You know that building a budget is important, but it can be overwhelming knowing where to start. Things can feel even more complicated when you’re managing money as a couple. That’s why you need our best budget apps for couples list!

We break down the best features of some of the most popular budgeting apps. Specifically, we will share what makes them user-friendly and intuitive for couples. After you’ve reviewed the best of the best, you can decide which budgeting app might be right for you.

Best Budget Apps for Couples

Need to get on the same page as your partner financially? Looking to crush your money goals together? Ready to move on to the next money win? We rounded up the top options to create our best budget apps for couples list.

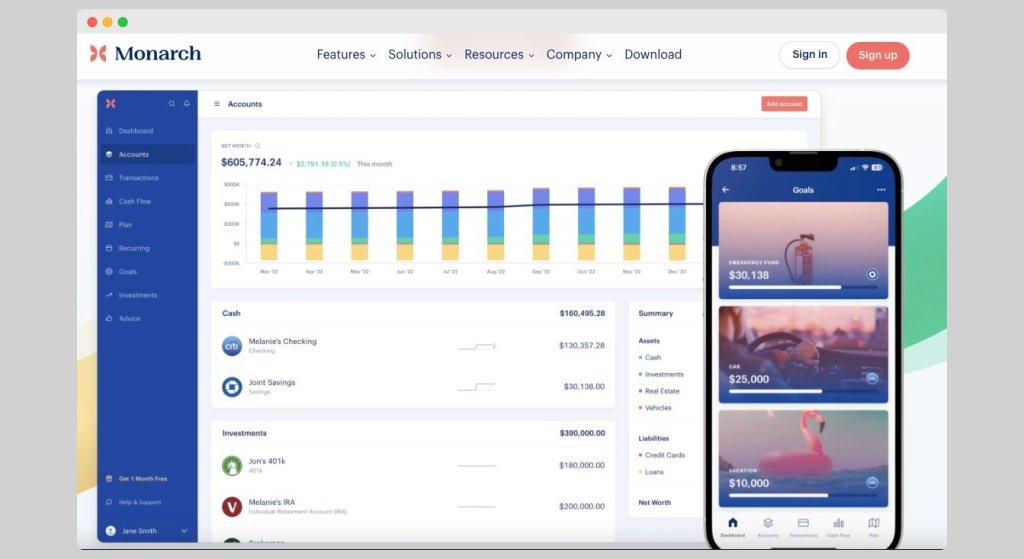

Monarch

Monarch Money flew onto the finance scene in 2018 and has grown steadily ever since. That’s because Monarch Money is so much more than a budgeting tool. Users can track spending, identify recurring expenses, and set financial goals. You can also calculate your net worth and get accurate financial advice.

One aspect that users really like is how powerful a single subscription is. There is one cost to use the platform whether you are using it yourself, as a couple, or even with other household members (sandwich generation folks, we see you!).

Best Features

There are plenty of reasons to love Monarch. Some of the top Monarch features include:

- A personalized dashboard tailored to your goals

- Household member add-ons

- An ad-free experience

- Bank-grade safety and security features

Areas for Improvement

For all its perks, there are a few minor issues with Monarch. Despite a robust dashboard, Monarch currently does not allow users to monitor their credit scores.

Additionally, it currently only works with Coinbase as a cryptocurrency exchange. Neither of these areas for improvement is enough to move the platform from a top spot on our couples budget app list. But they are worth considering if credit scores and crypto figure heavily in your financial planning.

For more information, check out our detailed Monarch Money Review.

How Monarch Works for Couples

Monarch allows users to invite a partner to view their finances. Partners receive separate log-ins and can contribute to shared space if invited to do so. This also works for financial advisors!

Cost

$99.99/year or $14.99/month – both include unlimited household collaborators (with discounts sometimes available)

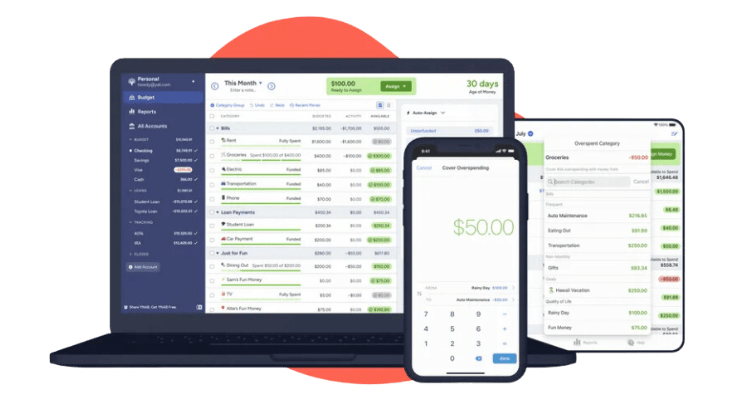

YNAB

If you’re interested in budget apps, you have to take a look at YNAB. One of the OGs in the personal finance space, YNAB–otherwise known as You Need a Budget–has been around for more than 20 years. While some standard features in YNAB are common among most budgeting apps, a few really set it apart from the rest.

