A budget is a great way to eliminate debt, save money, and reach financial milestones. But updating your budget? That’s the hard part. Still, it’s something you must do to keep your spending on track and improve your personal finances.

Luckily, Tiller Money makes it easy. Tiller is a financial management tool that gives you more control over your budget and finances.

It taps into the power of spreadsheets, so the possibilities are endless. Tiller is an excellent option, even if you don’t have a lot of experience with spreadsheets. You get support for both Google Sheets and Microsoft Excel, and the app has pre-made sheets that are a breeze to set up.

If you’re one of the 33% of people who struggle to maintain their budget, Tiller’s daily automatic update might be just what you need to get your finances on track.

What is Tiller Money?

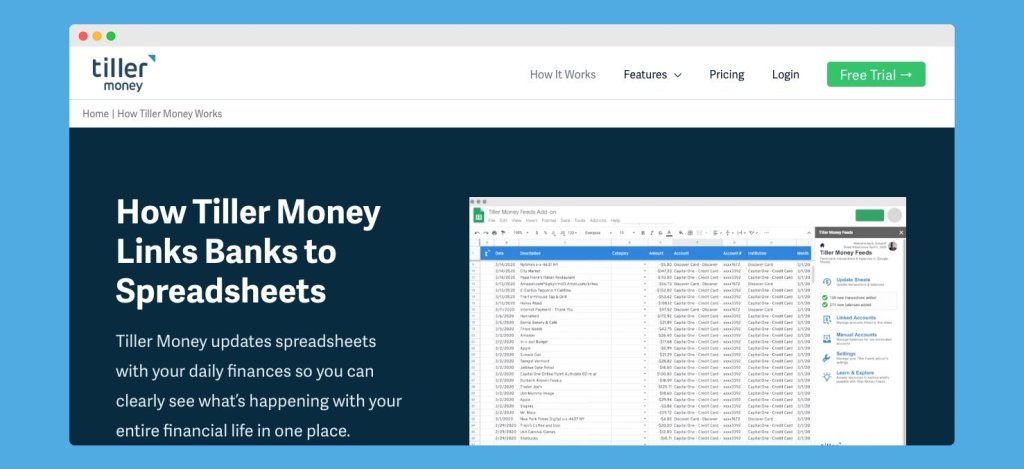

Tiller Money is one of the best budgeting apps out there. The software links your financial accounts to sync your transactions daily. It drops the data from your checking account, savings, credit cards, and other accounts into a spreadsheet.

It started as an add-on for Google Sheets, but the program has expanded to include Microsoft Excel. You can use one or the other, or use both Sheets and Excel at the same time.

The goal behind the app is to empower you to manage your finances and make better financial decisions. When you have all your financial information in one place, it becomes that much easier.

How Does Tiller Work?

A typical money management app will connect your accounts and import the transactions into its unique software program. Since no budget app is perfect, you typically have to change your budget to fit the software.

But Tiller uses spreadsheets.

If you have any interest in tracking your personal finances, you’ve probably used a spreadsheet at some point. They give you more options to customize your budget.

There’s just one downside to a traditional spreadsheet: You must manually update it to track your budget and financial goals.

Peter Polson founded Tiller to solve that problem. Instead of struggling to personalize your finances with spreadsheets, Tiller has ready-made solutions and the ability to customize the app to fit your needs.

But the best part? Tiller automates the entire process.

You connect your financial accounts to Tiller, and the app automatically pulls data into Google Sheets or Microsoft Excel. It has your bank information and transaction history organized in a spreadsheet. This gives you options to control and customize your finances.

How Much Does Tiller Money Cost?

Tiller’s ability to generate customized, up-to-date spreadsheets comes at a cost. But first, let’s talk about the free trial.

You get a 30-day free trial with Tiller. There are no hidden fees or upgrade costs to worry about, and you can cancel anytime.

After your free trial, Tiller is $79 a year. That comes out to $6.58 per month, which is less than what you’d pay for an iced coffee for you and your spouse.

Best Features of Tiller Money

So many free money management apps exist, you might wonder why Tiller is one of our favorite best budget apps for families. Tiller goes above and beyond any other app that’s out there. Here are the top features to look for.

Expense Tracking

Expense tracking is the heart of getting your finances under control, whether you’re new to budgeting or a seasoned pro. Tiller imports your transactions and drops them into a spreadsheet, saving you time by not having to enter data manually.

