One of our favorite wealth-building hacks is automation. We set up a process, put it on autopilot, and watch our net worth grow.

There have been a variety of automation strategies we’ve learned over our decade of marriage. Those strategies have helped us to do incredible things like become debt-free, mortgage-free, and millionaires all in just 10 years.

Our higher-than-average income during that timeframe helped (around $190,000 per year). However, it was automating our finances that made the wealth-building process much easier.

Here are five financial milestones we’ve hit as a family by automating our finances.

Becoming Debt Free by Eliminating $50,000 of Debt (Age 29)

At the beginning of our marriage, Nicole had a $20,000 car loan and I had $30,000 of student debt. We wanted to clean up all this debt before our daughter was born.

That’s when we put automation to work.

We calculated how much extra we’d need to pay for each debt (starting with my student loans due to the higher interest rate). With that info, we set a recurring extra debt payment.

If we had more (or less) to throw at our debts each month, we’d adjust the recurring payment accordingly. We felt comfortable knowing that no matter what, our balances were going down automatically.

After 12 months of living on half of our income, budgeting out each of our months, and letting automation do its thing, we became debt-free!

Saving for a Home Down Payment of $150,000 (Age 32)

After living in my bachelor pad for a few years, Nicole was ready to move and get a “real family home.” My beer bottle decor was cool in my bachelor pad, but perhaps it needed a refresh.

I had a horrific time with the mortgage process with my first home. Putting less than 20% down on the property made me feel like the home owned me instead of the other way around. I didn’t want to repeat that.

By setting up a recurring monthly deposit into our high-yield savings account, our down payment for our “real family home” grew during the years that followed our initial debt freedom.

Automating our finances helped us save up a huge 45% down payment on our new $350,000 home. This gave us a $195,000 mortgage and reasonable monthly payments.

I enjoyed this version of homeownership more than my first round (even without the beer bottle decor).

Paying Off Our Mortgage in Less Than 5 Years (Age 35)

Since living on half our income and automating the wealth-building process worked so well for us, we decided to keep it going. Our next big (and crazy) goal was to pay off our mortgage early. With no mortgage, we’d have more money to invest for the future, give back in our community, and spend on vacations!

Each month, we’d pay our regular mortgage payments automatically and add a set amount of additional principal payments. This automatic habit helped to chip away at our mortgage month after month.

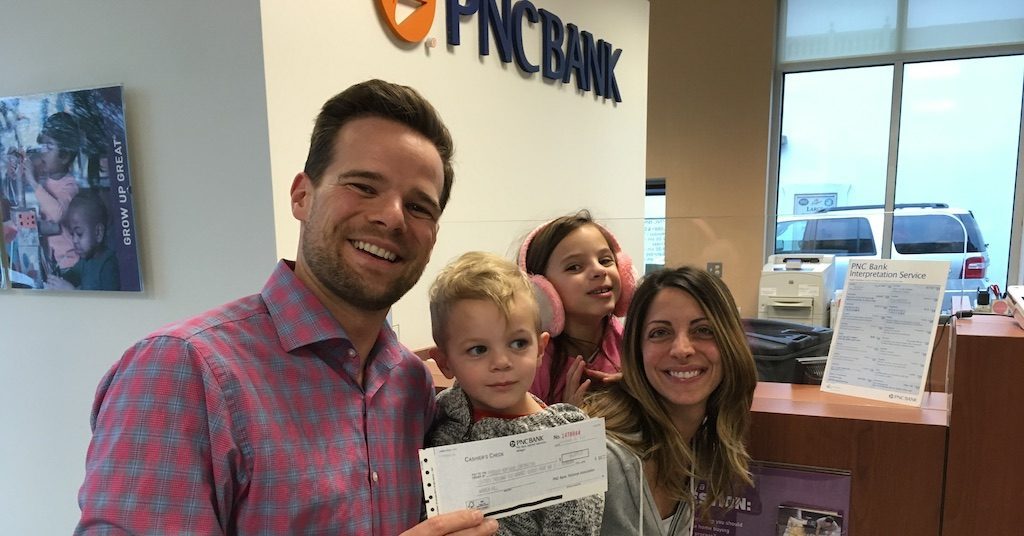

Eventually, our mortgage balance hit $0! We became mortgage-free at 35 years old and were ready for our next big challenge.

Becoming Millionaires (Age 38)

When we were working on our first three millionaire milestones, we were also investing for our retirement in the stock market. Our 401ks and IRAs helped us build a comfortable nest egg and save on taxes.

We discovered the power of index funds with their low costs, broad diversification, and self-cleansing ability that weeds out the poor performing companies. JL Collins taught me a lot about that!

Once we picked our funds and a proper asset allocation, we set up our automation, maxed out our contributions, and let them ride. During the period from 2013 through 2020, my 401k balance grew from $0 to almost $200,000! That’s the power of automation, compound interest and patience.

Between our paid-off home, our savings, and investments, we achieved a million-dollar net worth by age 38.

Achieving Coast FIRE Status (Age 40)

During this process, I discovered a term called “Coast FIRE.” Essentially, it refers to the point when you can stop investing for your retirement because time and compound interest can get you to your desired nest egg without any more contributions.

When I discovered this incredible concept, I decided to calculate if automation, time and compound interest had helped us achieve Coast FIRE already.

Our current retirement investment balance is $650,000. If we let that ride in the stock market making a conservative 7% interest until we reach 65 years old, we’ll have around $2.9 million.

Using a 4% safe withdrawal rate, we should be able to live on around $115,000 per year. Given that we currently live on $80k-$90k per year comfortably, this should be plenty.

If you’re interested in doing this calculation for yourself, check out our free Coast FIRE Calculator and see what your nest egg will look like by the time you retire.

Other Ways Automating Your Finances Can Help You Build and Protect Wealth

Automation doesn’t only help you build wealth, it can also protect your wealth. If we’re not careful with our money, life may just happen to our money.

Here are a few more ways automation can do wonders for your financial life.

Budgeting

When you create a budget, you’re telling your money what to do. If you use an automated financial tool like Monarch Money, you can sync up your bank account, track your spending and monitor your net worth all through automation.

Monitoring Your Credit

I like to set an annual calendar reminder on my phone that tells me to review my credit report on AnnualCreditReport.com. This ensures there are no fraudulent accounts on my credit report and the debts I’ve paid off show that they are paid in full.

Automatic Bill Payment

Setting your credit card bills, utility bills, and any other recurring monthly bills to auto-pay is a smart way to avoid late payments and fees.

We all have to make so many decisions in the day. Ensuring your bills are paid on time and in full can be something we don’t even have to think about if we use a little automation.

Final Thoughts on Automating Our Finances

Automation makes managing money easier. We have so many other things to worry about when it comes to marriage and kids. Let automation be your partner and see how much easier it is to achieve your goals.

An excellent place to start automating your finances is with your family budget! Check out our best budget apps for families and see which fits best to help you hit your millionaire milestones.

Are you automating your finances? Which strategy has worked best for you?

Please let us know in the comments below.