Best Features

Hands down, the best part of YNAB is how it helps people think about their money. YNAB suggests that users follow four rules:

- Give every dollar a job.

- Embrace your true expenses.

- Plan for the unexpected.

- Consider the age of your money.

This unique perspective gets at more than just finances–it helps people understand their financial behaviors, impulses, and instincts.

YNAB provides custom spending and net worth reports, in addition to allowing you to set spending and savings goals.

Of course, they wouldn’t make our list of best budget apps for couples if they didn’t let you mingle your money. YNAB Together is actually a dedicated portion of their platform specifically designed to help couples win with money together.

Areas for Improvement

The biggest reason people shy away from YNAB is that there is a learning curve–and even YNAB admits it! The YNAB rules require a mindset shift, so it makes sense that learning how to use their budgeting tool might not come naturally. But if you ask any long-time user if the extra mental muscle is worth it, they will undoubtedly say yes.

Another sore spot is the fact that YNAB is pretty pricey. We think that they deliver a valuable product, but we also know that a lot of budgets have Thrifty as a middle name. If shelling out for an app isn’t your thing, this might not be the tool for you.

For more information, check out our detailed YNAB Review.

How YNAB Works for Couples

YNAB has a special feature called YNAB Together. Within YNAB Together, you can share a subscription with up to five household members to manage your money together. All members have their own log-ins.

Cost

$109/year or $14.99/month – includes up to five additional people on your YNAB Together team for no extra cost

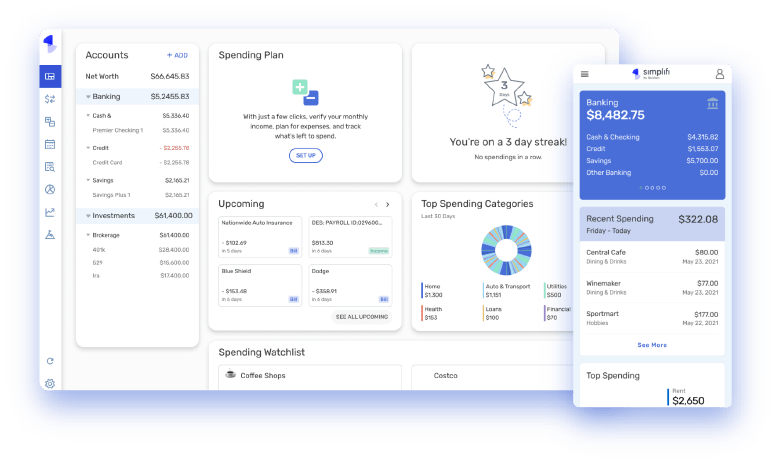

Simplifi by Quicken

Do you want a simple budget solution? Simplifi offers just that! This tool is designed by the same folks who put together Quicken, one of the most well-known personal finance management systems.

Best Features

If you’re already familiar with Quicken, then the user interface for Simplifi will feel intuitive. Other things we love about Simplifi include:

- Automatic account tracking

- Real-time alerts

- Personalized money goals

- Shared access to account information

- Projected cash flow for estimates of future growth

Areas for Improvement

In addition to holding out hope for them to offer free trials, one other thing we’d like to see Simplifi do is offer credit score monitoring. Credit scores don’t directly impact your budget. Still, it can be a useful financial metric that many people look to measure.

For more information, check out our detailed Simplifi Review.

How Simplifi Works for Couples

Once you set up your Simplifi account, you can invite a member to join you. They will receive an email with directions to set up their own log-in and password. Then, you can tackle your finances together!

Cost

$5.99 per month (with discounts sometimes available)

Copilot

Copilot is a new addition to the world of budgeting apps. Even though it hasn't been around long, people are taking notice. Recently, it ranked as a 2023 Finalist in the App Store Awards. Let's learn more about this up-and-coming app!

