Coast FIRE is when you’ve saved up enough in traditional retirement accounts that you can simply coast to retirement without any further contributions.

I love this concept because it allows you to metaphorically check another box on your family financial independence path. It allows you to relax more when it comes to your overall financial life.

For example, when you have a 3-6 month Emergency Fund, you worry less knowing that your family is taken care of and you don’t have to go into debt to pay for the emergency. That financial relaxation box is checked!

Coast FIRE is the same thing!

Once you achieve it, you have the ability to rest easy knowing that you’ve built your own pension and you’ll be ready to retire in your 60s. Another financial worry is eliminated!

To help you find this “financial worry eliminator” faster, I thought I’d provide a quick reference guide for you. This guide will help you check how to reach coast fire by age 30, age 40, and age 50.

Are these numbers perfectly accurate? No.

Is it better to work with a financial retirement professional who knows your situation best? YES!

But if you’re looking for some financial entertainment to help you get motivated in a positive direction then stick with me here.

Coast FIRE by Age: Data

For this fun math experiment, I’m going to keep the following information constant through each example:

- Growth Rate: 6% (average annual growth rate of an 80% stock and 20% bond portfolio with dividends reinvested minus average annual inflation) – again, this is a guesstimate, use different numbers if you’d like

- Investment Vehicles: Tax-advantaged retirement accounts (preferably after-tax) like the 401k, Roth IRA and even the HSA. A taxable brokerage account works too.

- Traditional Retirement Age: 62

- Coast FIRE Number: $2,125,000

- Comfortable Living Expenses in Retirement: $85,000

This $85,000 comes from the Bureau of Labor and Statistics which shows the average American spent around $72,967 on household expenses in 2022. I rounded up to $85,000 so we have a nice comfortable number.

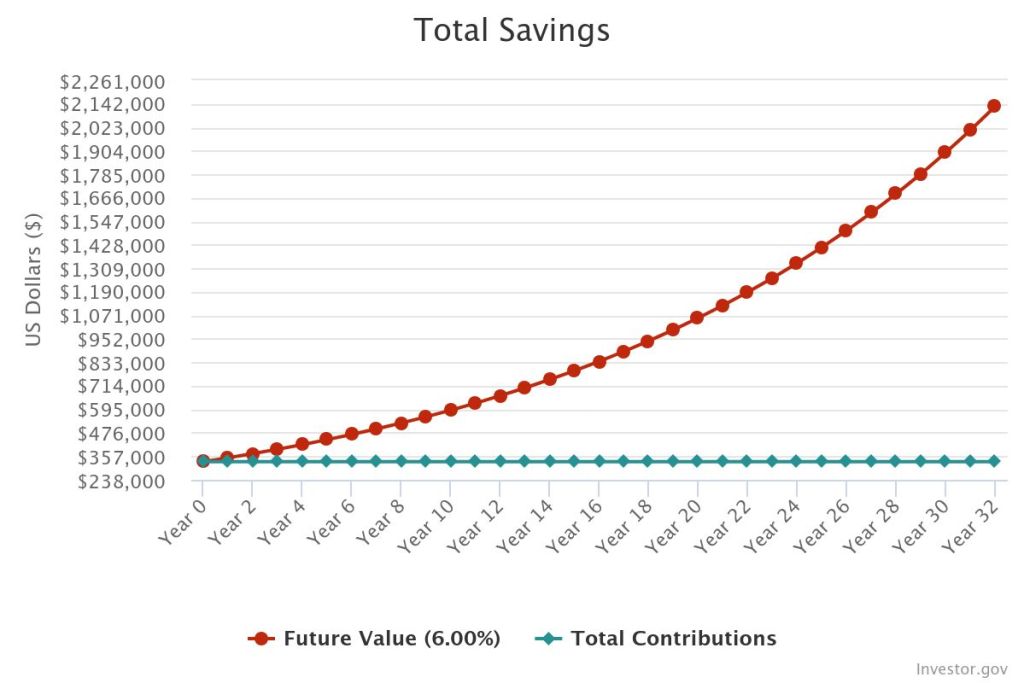

Coast FIRE by Age 30: $330,000 Invested

For Coast FIRE to work for a 30-year-old, you need to get started investing early. I think about some 20-somethings, teens or even pre-teens like I’ve interviewed that have started their investing journey already.