And when you get visibility into your actual spending to see where your money goes each month? That’s when financial awareness comes in, and you start to feel in control of your financial future.

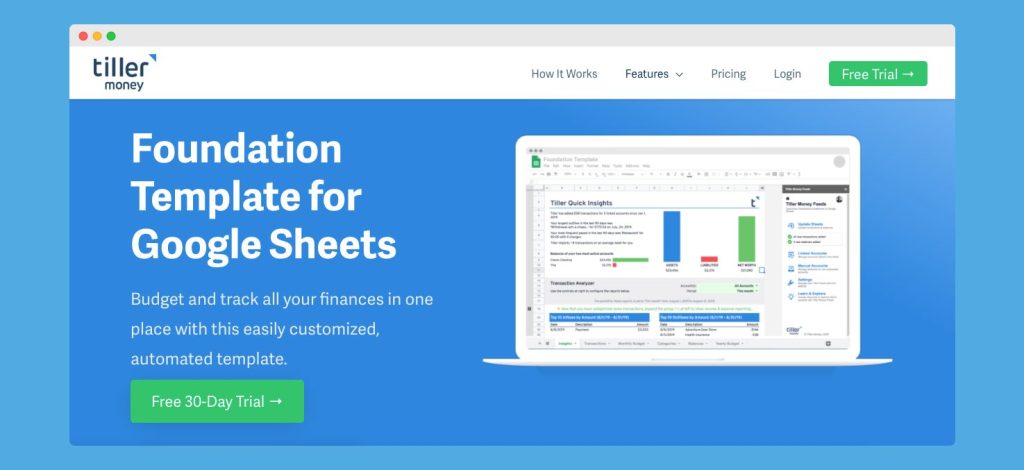

The Foundation template is an automated ledger that neatly categorizes each expense. If you want to take a more advanced approach, you can manipulate the data, add charts and graphs, and build your own customized spreadsheet to track your expenses in a way that makes the most sense to you.

Set and Stick to a Budget

Everyone budgets their money a little differently. You might take a “bird’s-eye view” approach and label your spending with major categories, such as using “utilities” for your gas, electricity, water, and sewer bills.

But you can also manage your budget with more detail by creating custom categories for each expense type.

Whichever you prefer, Tiller’s Foundation template lets you set up your budget categories with as much or as little detail as possible. It also has the option for zero-sum budgeting with the Envelope Budget template sheet.

Remember: The app automatically imports your transactions, so you can easily see where your money is going and how much cash you have left in each category.

Collaborate with Your Spouse

You know what they say, “Couples who budget together, stay together.” Shared financial goals can bring harmony to a relationship.

Whether you have joint checking or split your budget expenses, Tiller’s got your back.

For instance, let’s say you wanted to know how much you spend on groceries vs. how much your partner spends. Use tags in the spreadsheet when categorizing your transactions and your spending reports will automatically break it down for you.

Sharing your financial spreadsheets with your spouse is simple, too. Tiller has built-in sharing options that allow easy access to your partner.

Daily Updates

Tiller will check your account balances and import transactions to your sheet every day. It may take two to three days for some expenses to appear since the app can only pull in cleared transactions. The refresh happens automatically, so the data will appear when it’s ready.

If you have accounts that require multi-factor authentication, you may need to refresh the transactions manually. It’s simple to do – it just requires a click of a button. Once you do, your data will import on its own.

You also get an email each day that shows your recent transactions and balances from all your linked banks, credit cards, and other accounts. It’s called the Tiller Daily Update and it’s an overview of your finances sent straight to your inbox.

Pre-built and Custom Spreadsheets

The Foundation template is everything you need to start with Tiller. It’s where you’ll find pre-built sheets to track your spending, manage your budget, and get an insightful analysis of your financial picture.

No matter your skill level with spreadsheets, the Foundation template lets you jump in and get started immediately.

As you get more comfortable with how it works, manipulate the data to customize your financial journey. It’s simple to do, and you can change any of the data in the Foundation template or create and add your own custom sheets to Tiller.

You also get access to Tiller Money Labs, a community-supported library of personal finance templates, tools, and reports. A few examples of sheets you’ll find in Tiller Money Labs are a year-to-date spending comparison, weekly analysis by category report, estimated quarterly tax planner (great if you’re self-employed!), and holiday gift planner to track holiday spending.

Customized Budget Categories

Some of the best budgeting apps limit your ability to customize your budget categories. A budget doesn’t do you any good if you can’t change the categories. How else can you accurately track your spending?