Best Features

Copilot works using your existing financial data. It attempts to understand your financial behaviors and then build a budget based on your current spending habits.

In addition to this innovative approach to budgeting, users also really like the following Copilot features:

- Intuitive interface

- Practical approach to budgeting

- Responsive development team

- Ability to re-categorize transactions

Areas for Improvement

Currently, Copilot does not allow users to input financial goals. While some of those goals might be implied in your spending patterns, we think there is value in explicitly identifying them … especially if you're trying to get on the same financial page as your partner!

How Copilot Works for Couples

Couples can create a password for their partner to use to sign into Copilot together.

Cost

$95/year or $13/month if billed monthly

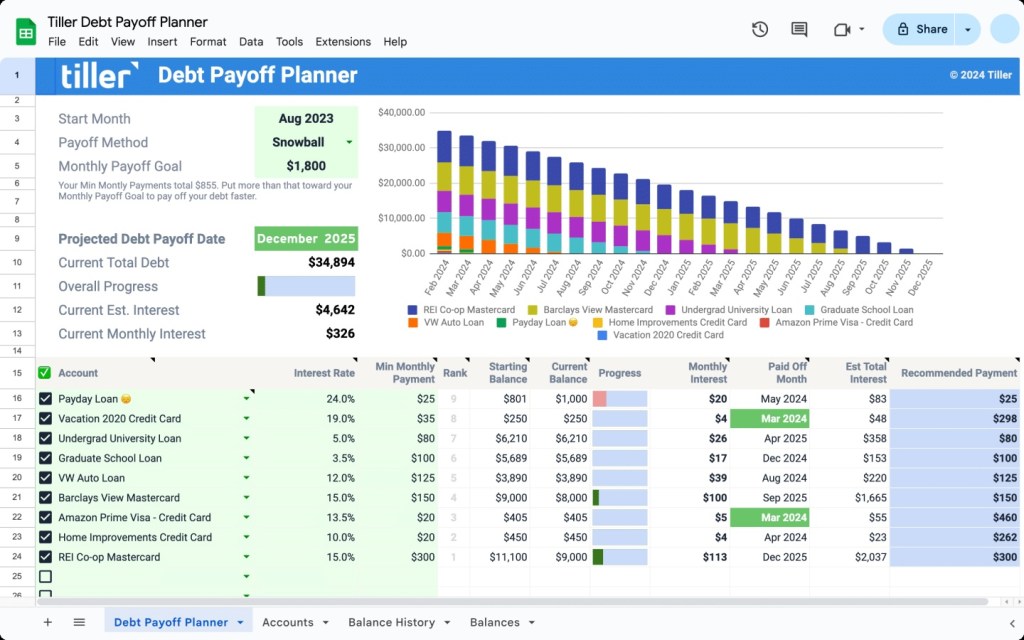

Tiller

Are you looking to get a handle on your income, expenses, and account balances? Do you love spreadsheets? Then Tiller is absolutely the app for you. Whether you live in Excel or Google Sheets, Tiller has you covered. You can make your budget spreadsheet as simple or as sophisticated as you like.

Best Features

Since Tiller is spreadsheet-based, the features might surprise you. Some things we love about Tiller include:

- Zero advertising

- Various budget dashboards

- Automated data imports

- Customized automatic transactions

- Tailored budget templates

Areas for Improvement

The biggest area of improvement for Tiller is that it only works from a desktop or laptop. There is no mobile app. However, if you use Google Sheets, you can access your budget through their app.

Still, this is a big drawback for people who are looking for the convenience of quick financial check-ins from their phones.

For more information, check out our detailed Tiller Review.

How Tiller Works for Couples

Tiller works a bit differently than other budgeting apps when it comes to managing your finances together. Since Tiller creates budgets in either Google Sheets or Microsoft Excel, Tiller does not create a separate account for your partner. Instead, you can share the budget directly with them, giving them viewing or editing ability.

Cost

$12.95 per month or $79 per year

Lunch Money

Lunch Money is a personal finance and budgeting app that works well for singletons and partners. In fact, it promises to address the needs of the money spender, and we believe it really does. Whether you work a traditional 9-to-5 collecting a regular paycheck or live as a digital nomad with a variable income, Lunch Money has features to meet your needs.

Best Features

Lunch Money rounded up a lot of the issues that other budget apps have and proactively addressed them.