- Award-winning financial literacy creator Rishi Vamdatt started investing at 7 years old after putting away half of his birthday money each year in index funds.

- By starting to build wealth in her teens, author and successful business owner Tori Dunlap was able to save and invest $100,000 by age 25!

- And AJ Thompson, a military service member, started investing in his 20’s and reached $400k invested by 31

All of these individuals invested early and consistently. These folks will undoubtedly hit Coast FIRE.

So let’s talk about that general number to hit if you want Coast FIRE in your life at age 30. If you can save and invest $330,000 by age 30, you’re Coast FIRE!

At this point, you could choose to stop or drastically slow down your contributions and can reach $2,125,000 by age 62.

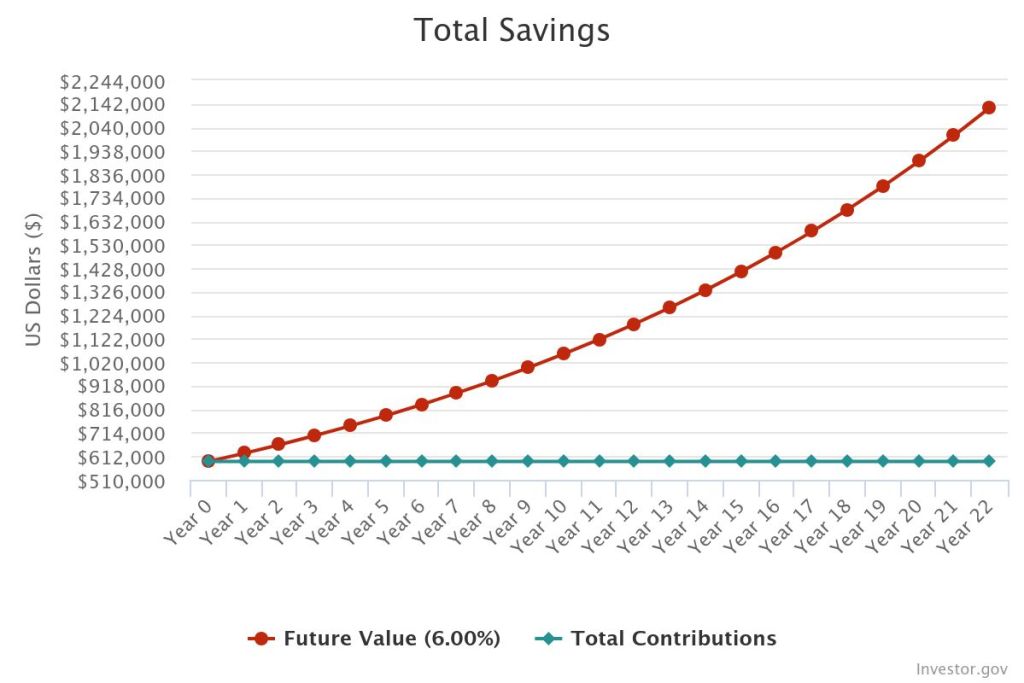

Coast FIRE by Age 40: $590,000 Invested

To achieve Coast FIRE by 40 years old, investing consistently in your 20’s and 30’s is crucial. If you’re traditionally employed (like I was), utilizing a workplace 401k and a Roth IRA can be a smart way to invest for Coast FIRE.

These investment choices helped our family achieve Coast FIRE by 40 years old.

If you are able to have $590,000 invested by age 40, you’re Coast FIRE!

Again, this assumes your comfortable living expenses now (and in the future) are around $85,000 per year. This is adjusted for inflation. So assume your $85,000 would be the same in 22 years when you retire.