You’ll want to keep it as simple as possible, but Tiller will support up to 200 categories. You’re not stuck with the default ones, either. Feel free to add, delete, or overwrite the example categories that come with your budget spreadsheet.

When you use the Foundation template for budgeting, set up your budget amounts per category to easily track your spending. That way, you can see at a glance if you can order pizza for takeout on Friday or if you need to prepare a meal at home.

Automatically Categorize Transactions

With Tiller, you get something called “AutoCat” that automatically categorizes your transactions. You might not think that’s a big deal because some budget apps will assign categories.

But those apps don’t always get it right, and you end up going through your transactions to check the categories anyway.

Tiller is different. You assign rules that add a particular category to a certain expense type. For instance, you might use AutoCat to auto-categorize recurring transactions like Netflix and mortgage payments. Because Tiller relies on rules, your categories will be right the first time.

Tackle Debt

Becoming debt-free can change your life, and Tiller can help to make it happen. Rather than carrying around the mental stress, physical stress, and marital stress that debt brings, use Tiller to organize your debt and create a plan to pay it off.

You have two options to make this happen: Create your own debt payoff spreadsheet to add to Tiller or use the pre-made Debt Progress sheet. Either way, Tiller can auto-import your credit card and loan balances and track your monthly payments.

As you pay down the debt each month, your spreadsheet will track your progress. Tiller’s Debt Progress sheet can calculate your debt freedom date to give you something to look forward to.

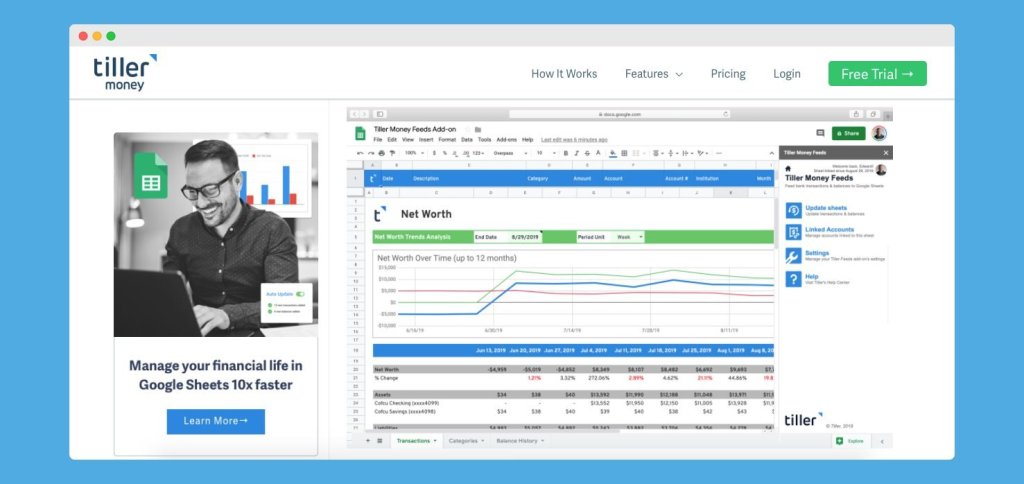

Watch Net Worth Grow

Net worth is an excellent indicator of your financial health. Tracking your net worth is like taking your financial temperature.

Basically, you add up all of your assets and subtract all of your liabilities. For example, your house and investment accounts are assets, but your mortgage and credit card balances are liabilities.

Setting up a spreadsheet can be cumbersome, so Tiller has a pre-made one that you can jump into using. But creating your own is an option, too.

Connect your bank accounts, credit cards, and loans to have the app automatically update your balances and make keeping tabs on your net worth that much easier. If the value goes up, your financial health is improving. If it goes down, Tiller can help you assess your spending habits and savings goals to get back on track.

Supports More than One Budget

Having more than one dashboard to track more than one budget is a feature that sets Tiller apart from the rest. Most money management programs give you one budget. Tiller lets you track as many as you need.

For instance, if you have a side business that requires separate expense tracking from your household budget, you can easily set that up in Tiller. The Simple Business dashboard automatically pulls in your transactions and can generate a profit-and-loss statement for your business.

Import Data from Other Budget Apps

When you switch to using Tiller, you don’t have to start from scratch. The software can import your financial history from other budget apps, including Quicken, You Need a Budget (YNAB), Personal Capital, and more.

If you can download a CSV file from your program, Tiller lets you import it. That way, all of your data is in one spot, and you have the benefit of comparing historic expenses to current expenses.