Some of our favorite Lunch Money features include:

- Tracking expenses across multiple currencies

- Incorporating cryptocurrency wallets and ledgers

- Streamlined net worth calculator

- Query tool to offer insights and feedback on your finances

- Stats and tools to offer a broad financial picture and identify patterns in your spending and saving

- Collaboration features to share budgets with a partner or a whole team

Areas for Improvement

The biggest area for improvement isn't really something that needs to be made better–it just isn't offered. Lunch Money is a web-first platform. As a result, there is no mobile app for Lunch Money. That decision was deliberate. Lunch Money believes that budgeting is a big-screen activity (and we agree!).

However, we also understand that some people prefer a mobile app. If that's the case, you will want to look elsewhere.

How Lunch Money Works for Couples

Lunch Money allows users to manage their money jointly or as a team. Every collaborator has their own log-in and password at no additional cost.

Cost

$10 per month or yearly subscriptions starting at $40

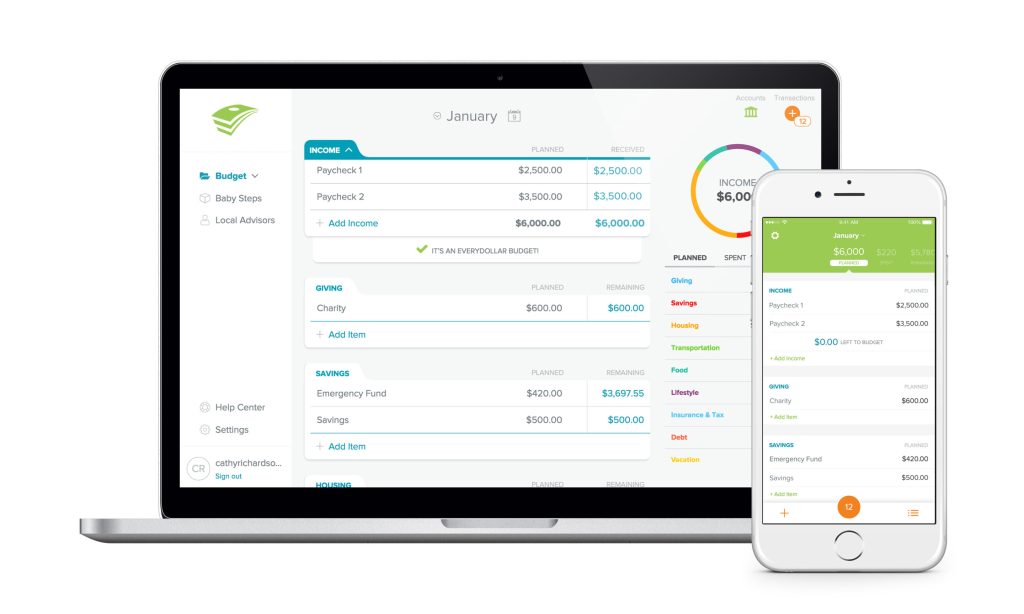

EveryDollar

If you or your partner are familiar with Dave Ramsey, you might have already heard about EveryDollar. This app is part of Ramsey Solutions and integrates his Baby Steps approach to money management.

Best Features

The biggest draw to EveryDollar is that it feels intuitive for Ramsey followers. They understand and apply his methodology. So seeing it used in a budgeting app makes a lot of sense to them.

Other great features of EveryDollar include:

- Budget category customization

- Split transactions

- Personalized savings goals

- Due date reminders

- Access across multiple devices

- Debt payoff trackers (premium version)

Areas for Improvement

The first thing you will want to note about this app is that the free version requires you to manually input all of your transactions. If you are looking to simplify the process of getting on the same page financially, automatic transactions are usually more effective.

You also want to note that even with the paid version, you can’t track your credit score. Additionally, monitoring your investments is extremely limited. EveryDollar is best viewed as a budgeting tool, not an all-in-one financial app.

Also, given that the Ramsey crew is fairly anti-credit card, you'll find the app isn't the most intuitive if you use a credit card.

How EveryDollar Works for Couples

To use EveryDollar jointly, you can sign into the same account on different devices.

Cost

Free or $17.99/month or $79.99/year

Best Budget Apps for Couples: Other Budget Apps to Consider

In addition to the powerhouse budget app options detailed above, there are other best budget apps for couples for you to consider. While these apps might not have the fan base of those listed above, they are worth a look!

