You’ve paid off your mortgage, but other than your word, you might wonder how do I prove I paid off my mortgage? You might need proof for future lenders or other financial situations.

The good news is that you can prove you paid off your mortgage in many ways. The bad news is it might require a little legwork to get the proof you need.

You must have valid proof you paid off your mortgage, though. Don’t rely on the county recording your mortgage as paid off and removing the lien or on your lender letting the credit bureaus know your mortgage is paid in full.

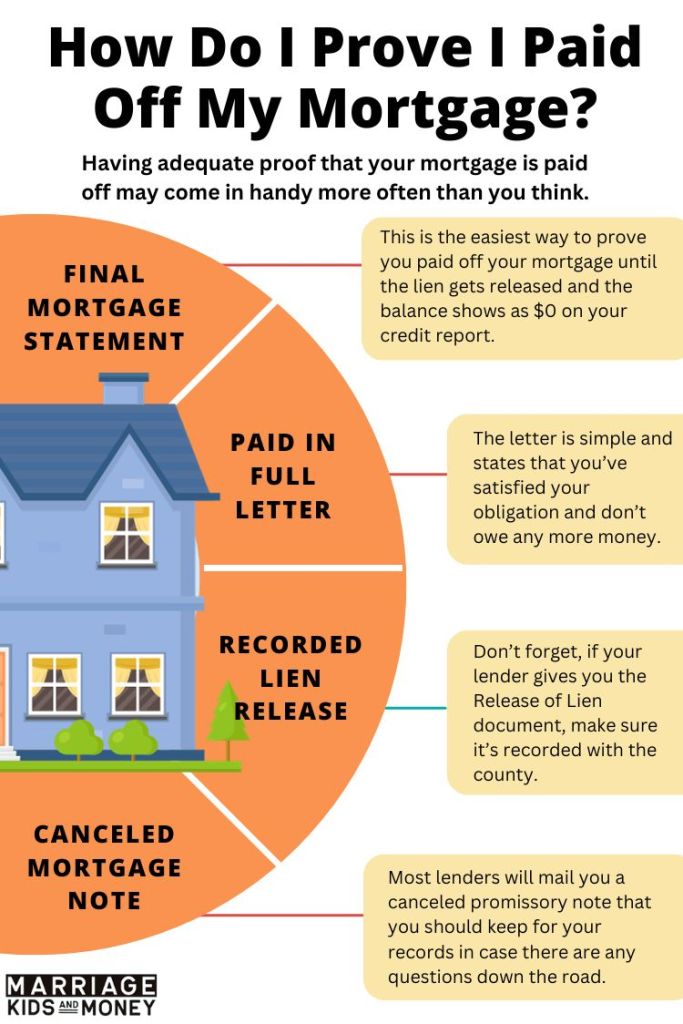

Having adequate proof that your mortgage is paid off may come in handy more often than you think.

What Happens When You Pay Off Your Mortgage?

The first thing you should do when you pay off your mortgage is celebrate! This is a tremendous milestone in your life.

Next, you’ll hear from your lender, receiving several documents that show you satisfied your mortgage agreement. Some lenders send your canceled note, a final mortgage statement, or a Release of Lien.

No matter what your lender sends, keep the proof as it may come in handy down the road.

Questions To Ask Your Mortgage Lender Before You Pay Off Your Loan

Before you pay off your mortgage, ask your lender the following questions:

Will they record the Release of Lien, or should you do it?

This is a crucial step when you pay off your mortgage. The Release of Lien shows that you own the property without anyone else laying claim to the property.

Unfortunately, not all lenders file the Release of Lien with the county. If they won’t, you must.

Will your lender notify the insurance company and county, or must you?

If you paid your real estate taxes and insurance money to an escrow account each month, you’ll be responsible for making your payments directly to the county or insurance company moving forward. In addition, you must let the insurance company know the lender is no longer a factor and should be removed from your policy.

Related Content: Is House Insurance Cheaper Without a Mortgage?

What documents will they provide to prove you paid the loan in full?

Each lender offers different documentation. Make sure you know what to expect, so you have proper proof that your mortgage is paid in full.

How much is required to pay off my loan?

Your lender should provide you with a mortgage payoff statement that shows how much you owe to pay the loan off in full. The payoff statement will be good through a specific date. If you don’t pay it off by that date, you’ll owe extra money for the per diem interest.

Proving Your Mortgage Is Paid in Full

If you’re wondering, how do I prove I paid off my mortgage? Here are the steps you’ll take. Remember, each lender is different, so you might get one, some, or all of these documents.

Final Mortgage Statement

Always ask your lender for a final mortgage statement first. This is the easiest way to prove you paid off your mortgage until the lien gets released and the balance shows as $0 on your credit report. Lenders can supply this immediately after you pay off your mortgage, so you have the evidence handy if you need it.

Your final mortgage statement can easily prove that you paid off your loan. Looking at previous mortgage statements, you’ll see that they show how much you owe, how much you’ve paid, and the proposed payoff date.