Custom Reports

Spreadsheets have an enormous capability to manipulate and analyze data. Because Tiller pulls your financial data into a spreadsheet, you can tap into that power and create custom reports.

When you sign up with Tiller, you’ll find some reports built into the Foundations template. It’s enough to get you started creating a budget and tracking your expenses, but there’s so much more you can do.

Creating custom reports, graphs, pie charts, and pivot tables can take your finances to a whole new level.

Compare your spending from two different time periods to analyze how your budget has changed or run a report that tells you exactly how much discretionary money you have to spend each month.

If you don’t want to create your own, Tiller has several templates that you can use.

Customer Support

Customer support is another area where Tiller really shines. If you hit a snag with a spreadsheet, you won’t get the runaround.

First, the link to locate customer support is easy to find. Click the link for “Customer Support” in the Resources section at the bottom of the site. From here, you have a few options to get your questions answered.

Tiller has a community forum where users can post problems and get help and ideas from other users. You can review the help docs for answers to common questions or check out Tiller’s free weekly webinar.

But the most impressive thing about its customer service is that Tiller lists the support email address in plain sight. There’s no digging around to get help – a quick email to [email protected] can get you the answers you need.

Where Tiller Falls Short

With so many excellent features, is there anything Tiller can’t do? Nothing is perfect for everyone, and there are a few places where the app falls short.

The first point is that Tiller requires you to have some basic knowledge of how spreadsheets work. Tiller relies on Google Sheets and Microsoft Excel to set up and track your finances. You don’t need to know a lot about spreadsheets, but knowing something can help you hit the ground running.

Another downside is that Tiller isn’t free. The cost isn’t much. It comes to a mere $6.58 a month when you consider the $79 annual subscription fee.

The program doesn’t have a dedicated mobile app, either. However, your data is found in Google Sheets and Microsoft Excel, and both have mobile apps available for iOS and Android devices.

Still, updating and reviewing your financial spreadsheet on a tiny mobile screen isn’t the most intuitive experience.

Compared to everything you can do with Tiller, these issues are minimal. Tiller is a fantastic app to manage your finances and has ready-made solutions if you’re not familiar with how spreadsheets work.

Tiller Money Review – FAQ

Does Tiller Work With Google Sheets?

Yes! Tiller works with Google Sheets or Microsoft Excel. You can feed data into Google Sheets using the Tiller Money Feeds ad-on.

You can also explore their set up recommendations for a step-by-step guide on how to use their templates seamlessly with Google Sheets

How Much Does Tiller Money cost?

Tiller Money costs $79 a year. That fee means that you get access to an ad-free platform with no upsells, pop ups, or other disruptions.

Is Tiller Money safe?

Yes! Tiller Money is safe. In fact, Tiller prioritizes user safety and security. Your data is not for sale, and they do not run ads on their platform. More so, Tiller uses bank-grade encryption and Yodlee–the same web application software that the biggest banks trust–to aggregate your data from other financial institutions.

Additionally, your data is stored in your spreadsheets. This data is managed by you, independent of Tiller.

What type of support does Tiller Money provide?

Tiller offers a lot of different support for users. The Tiller website hosts a user community. Additionally, you can also find different Help documents and get access to live webinars.

If you require additional support, you're in luck. The Tiller Help Bot is a feature that helps you sort through different topics to target the area of support you're looking for. They also have a US-based customer support network. To connect with them, you can file a help ticket through the platform.

Tiller Money Review: The Bottom Line

When you start with Tiller, you get a 30-day free trial. That’s a full month to explore the app and all it can do to see if it’s a good fit for you and your finances.

I encourage you to take Tiller for a test drive. If you decide you don’t like it, you can cancel anytime during the free trial and still get 30 days of free access.

Tiller supports both Google Sheets and Microsoft Excel, which opens up a world of opportunity. If you love spreadsheets, using Tiller to pull in your data automatically is a no-brainer. But even if you’re a new spreadsheet user, the pre-built templates allow you to quickly set up your financial dashboard.

What do you think of this Tiller Money review? Have you tried it out?

Please let us know in the comments below.

2 Comments

1. What unique security support does Tiller provide for access to my bank accounts?

2. Is email the only support that Tiller provides? As with my bank, when it comes to my money, I must be

able to speak directly to a human being who can see my account, (as with a bank teller) and resolve my problem.

Thank you for your comment Sheffra! We’ve added more detail to the FAQ based on your question.