Empower

Formerly known as Personal Capital, Empower is a financial powerhouse. This platform is designed to be so much more than a budgeting tool. In fact, budgeting plays a fairly small role in its overall offerings.

Financial independence enthusiasts quickly adopted the platform to calculate their progress toward early retirement. Its cult following quickly turned mainstream once people started to understand all the features Empower offers its users for free.

For more information, check out our detailed Empower Review.

Cost: Free! Be prepared for a sales pitch phone call once you have more than $100,000 in management, though.

HoneyDue

HoneyDue came onto the scene as a solid answer to couples’ finances. The idea behind the platform is that each couple can determine how much of their finances they would like to combine. Then, HoneyDue helps you manage your money together.

To jumpstart your money conversations, HoneyDue actually allows you to react to transactions. Additionally, there is a chat feature so you can talk money with your partner anytime.

However, you do want to note that the biggest criticism of the tool is that it could use some updates. The HoneyDue team maintains radio silence on if or when this will happen.

If you are looking for a free tool, check this out. Just know that as other apps evolve, this one hasn’t.

Cost: Free

Credit Karma / Mint

Are you a former Mint user? The beloved budgeting app shuttered in January 2024. However, Credit Karma actually integrated many of Mint’s budgeting features. Since both Credit Karma and Mint have the same parent company, it makes sense that former Mint users would be able to transfer their data fairly easily.

You can log onto Credit Karma to find easy steps to transfer your data. Once you move your Mint data, you can check out these features:

- Review your expenses

- See all of your synced account balances

- Track your net worth

- Analyze your cash flow

- Identify areas to save money

And like Mint, Credit Karma is also free to use.

Of course, you want to note that Credit Karma is not Mint. It won’t do everything Mint used to do. Additionally, some features like net worth tracking, aren’t widely available yet.

Personally, we think there are probably more robust options in the best budget apps for couples list. Still, if you used to use Mint, you might want to check this out!

Cost: Free

GoodBudget

GoodBudget takes the cash envelope system into the digital world. That means that each month, you set aside a portion of your income for spending. Then, you assign different amounts of money to each spending category.

As you spend throughout the month, deductions are made from your digital envelopes. By tying these cash envelope budgets to your income, you can tackle the problem of overspending once and for all.

GoodBudget also allows you to sync with another person. If you’re coupled up–and we assume you are since you’re looking for a top couples app!–this makes it easy to manage your money together.

Cost: Free; $8/month or $70/year for their unlimited plan

Rocket Money

Rocket Money is definitely a budget app worth exploring. That’s because it has features that other apps don’t.

Rocket Money pledges to help you manage your subscriptions. Even if you signed up years ago and forgot all about them, your subscriptions can’t hide from this tool. Additionally, Rocket Money offers a concierge service that is willing to cancel those unwanted subscriptions for you.

Another tool that Rocket Money features is the bill negotiation tool. Then, their team of negotiators will lock in the best possible rates for you.

In addition to these features, Rocket Money comes with standard budget app options to see your net worth, manage your spending, set goals, and review your credit score.

Cost: Free; Premium Membership offered on a sliding scale of $4-$12/month

Qube

Like GoodBudget, Qube relies on a cash envelope system. Instead of stuffing envelopes into your wallet or handbag, the envelopes are digitized.

As an added bonus, these envelopes are linked to your Qube card. That makes this budgeting tool a strong contender for people who want to streamline their banking system.

If you start managing your money as a couple and find that your family is growing, you can also add kids to this platform. Though you do have to upgrade your account, families appreciate the fact that there is a parent view and up to five authorized users can join the account.

Cost: Free; Couples plan costs $9/month or $108/year and Family plan costs $19/month or $180/year.

Best Budget Apps for Couples Frequently Asked Questions (FAQ)

You know that effectively managing your money together is an important part of keeping your relationship healthy. But it doesn’t always come naturally to couples. As a result, you might have some questions about the best approach to managing your money with your partner.

Check out our best budget apps for couples FAQ to see what other couples are wondering about–and the answers to some of the toughest money questions!

What is the best way to track spending as a couple?

The best way to track spending as a couple is to find a system that works for you! We can definitely recommend many best budget apps for couples. But if the app doesn’t fit your style or your goals, then it’s not right for you.

Get on the same page with your goals. Before you do anything specific to your spending, make sure you and your partner are clear on what you hope to achieve. Do you want to pay down debt? Are you saving up for a big-ticket item? Is there a down payment in your future? Would you like to retire early?

