what we spent last month, what our plans are for this month and how that aligns with our future goals.

This meeting helps us stay on top of where our money is going and if our spending patterns match up with our family plans.

To save some money lately, we switched our cell phone providers from Verizon to Tello Mobile and saved around $40 per month. This might not sound like a lot but close to $500 per year for pretty much the same service is a big deal when our income is a lot lower than it used to be.

Increasing our Income

For the next 6 months, while my wife is going back to school, I’m looking at ways to grow my income through my small business.

Diversifying and growing my income in the past has been my ticket to achieving major financial goals like becoming debt-free, mortgage-free, and achieving Coast FIRE.

Since I’m still fairly new to this entrepreneurship world, I’m still learning every day about how to grow my income more (without turning my platform into a constant sales engine). It’s a fine balance, but I’m working on it!

This past quarter, I was able to give myself a raise to $65,000 per year. If I continue to perform well and grow my small business revenue, I may just give myself another raise next quarter!

With those additional funds, we’ll be able to travel more, give more, have more fun, AND of course, invest more to ensure our Coast FIRE dreams stay alive and well.

Final Thoughts on Coast FIRE After This Market Downturn

In the end, the idea of Coast FIRE is one that our family enjoys very much. The freedom and flexibility that comes with never needing to make another contribution to your retirement is so relaxing to me.

For a couple in their late 30’s / early 40’s, it’s incumbent on us to make our pension. That’s what Coast FIRE is to us.

As long-term investors, I believe we’ll be just fine over the next 20 years as we make our way to retirement. Continuing to buy and hold will be our plan. And I believe it’ll pay off in the long run.

What do you think about the concept of Coast FIRE in the midst of a bear market?

Are you working toward this goal?

Please let us know in the comments below.