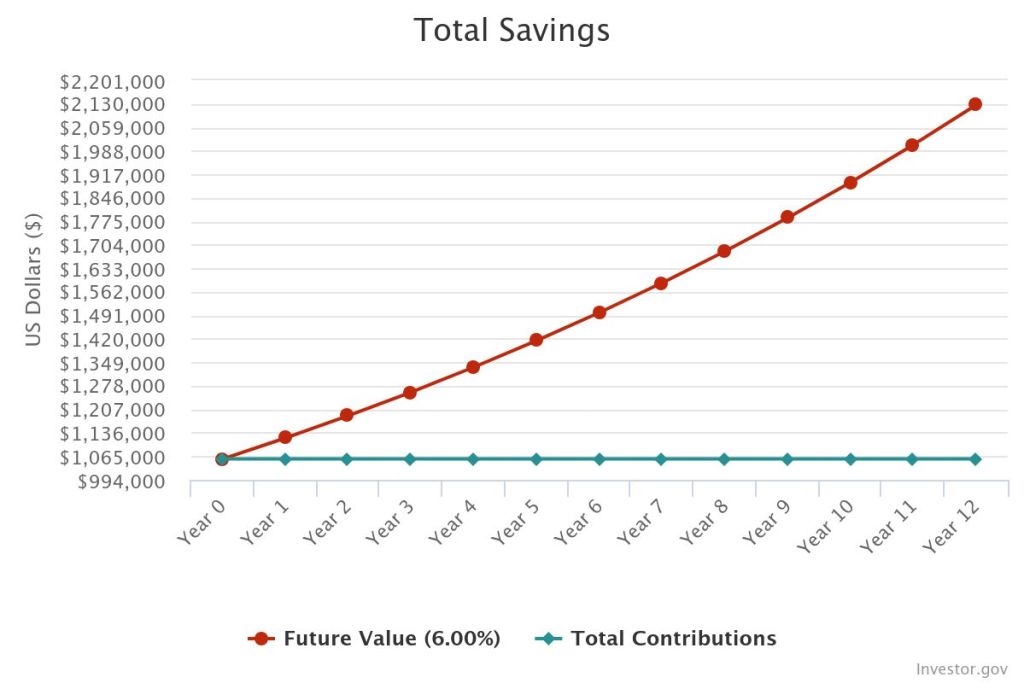

Coast FIRE by Age 50: $1,057,000 Invested

Hitting Coast FIRE by 50 may just allow you to decrease your working hours. This could allow you to ease into retirement and feel so ready to stop working altogether.

After all, having some work in your 60s and beyond can be great for your health. A study published by BMC Public Health found that people who worked in lower-stress positions in their traditional retirement years had improved mental and physical health.

So if you are able to have $1,057,000 invested by age 50, you’re Coast FIRE!

That $1,057,000 could grow to $2,125,000 by the time you’re 62 years old without any further contributions. Of course, you can choose to contribute to your accounts, but maybe you decrease your savings percentage so you can enjoy more of your money.

After all, life is for living. And I know when I’m in my 50’s, I’m going to make sure I’m having fun and making memories with the people I love.

Coast FIRE by Age 30-56

For fun, let’s add the ages between 30 and 56 so people can see how they are tracking on their Coast FIRE journey. After all, you might be right in the middle of one of these decade milestones and be eager to jump on this Coast FIRE goal!

If you don’t agree with these numbers or calculations, I totally understand! Personal finance is personal and what you deem as too conservative or too aggressive may rub you the wrong way. I get it!

The goal of this content is to get you thinking more about your situation and how you can achieve Coast FIRE. Check out our free Coast FIRE Calculator here to get started!

I encourage you to work through the numbers yourself. Or better yet, meet with a certified financial planner professional who knows your situation best. Find an advice-only financial advisor that will act in your best interest and help you achieve your retirement goals.

If you're not investing yet, a great place to start is with a Roth IRA. Here are step-by-step details on how to start a Roth IRA with Vanguard.

What do you think about these Coast FIRE by Age calculations? Does this help you think more about how Coast FIRE could be a goal for you?

Please let us know in the comments below.

2 Comments

Really interesting to think about! I learned about the FIRE movement at 25 and started saving aggressively and got my now husband on board – at 31 I’m so glad that I did!! Are these numbers based on a couple or individual? I’m guessing it is a household because a couple spending $75k each would be really spendy!

I think we’ve reached coast FIRE already, but we’d like to retire around 50 vs 62 – where can I access this calculator to change up the numbers?

Hi Jess! Yes, this is for a couple. I’m working on a calculator right now! I’ll include it on the site soon.