Once you pay the loan in full, the principal and interest due should show $0, and the amount you’ve paid should be the total loan amount. As long as it’s an official statement with your lender’s logo, this is adequate proof that you paid off your loan. In addition, the statement is dated and has the information any lender would need.

Paid in Full Letter

Your lender should send you a paid-in-full letter after receiving your final payment. The letter is simple and states that you’ve satisfied your obligation and don’t owe any more money.

Keep this letter as it can help if the credit bureaus don’t update your credit report with the correct information.

Recorded Lien Release

When you borrowed your mortgage, the lender filed a lien against your property. This is in response to using your home as collateral for the loan and provides the lender with the right to foreclose on your home if you stop making your mortgage payments.

Once you pay off the loan, the lender no longer has a lien on your property. However, the lien release isn’t automatic. Instead, there are one of two ways to activate a lien release:

- The lender contacts the county recording office and provides them with the documentation that you satisfied the lien. The recording office then removes the lien from your record.

- You contact the county recording office and provide them with proof that you’ve paid off your mortgage. Your lender will provide the necessary documentation, including a Release of Lien document or Certificate of Satisfaction proving you paid the mortgage in full.

Proving the lien release is evidence enough that you’ve paid the mortgage in full. No lender would release a lien without proper payment.

Don’t forget, if your lender gives you the Release of Lien document, make sure it’s recorded with the county. Without recording it, the lien still looks like it’s outstanding.

Canceled Mortgage Note

The mortgage note is an important document when you borrow a mortgage. Known as the Promissory Note, this document is what you signed to say that you promise to make your mortgage payments as agreed each month.

The promissory note is no longer valid when you pay off your loan because you don’t owe the lender any more money. This means they can cancel the contract. Most lenders will mail you a canceled promissory note that you should keep for your records in case there are any questions down the road.

I Paid Off My Mortgage. What’s Next?

You might wonder now what you’ll do since you paid off your mortgage. Of course, every homeowner is different, but here are some ideas on handling your finances.

Pay Off Consumer Debt

Credit card interest rates are at an all-time high, making carrying credit card debt unaffordable for most. With your newfound money available, consider paying your consumer debt off as quickly as possible.

Use the debt snowball or debt avalanche method if you have more than one credit card. These methods help you stay organized with your debt payments, and get out of debt faster than making only the minimum payments. If you need more money to get ahead of your credit card debt, consider ways to reduce your monthly expenses.

Save More For Retirement

It’s never too late to add more money to your retirement savings. Whether you have a 401K with your employer or an IRA, increase your contributions. You can contribute up to $23,000 a year in your 401K and $7,000 in your IRA in 2024.

If you don’t have a retirement account yet outside of work, now is the perfect time to create one so you have enough money for retirement. Check out Vanguard to open a Roth IRA and use your newfound income to grow your future wealth.

Boost your emergency fund

Everyone should have at least three to six months of expenses for an emergency fund. If you don’t have a fund set up yet or it doesn’t have six months of expenses, use your extra money to boost it.

For some more inspiration, here are some more ways to create financial independence for your family after you pay off your mortgage.

FAQ

How do I receive a mortgage payoff letter?

You must request a mortgage payoff letter from your lender. Some allow you to call with the request, and others have a more formal process that requires you to complete a form online or print and mail it to the lender. You must provide the account number, the date you want the payoff letter good through, and the property address. Lenders may instantly provide a payoff quote over the phone, but it may take a few hours or days to receive a written payoff statement.

Do I receive a deed when I pay off my mortgage?

When you pay your mortgage in full, you'll receive a deed of reconveyance. This happens when the lender transfers ownership of the house from themselves to you after satisfying your mortgage agreement. It's their way of relinquishing property ownership after you pay the mortgage in full.

When I sell my paid-off home, how do I prove I own it?

The buyer's lender will conduct a title search when you sell your home. This is a search into the home's public records, verifying ownership and the legality of transferring the property. This should be enough to prove you own the house without any liens. If there are questions or concerns, you can provide your deed of reconveyance or final mortgage statement with a $0 balance.

I paid off my mortgage a long time ago. How do I prove I own the house?

The property deed shows who the rightful owner of the house is, and who has the legal right to sell it. The buyer's lender can get this information when they order a title search on the property.

Final Thoughts On How Do I Prove I Paid Off My Mortgage

The answer to how do I prove I paid off my mortgage is simple. The lender will provide you with the documentation you need. If they don’t, follow up and ask for the paid-in-full letter, canceled note, Release of Lien, and final mortgage statement.

With these documents, you can prove you paid your loan in full. So whether you’re applying for a new loan, proving to the insurance company you paid your loan off, or need the proof for any other reason, the documentation mentioned should suffice.

Are you wondering how do I prove I paid off my mortgage? What are you going to do now that you're mortgage-free?

Please let us know in the comments below.

2 Comments

Well what if it’s been over 10 years and lender no longer has documentation

It was 20 years ago paid in full mortgage! Do Not remember What bank it was. How do I rectify this please.