Uncover what motivates you and then use that as a framework to track your spending. Then, when you do start to track your spending, you will be clear on your purpose. Too often, people abandon tracking their money quickly since it feels restrictive and even judgemental. However, if you look at it as a way to make sure your spending aligns with your values, you might feel very different about it!

Now that you’re clear on what you’re looking for, you want to commit to tracking your spending regularly. Of course, there is some trial and error involved when it comes to the best budget apps for couples. Different couples look for different things. Still, for consistency’s sake, stick with your tracking method for at least one month to see if it meets your needs.

Finally, review your spending regularly. In addition to having monthly budget dates, you should also monitor your spending throughout the month. That way, you’ll know if you’re having an exceptionally expensive month before your budget is busted.

You can do these quick reviews in a variety of ways. If you use one of our best budget apps for couples, it’s as simple as opening the app and reviewing your transactions. You could also log into your different credit card and banking accounts to see how much you’ve swiped so far. Traditionalists can check spending logs, checkbook registers, or spreadsheets. No matter what you do, get your eyes on your spending for a few minutes every week. Then, if something looks off, you can solve the problem together!

What can I do if my partner doesn’t want to budget?

Money is a top-cited cause for conflict in relationships. Don’t let money fights break out over budgeting.

Very often, when one partner is resisting the idea of budgeting it’s because too much emphasis is being placed on the budget itself. A budget is merely a spending plan. It is an opportunity for you and your partner to tell your money where you do and don’t want it to go.

Before you build a budget, get clear on your goals together. Identify long-term, mid-range, and short-term goals. Then, weave those categories into your budget.

That way, you are now looking at a spending plan that builds pathways to get to things you’re excited about. Maybe you have one line dedicated to a winter vacation and another for debt repayment. If your budget matches your goals and priorities, your partner is much more likely to be excited about budgeting.

My spouse’s spending is out of control. What can I do?

There are spenders and there are savers–and somehow, they always seem to marry each other! If you’re the saver in the relationship, it’s probably easy to feel like your partner’s spending is out of control.

There are a few possibilities here. The first thing is that your budget may not fit your lifestyle. If weekly coffee or monthly dinner dates are important to your partner, weave them into your budget. Sometimes, we build barebones budgets to get us out of dire financial straits and then never recalibrate once we find our financial footing.

Another possibility is that your partner simply doesn’t realize how much they’re spending. Try out some of the best budget apps for couples and see if that opens their eyes to how quickly spending can add up.

Of course, if your partner’s spending is really throwing a wrench into your finances and your future, you might also consider marriage counseling. Sometimes a neutral, third-party perspective can help you find common ground.

Should we have a joint account in marriage?

Only you can answer this question. Of course, some financial experts take a hard stance on this and say absolutely. Rather than telling you exactly which finances to combine, we take a slightly different approach.

Regardless of how you combine your finances, you need to manage your money jointly. That means that even if you have some separate accounts, you still need to decide on a financial plan together.

After you put together an initial plan, commit to monthly check-ins. This is when you can take a deep dive into your finances to see how your spending and saving for the month helped you tackle your goals. Additionally, you can weave in shorter weekly check-ins.

If something isn’t working for either one of you, don’t hesitate to call it out. It’s critical to remember that you’re a team. When one of you wins, you both do. The same is true for struggles.

Like most things in life, there are pros and cons to joint bank accounts in marriage. See if the pros outweigh the cons for you!

How can I make budgeting fun with my spouse?

Turn your budget check-ins into money dates! Make some appetizers or pour yourselves a glass of your favorite wine. Then, structure the date around your goals. Dream about your future together, and consult your budget app, spreadsheets, and other nitty-gritty details as a means to check in on your dreams. Your goal should be to leave the dates energized and motivated with a plan rather than feeling like you just took a math class together.

You also want to find ways to celebrate your financial wins. Don’t wait until you make your down payment or pay off your last student loan. Instead, celebrate smaller money milestones along the way. Maybe you splurge on fancy chocolate or craft beer. Work in small celebrations as you go to make budgeting with your spouse more fun.

Final Thoughts on Best Budget Apps for Couples

Managing money as a couple can be a lot of work. Thankfully, you can streamline the process with one of these best budget apps for couples. Whether you want something manual or automated, browsing this list should help you find a tool that can make it easier to talk money together.

Which app from our best budget apps for couples list do you use? What other tips do you have for managing money as a couple?

Please let us know in the comments below.